Feb 25, 2021

Vale Set to Join Peers in Doling Out More of the Mining Windfall

, Bloomberg News

(Bloomberg) -- Vale SA, the world’s second-largest iron ore producer, appears set to raise its dividend, joining other miners that are boosting payouts on the back of surging metal prices.

Bloomberg’s Dividend Forecasting team is projecting Vale will increase its payout to 2.697 reais a share from 1.41 reais in September. The Rio de Janeiro-based company resumed its dividend policy last year after halting payments in the wake of a tailings dam disaster in early 2019.

The three-year growth rate for Vale’s dividend is estimated at around 15%, Bloomberg data show. The company is expected to outline dividend plans as part of its fourth-quarter results after the close of regular trading Thursday.

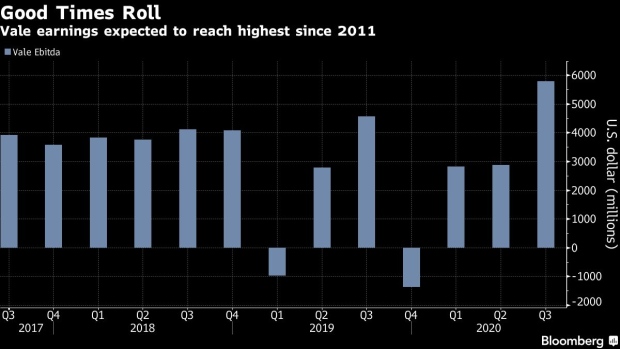

Mining companies from BHP Group to Glencore Plc are rewarding investors for sticking with the industry through several lean years. Now with metal prices surging to multi-year highs on the prospect of resurgent demand and supply shortfalls, miners have become cash machines once again. Vale is expected to report its highest earnings before items since 2011.

One of Vale’s Australian iron-ore rivals, Fortescue Metals Group Ltd. doubled its interim payout year-on-year, while Grupo Mexico, which owns one of the world’s biggest copper producers, raised it by more than 50% from last March. In Brazil, materials companies are projected to lead dividend payouts on the benchmark index, with a projected 36% increase compared with 2020, Bloomberg data show.

While a recent $7 billion dam disaster settlement is expected to take a toll on Vale’s minimum payment, analysts still see room to offset that through extraordinary payments. In December, Vale management signaled an extraordinary dividend was “very likely” this year.

©2021 Bloomberg L.P.