Nov 30, 2021

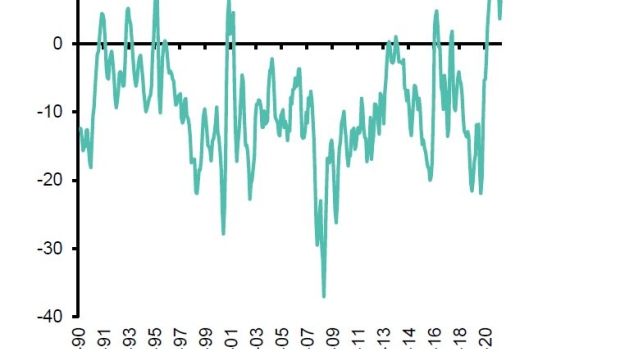

Value Quant Trade Drops Near 1970s Lows in Replay of Covid Crash

, Bloomberg News

(Bloomberg) -- Value stocks are getting crushed again by bad Covid news in a fresh blow to their long-suffering fans in the quant community.

With governments re-introducing restrictions to fight the spreading omicron variant, the case for buying cheap companies typically tied to the business cycle is faltering on risk aversion and the deteriorating economic outlook.

The MSCI World Value Index underperformed for a fifth straight day on Tuesday, nearing a five-decade low versus its growth counterpart after top executives at Moderna Inc. raised fears that existing vaccines could be much less effective against the new strain.

Investors are returning to the standard playbook from the early days of the pandemic: Bidding up growth stocks that have a reputation for increasing earnings irrespective of the twists and turns of the macro cycle.

Think Apple Inc. rather than United Airlines Holdings Inc.

The question now is whether the fallout from the omicron variant will prolong the value pain. While these shares have rebounded this year on an absolute basis, their underperformance compared to growth equities have pushed them back near the cheapest since the dot-com era. That’s even as they win more earnings upgrades.

At the same time, the recent rise in bond yields -- typically a boon for the investing style -- has fully reversed as traders pare expectations for interest-rate hikes and inflation trends next year.

“It’s what can we lean against that’s the safest, and it’s the well-known horsemen of the technology world,” said Art Hogan, chief markets strategist at National Securities. “In that environment, at least this calendar year, value can take a bit of a backseat.”

Thanks to the deteriorating virus-related newsflow, safety is in and risk is out across a variety of quant trades.

A market-neutral version of the value factor headed for its biggest four-day decline since June, while a strategy that bets on small-caps had its worst four days in four months, Dow Jones indexes show. The quality style favoring steadily profitable shares rose to the highest in a year.

The macro outlook -- rather than corporate fundamentals -- has dominated the performance of value investing over the last few years. That looks set to continue as investors sweat headlines on virus data and Federal Reserve policy.

On the latter, Fed Chair Jerome Powell has flagged the risk the variant will hit economic growth but also quicken inflation. In other words, it’s less clear how the renewed flare-up of the virus will sway monetary policy compared with early 2020.

If the Fed does stay on its tightening path to fight consumer-price gains, bond yields are likely to rebound in a boost to value.

“We remain tactically overweight value as our base case is for higher yields next year,” Sanford C. Bernstein strategists led by Sarah McCarthy wrote in a Monday note. “But we recognize that central bank decision making on the correct level of yields in the economy is influenced not only by inflation expectations but also other risks such as the outlook for growth and levels of debt, which could affect the timeline of higher yields.”

The Russell 1000 Value Index has jumped 17% this year in the global risk boom, while strategies deployed by hedge funds that are sector-neutral have held onto their 2021 gains despite the latest virus worries.

But in terms of widely tracked indexes, value’s comeback was still no match for growth’s continued rally as the love for tech names proved enduring. The Russell 1000 Growth Index is up 26% in 2021 so far.

Nonetheless value fans see a good case in the long run for anyone buying at today’s valuations. Using Russell 1000 indexes, the factor is near the cheapest versus growth since at least 2000 whether one is comparing its price to forward earnings, sales or book value.

One reason for this is that value’s profits rose faster than its price in the economic reopening. That means relative to earnings, these shares actually look cheaper. What’s more, in terms of earnings upgrades, value is still beating expensive stocks, Bernstein says.

The worry is that the omicron variant could completely overwhelm the fundamental case for the factor.

“Tough to make a strong case for value until we know more on the virus severity data,” said Dennis DeBusschere, founder of 22V Research.

©2021 Bloomberg L.P.