May 17, 2022

US, European Firms Rethink China Investment After Lockdowns

, Bloomberg News

(Bloomberg) -- US and European businesses are reconsidering their investments in China after the lockdown in Shanghai and restrictions in other cities caused major disruption to their operations.

The American and European Union chambers of commerce in separate briefings said their members are rethinking their supply chains and whether to expand investment in the face of China’s zero tolerance approach to combating Covid-19.

“The Covid lockdowns this year and the restrictions over the past two years are going to mean that three, four, five years from now, we will most likely see investment decline,” Michael Hart, president of the American Chamber of Commerce in China, said Tuesday in Beijing.

While this doesn’t mean an immediate shift outside of China, Hart said that many firms that source from China are asking where else they can get supplies, and whether they should be building or sourcing from somewhere else.

The outlook is shared by European companies. Many members of the European Union Chamber of Commerce in China are putting investment plans on pause and starting to consider whether to leave the country, the business group’s representatives said at a briefing Monday. Uncertainties about a potential next wave of outbreaks are taking a heavy toll on business confidence, they said.

“Uncertainty is really the keyword, because there’s no view, no outlook about how long this could last, and what will be next after Shanghai,” said Massimo Bagnasco, vice president of the European chamber.

Read More: China Vows to Ease Supply Chain Woes in Foreign Chamber Meeting

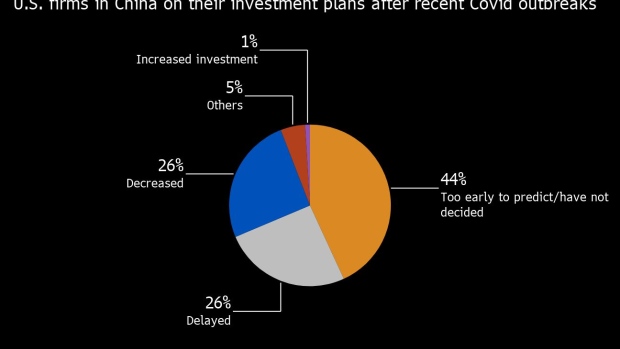

Profits of foreign firms in China are falling, and companies have become increasingly vocal about the impact on their businesses from Covid lockdowns and restrictions. Earlier this month, more than half of US firms said they were reducing or delaying investment plans and expected lower revenue due to the economic fallout from extended lockdowns, which have clogged the world’s biggest port, closed highways and shuttered factories and businesses.

And last week, respondents to a survey by the German Chamber of Commerce in China reported that nearly 30% of their foreign employees had plans to leave China because of Covid. The chamber surveyed 460 companies.

The restrictions that began in March in Shanghai and elsewhere come on top of existing travel controls, which have made it hard for employees of foreign firms to travel to China or visit headquarters overseas.

The travel restrictions have left AmCham “very concerned” about US and other foreign investment into China, Hart said at a press conference to launch the chamber’s 2022 White Paper.

China usually ranks among the top three destinations for investment among AmCham’s member companies, but “it is falling in preference,” Hart said, adding that if people can’t travel to the country, it will “decline as an investment destination.”

European businesses continue to face challenges including lost production days, labor shortages and supply chain and logistics disruptions due to lockdown measures. The pressure to leave China will rise significantly if the obstacles don’t improve by the end of the year, said Joerg Wuttke, president of the chamber.

The economy is also unlikely to rebound this time around as sharply as it did in 2020 because of ongoing headwinds from the crackdown on the technology sector, a persistent property market slump, and capital flowing out of China as the China-US interest rate differential diminishes, according to Wuttke.

Read more: China’s Covid Exit Hinges on Seniors Who Don’t Want Vaccines

Wuttke urged China to accelerate its vaccination efforts, as the vaccine uptake among those older than 65 has slowed in recent months.

“You cannot hold an economy hostage by 150-to-160 million people that are insufficiently vaccinated,” he said. “This has to change, it can’t go on forever.”

(Updates with details about a survey by the German chamber of commerce in paragraph eight.)

©2022 Bloomberg L.P.