Mar 8, 2023

US Crypto Caution Adds a Hurdle to Silvergate’s Rescue Effort

, Bloomberg News

(Bloomberg) -- Anyone working with US regulators to salvage Silvergate Capital Corp., the crypto-friendly bank, will have to reckon with a key variable — the wariness of those same officials about digital assets.

The Federal Deposit Insurance Corp. can get involved when a bank is near the brink, which is where Silvergate said it stood last week when it raised questions about its stability. With that out in the open, Wall Street analysts including Wedbush Securities have been speculating that the bank won’t survive, and FDIC officials have been talking with management about ways to avert a collapse, according to people familiar with the matter.

If a bank fails, one typical remedy could involve the FDIC finding a healthy bank to take on the troubled firm’s deposits, so the agency doesn’t have to tap its insurance fund to pay off customers. Another possible option involves lining up crypto-industry investors to help Silvergate shore up its liquidity, one of the people said. The bank was still open and deciding how to move forward as of Tuesday evening.

The challenge for a crypto investor is that the FDIC, along with two other top regulators, has been publicly urging banks to beware of the sector. And after shutting down its main crypto platform last week, Silvergate doesn’t have much else to attract a traditional bank as a buyer.

Silvergate “has no real value beyond the charter at this point, as there’s no franchise or customer value once the crypto stuff is gone,” Todd Baker, a senior fellow at Columbia University’s Richman Center for Business, Law and Public Policy, said in an email. “It abandoned traditional banking years ago.”

The shares fell more than 12% in New York trading on Wednesday, amid concern that a resolution might leave current shareholders with little or nothing. “We do not comment on open and operating institutions,” said an FDIC representative. Silvergate didn’t immediately respond to a request for comment.

After a bank is seized by regulators, the FDIC as receiver has options. If it can, the agency tries to merge a failed bank with a stable lender that takes on the insured deposits. Customers of the failed institution become depositors of the buyer and keep access to their funds.

In situations where there is no buyer, the FDIC pays depositors directly, as much as the insured amount of their balances. The agency covers $250,000 per depositor for each category of account.

Prior statements from the FDIC could complicate a Silvergate merger deal. In a January joint letter, the agency joined the Fed and the Office of the Comptroller of the Currency in warning banks against risks linked to crypto. The regulators emphasized the importance of preventing risks tied to digital assets “that cannot be mitigated or controlled” from migrating into the banking system.

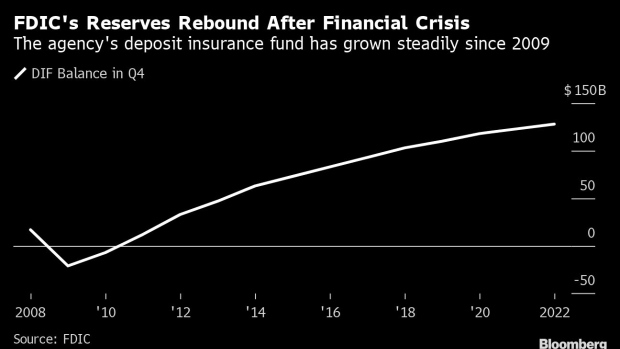

The last time a US bank failed was in 2020, and the last time the FDIC had to cover deposits for a failure was in 2013 when Connecticut-based Community’s Bank closed, agency data show. The FDIC had $128 billion in a deposit insurance fund for reimbursing customers as of the fourth quarter of 2022, according to an agency report.

“The FDIC is always guided by the principle of least cost resolution, so it will structure the transaction in the way that minimizes losses to the deposit insurance fund,” said Hilary Allen, a law professor at American University who testified before Congress on the collapse of the FTX crypto exchange.

A takeover by another bank, with or without help from regulators, typically would be the preferred option. When there’s no clear candidate to assume a failed bank’s operations, the FDIC will sometimes create a temporary “bridge bank” to help the firm continue operating and find an acquirer later, Allen said.

Silvergate’s singular focus on crypto could hamper any FDIC effort to find a buyer, if one is needed. The firm sold a business-banking franchise to HomeStreet Inc. in 2019 as it pushed deeper into the world of digital assets. Silvergate said in its fourth-quarter results that total loans clocked in around $590 million as of Dec. 31, down more than half from the prior quarter.

What’s Left?

The bank took steps to slim down even more after it reported a $1 billion loss for the quarter that ended Dec. 31, exiting the mortgage warehouse-lending business alongside other fee-based offerings to trim costs. The firm also said it would fire 200 employees, or 40% of its workforce, as part of that effort.

After Silvergate questioned its viability last week, prominent clients said they were pulling back, which could threaten to further squeeze the bank’s shrunken deposit base. This could erode whatever value exists for potential acquirers more interested in the crypto business over traditional banking.

Silvergate, which traded at more than $239 a share in November 2021, sold for as little as $4.57 on Wednesday.

“The discontinuation of the Silvergate Exchange Network could signal that Silvergate may consider winding down its operations,” Wedbush Securities analyst David Chiaverini wrote in a note. “We believe a receivership/liquidation scenario is a distinct possibility and arrive at a liquidation value of $5 per share.”

--With assistance from Yueqi Yang, David Scheer and Katanga Johnson.

©2023 Bloomberg L.P.