Jan 11, 2023

US Natural Gas’s 48% Drop in a Month Set to Deepen on Supply Growth

, Bloomberg News

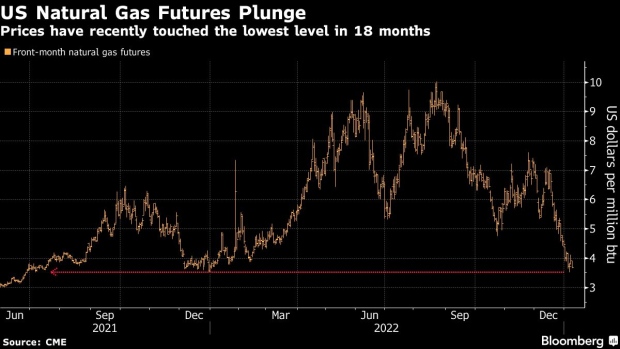

(Bloomberg) -- Natural gas prices in the US have almost halved in just under a month, and the downward pressure may continue as incremental production is expected to far outstrip demand growth.

Energy traders and analysts have adopted an increasingly bearish tone on natural gas as higher output levels have been met with abnormally weak demand for heating in the Northern Hemisphere this winter amid milder weather. Public drillers are unlikely to review their capital spending plans, having signaled modest production increases in the Haynesville basin in Louisiana, even after a recent plunge in futures of the heating and power-generation fuel, according to consulting firm Tudor, Pickering, Holt & Co.

“The market does not need this incremental growth and will ultimately need to force the curve lower to push rigs out of the market,” TPH analyst Matt Portillo said Tuesday in a note to clients.

The tumble is the opposite of what markets expected ahead of winter, when fears of inventory shortages led to fierce volatility in prices. For months, doomsday talk dominated the market narrative about whether suppliers could meet demand if the weather was too cold.

Read more: Warnings of natural gas shortages, rationing for US Northeast

Instead, natural gas futures have sunk 48% since their mid-December highs, the biggest drop among the main US-traded commodities on the New York Mercantile Exchange.

US demand could be on track to hit record lows in January if abnormally warm temperatures persist, Rystad Energy analyst Emily McClain said Tuesday. A longer-than-expected outage at a key Texas liquefaction terminal after an explosion in June, which has curbed America’s export capacity, has also weighed on prices.

US natural gas production is set to increase 2.4% this year to a record daily average of 100.3 billion cubic feet amid relatively flat demand, the Energy Information Administration said Tuesday. Average prices are seen falling almost 25% from last year’s levels, according to the agency.

TPH’s Portillo added that most US public producers have signaled that a drop in prices to $3 per million British thermal units or below would be “notable inflection point on capital.” That compares to current level around $3.70 per million btu.

Meanwhile, weak demand in Europe means the bloc may need to reduce imports of liquefied natural gas this year to prevent overfilling storage, freeing up cargoes for rebounding Chinese demand, according to Morgan Stanley.

“We see a much more manageable global supply/demand outlook for this winter and the next,” analysts at the bank including Devin McDermott said in a Friday note.

To be sure, gas prices are still vulnerable to spikes in the event of severe and persistent cold weather through the end of the winter. US gas futures for February delivery gained 2% to $3.71 per million btu as of 8:46 a.m. Wednesday on the New York Mercantile Exchange.

(Updates with gas price move in last paragraph.)

©2023 Bloomberg L.P.