Jun 5, 2023

US Services Activity Nearly Stalls as Price Gauge Slides

, Bloomberg News

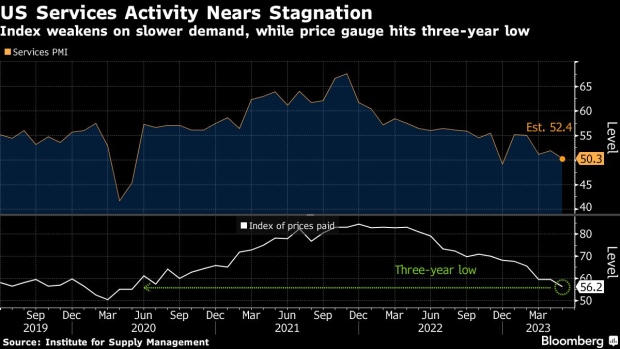

(Bloomberg) -- The US service sector nearly stagnated in May as business activity and orders downshifted, while a measure of prices paid slid to a three-year low.

The Institute for Supply Management’s overall gauge of services fell to 50.3, the weakest level this year, from 51.9 in April, according to data out Monday. The May reading was barely above 50, which separates growth and contraction, and weaker than all estimates in a Bloomberg survey of economists.

After the figures, yields on US Treasury notes dropped, the dollar fell and traders pared bets on an interest-rate hike by the Federal Reserve next week.

The business activity index, which parallels the ISM factory output index, fell for a fourth month to a three-year low of 51.5. Combined with softer orders, the decline indicates service providers are experiencing sluggish demand.

The new-orders gauge, a proxy of future activity, declined to 52.9 from 56.1 a month earlier. The moderation allowed service providers to whittle away at backlogs. ISM’s order backlogs index shrank at the fastest pace in 14 years.

“The majority of respondents indicates that business conditions are currently stable; however, there are concerns relative to the slowing economy,” Anthony Nieves, chair of the ISM Services Business Survey Committee, said in a statement.

Eleven industries reported growth last month, led by accommodation and food services, while seven indicated a decrease.

“Right now I’m not seeing the words of recession in the comments. I’m seeing things such as uncertainty and maybe a little bit of slowdown, but again, it varies by industry and by company within those industries,” Nieves said on a call with reporters.

Prices Paid

Softer demand, against a backdrop of higher interest rates and tighter credit conditions, is also helping reduce inflationary pressures. The ISM measure of prices paid for materials and services dropped more than 3 points to 56.2 in May. The metric is now closer to pre-pandemic levels.

About 25% of respondents said they’re paying higher prices for inputs, the smallest share since September 2020.

The release follows the ISM manufacturing survey, which showed the longest stretch of contracting activity since 2009. A jump in inventories at services and indications from providers that they are too high suggest further weakness in factory output.

Select ISM Industry Comments

“Employment needs have leveled off, and we are in a position to evaluate and upgrade rather than just maintain. Supply chain pressures have eased overall with some categories still hot spots.” - Accommodation & Food Services

“Overall slowing growth and market conditions dragging on some construction sectors.” - Construction

“Pent-up demand for services is driving strong revenue performance, but expenses (labor and supplies) continue to put pressure on margins, hindering the financial forecast.” - Health Care & Social Assistance

“Electronic components supply is strong, and lead times are nearly back to pre-pandemic.” - Information

“Economy is slowing amid increased financial banking and leasing activity. Credit standards have increased, and approvals have fallen — thus, a tight credit situation.” - Management of Companies

“Everything seems to have leveled off: not getting any worse, not getting any better.” - Professional, Scientific & Technical Services

“Overall business is good, and there has not been a significant change in direction.” - Retail Trade

“Supply is plentiful, freight is moving quickly and costs are coming down. This is a 180-degree change from a year ago. Also, sales demand is down.” - Wholesale Trade

The ISM measure of inventories at services increased to a more than two-year high, while a separate gauge of sentiment about inventory levels surged to the highest since April 2020.

Meantime, the ISM services employment index fell to 49.2, the lowest since October. While the measure suggests a slowdown in hiring, government data last week showed a larger-than-expected gain in May payrolls.

--With assistance from Chris Middleton.

(Adds ISM industry comments)

©2023 Bloomberg L.P.