Feb 22, 2019

Vanguard Bond ETFs Lose $1.4 Billion as One December Buyer Bails

, Bloomberg News

(Bloomberg) -- It’s been a painful week for a clutch of exchange-traded funds run by Vanguard Group Inc.

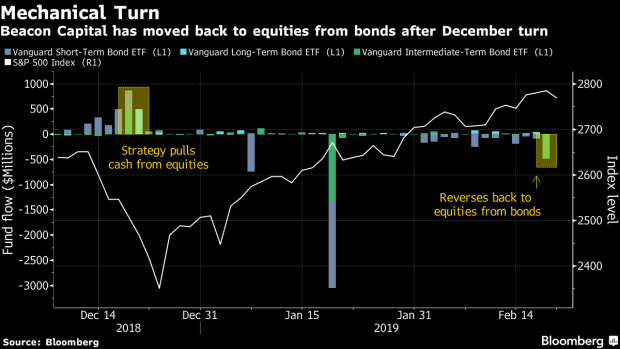

Three of its bond ETFs lost a total of $1.4 billion in a single day as one large trader, Beacon Capital Management, decided to sell. The Vanguard Long-Term Bond ETF, ticker BLV, saw its largest daily outflow on record as over $470 million drained away, data compiled by Bloomberg show. Short-term and intermediate-term debt funds also lost more than $400 million apiece.

Beacon is shifting back to 11 of Vanguard’s sector ETFs after volatility late last year prompted the firm to sell stock funds and hole-up in debt, according to Chris Cook, the firm’s president. The firm adheres to a rules-based strategy, and a 10 percent drop in its benchmark spurred the temporary move into debt ETFs, he said.

“We had taken more of a risk-off position in December, and those trades have reversed,” Cook said.

The S&P 500 touched an almost three-month high on Wednesday.

More than $1.3 billion of large block trades in the three funds crossed the tape between 10:38 a.m. and 10:46 a.m. in New York on Tuesday, data compiled by Bloomberg show. In addition to BLV, millions of shares traded in the Vanguard Intermediate-Term Bond ETF and the Vanguard Short-Term Bond ETF in a matter of minutes.

A spokesman for Vanguard declined to comment.

--With assistance from Sarah Ponczek.

To contact the reporters on this story: Reade Pickert in New York at epickert@bloomberg.net;Kriti Gupta in New York at kgupta129@bloomberg.net;Rachel Evans in New York at revans43@bloomberg.net

To contact the editors responsible for this story: Jeremy Herron at jherron8@bloomberg.net, Brendan Walsh, Dave Liedtka

©2019 Bloomberg L.P.