May 16, 2019

Vegan Burgers Have Kickstarted a Dangerous Stock Frenzy in China

, Bloomberg News

(Bloomberg) -- Sign up for Next China, a weekly email on where the nation stands now and where it's going next.

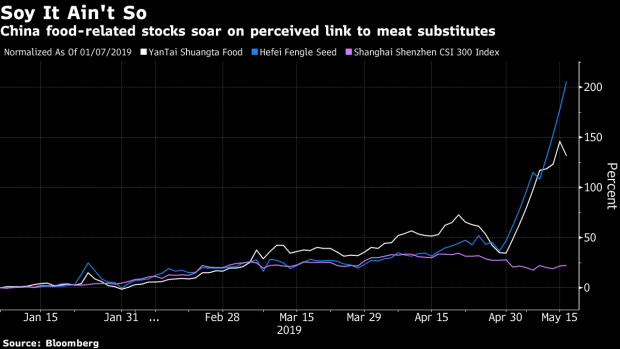

A meat-substitute inspired rally in Chinese stocks may lack substance.

Following Beyond Meat Inc.’s spectacular U.S. debut, equity traders have been looking to play the global plant-protein trend in China, and it’s been a winning bet in May. Hefei Fengle Seed Co. and YanTai Shuangta Food Co. have soared more than 70% even as the broader market fell. Just one snag: the companies don’t make anything close to vegan burgers.

The trade is getting so speculative that it’s forced some companies to explain why they won’t benefit from the growing global appeal of meat substitutes -- a market that barely exists in China. Escalating trade tensions and rising pork prices attracted even more buyers to the sector, betting that prices for some agricultural goods will increase.

“Low share prices made these a convenient choice for speculators,” said Dai Ming, a Shanghai-based fund manager with Hengsheng Asset Management Co. “Beyond Meat’s performance has stoked a frenzy. These speculative trades are particularly dangerous when risk appetite retreats.”

YanTai Shuangta and Hefei Fengle hit record trading volumes this week, the latter having already reacted to its soaring stock price by reminding investors that its pea sales are nonexistent and soybean seeds account for less than 1%. “Capital markets have been giving much attention to the artificial meat concept,” the Shenzhen-listed company said in a disclosure.

Harbin High-Tech Group Co., which processes soybeans, among a wide array of other businesses including real-estate development, said in a disclosure earlier this month that “investors should note that Beyond Meat’s chief ingredient is pea protein, not soy.” That hasn’t deterred traders from sending the shares on a 33% surge this month.

Such trend fixation in China was evident in February’s 5G craze, best illustrated by Eastern Communications Co.’s 224% rally in a little over a month. Nothing seemed to curb speculators’ enthusiasm, even as the company reminded investors that its businesses had nothing to do with 5G. The stock has since fallen 46% from its March peak.

“There is no market for substitute meat in China,” said Sun Zheng, an analyst at China Development Bank Securities. “These price moves don’t have anything to do with value.”

To contact Bloomberg News staff for this story: April Ma in Beijing at ama112@bloomberg.net;Mengchen Lu in Shanghai at mlu157@bloomberg.net

To contact the editors responsible for this story: Sofia Horta e Costa at shortaecosta@bloomberg.net, David Watkins, Will Davies

©2019 Bloomberg L.P.