Aug 15, 2019

Vestas Profit Misses Forecasts as Wind Turbine Revenue Falls

, Bloomberg News

(Bloomberg) -- Want the lowdown on European markets? In your inbox before the open, every day. Sign up here.

Vestas Wind Systems A/S narrowed its guidance for profit for the rest of the year after earnings and revenue fell short of expectations in the second quarter.

- Earnings before interest and tax for the three months ending June 30 were 128 million euros ($143 million), missing the median analyst estimate which was for 133 million euros. Revenue was 2.12 billion euros, short of expectations for 2.36 billion euros.

Key Insights

- Pressure on product prices taken its toll on Vestas despite a record turbine order backlog. The trade war between the U.S. and China is forcing manufacturers to pay more for the raw materials needed to build turbines.

- Increasing number of competitive auctions for power contracts that underpin new capacity is also forcing turbine makers to lower prices.

- Vestas’ main competitors, facing the same headwinds reported mixed results. Siemens Gamesa Renewable Energy SA’s shares plunged after Q3 net income fell 53% amid turbine prices falling. Nordex SE reported a record order intake in the second quarter and raised its capex guidance.

Market reaction

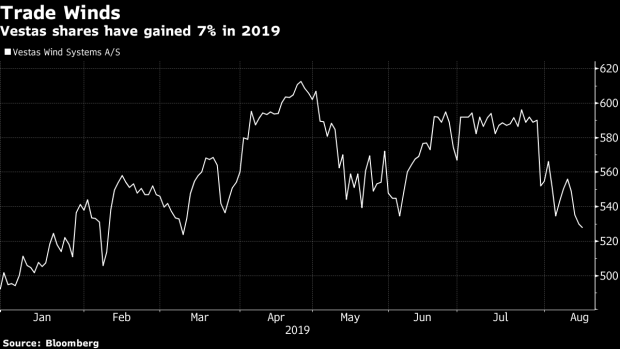

- Vestas shares have risen over 7% so far in 2019 but have fallen 14% since their April high of 612.6 kroner ($91.80 a share)

Executive reaction

CEO Henrik Andersen said, “Prices remained stable in the quarter, but further increases in tariffs, raw material prices and transport costs, continue to increase execution costs, causing our gross margin to decline compared to the same period last year.”

Know more

Vestas forecast Ebit margin for the full year of 8% to 9%.

- Sees FY revenue EU11.0 billion to EU12.25 billion, down from previous outlook for EU10.75 billion to EU12.25 billion. Estimates were for EU11.69 billion (range EU10.68 billion to EU13.11 billion) (Bloomberg data)

- 2Q Ebit EU128 million, estimate EU133.3 million (range EU59.0 million to EU201.0 million) (BD)

- 2Q revenue EU2.12 billion, estimate EU2.36 billion (range EU1.93 billion to EU2.98 billion) (BD)

- 2Q net income EU90 million, estimate EU99.0 million (range EU45.0 million to EU164.0 million) (BD)

- 2Q orders 5,696 MW

- Says total investments expected to amount to about EU800m compared to previously EU700m

- The adjustments to outlook are based on performance and improved visibility for remainder of year

- Prices remained stable in 2Q, but further increases in tariffs, raw material prices and transports continue to increase execution costs, causing gross margin to decline y/y

To contact the reporter on this story: Jeremy Hodges in London at jhodges17@bloomberg.net

To contact the editor responsible for this story: Reed Landberg at landberg@bloomberg.net

©2019 Bloomberg L.P.