Apr 20, 2023

US, Ukraine Allies Consider Near-Total Ban on Exports to Russia

, Bloomberg News

(Bloomberg) -- Some of Ukraine’s key allies including the US are considering moving closer to an outright ban on most exports to Russia, a potentially significant tightening of economic pressure on President Vladimir Putin over his war.

Group of Seven officials are discussing the idea ahead of a leaders summit in Japan in May, according to people familiar with the matter, and the aim would be to include European Union member states in the crackdown. The proposal is still being debated and could change, the people said.

The approach being discussed by diplomatic envoys would flip the existing sanctions regime around, with all exports banned unless exempted, the people said. Under the current criteria all exports are allowed unless sanctioned.

If G-7 leaders endorse the move at the summit, exactly what would be excluded would then have to be agreed, with medicines and agricultural products — including food — very likely to stay exempted, one of the people said.

But there are potentially serious obstacles to implementation. To come into force in the EU, the new criteria would need to be adopted by all members, and that would set off a testy debate given the likely backlash from companies that still export goods to Russia, alongside the risk of retaliation by Moscow.

If a near-total embargo on exports is imposed, much of the remaining trade flows from these countries with Russia would evaporate. A spokesperson for the US National Security Council declined to comment on the prospect of such a move.

So far sanctions have almost halved the value of EU and G-7 exports to Russia, with limits on everything from electronics to luxury items. That still leaves $66 billion worth of goods from Europe, the US, Canada and Japan going in, according to the Geneva-based Trade Data Monitor.

G-7 members are concerned that is too big a benefit to Putin’s wartime economy, especially as Moscow finds ways around sanctions to bring in goods via third countries. The G-7 and EU have imposed several rounds of penalties, some of which included a grace period before coming into effect.

Russia has responded to sanctions by imposing export bans of its own and periodically cutting energy supplies to Europe. The EU would be particularly vulnerable to restrictions on commodities like copper. And a near-total ban on exports to Russia could drive Moscow even closer to China as it seeks alternatives to sanctioned goods.

Moscow has stopped publishing figures on imports but several international monitors and governments track their exports to Russia and customs data.

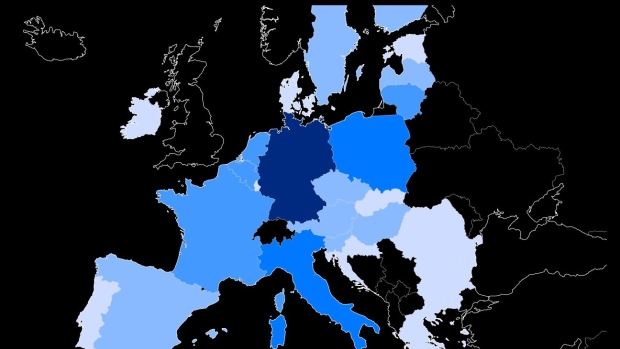

Germany, Italy and Poland remain the top three European goods exporters to Russia, Trade Data Monitor data show. Across the G-7, non-medicine and non-agriculture products that could be most affected include cars, chocolate, beer, footwear, flowers and make-up.

Even with the existing curbs, Russia has managed to import some sanctioned US and European components via third countries. That is putting an increased focus by the G-7 and EU on tackling sanctions circumvention, especially enhancing the monitoring of so-called dual-use goods that can serve either a military or civilian purpose.

That effort has involved applying diplomatic pressure on other countries, expanding restrictions to all goods that have been found in Russian weapons in Ukraine, and targeting companies that may be helping Moscow — intentionally or otherwise — to get around restrictions. Earlier this month the US sanctioned dozens of entities in 20 countries it accused of helping Moscow evade sanctions.

At the same time, European nations look to Moscow for some commodities including palladium, copper, iron and nickel.

Ramping up the efforts to limit Putin’s economic reach is likely to be a key item at the G-7 summit. Leaders are also expected to make progress on a mechanism to track and trace Russian diamonds across borders, eventually paving the way for restrictions on the trade, Bloomberg reported previously.

--With assistance from Jenny Leonard and Sylvia Westall.

©2023 Bloomberg L.P.