Jul 2, 2019

Utilities, energy bonds rule in Canada in longer-duration world

, Bloomberg News

Canada investors holding utilities and energy bonds are finally being rewarded, though it has little to do with the power businesses.

AltaGas Ltd. (ALA.TO) and other energy companies are among the largest issuers of longer-term bonds in Canada and they’ve been given a boost this year by rising expectations that the Bank of Canada will eventually have to cut interest rates.

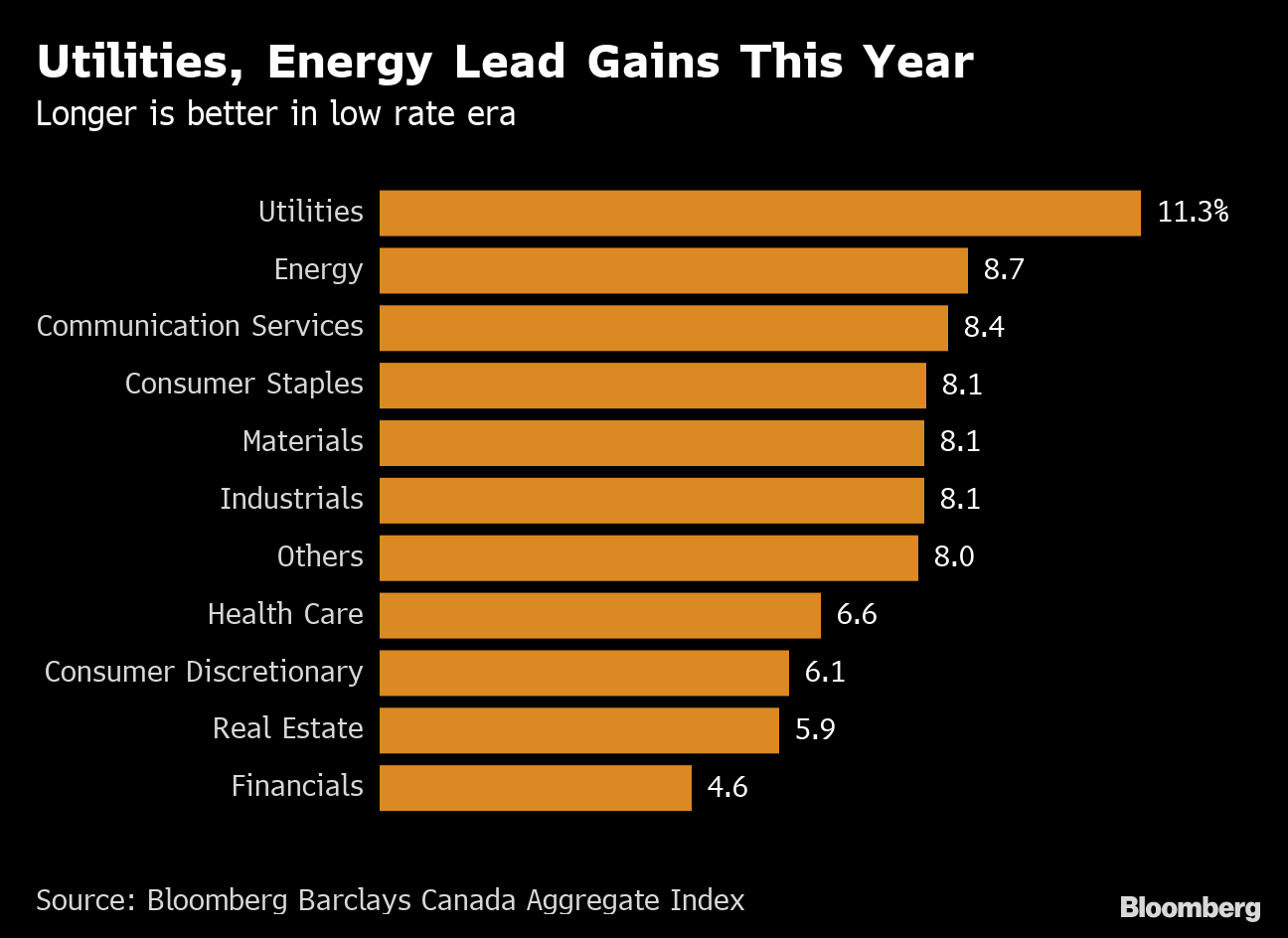

“The most duration sensitive bonds are outperforming and utilities and energy companies issue longer-dated bonds,” said Nicholas Leach, portfolio manager at CIBC Asset Management, which has $134 billion under management. These notes are leading gains versus other sectors that typically issue shorter-term notes such as financials, he said.

Holding unhedged local bonds of 10 years or more gave Canadian investors top returns of 13 per cent this year, according to a Bloomberg Barclays index. Buying notes of 7 to 10 years was the second-best bet, with a return of 8.3 per cent. That compares with a 6.5 per cent return for Canadian corporate bonds overall.

AltaGas, a Calgary-based power and natural gas supplier, led gains this year, returning 20 per cent. Canadian Utilities Ltd.’s note due 2062 was the second best performer, returning 18.8 per cent, followed by Canadian Natural Resources Ltd.‘s bond due 2047 at 18.6 per cent.

It’s not just in Canada that long-duration bonds are attracting investors. Bets on dovish monetary policy, relentless demand for safe assets and conviction that the so-called lowflation era will last are spurring money managers to gorge on long-maturity bonds, or duration risk, worldwide.