Jul 12, 2022

VinFast Says It’s Signed Banks to Raise $4 Billion for US Plant

, Bloomberg News

(Bloomberg) -- Vietnamese electric-vehicle maker VinFast said it has signed agreements with banks to raise at least $4 billion globally to fund its planned North Carolina EV factory and US rollout, according to a statement.

Credit Suisse Group AG will help arrange the issuance of offshore securities to raise around $2 billion, while Citigroup Global Markets Inc. will act as an adviser on transactions with a minimum value of around the same amount related to the development of VinFast’s US factory, the statement from VinFast parent Vingroup JSC said.

Read more: Vietnamese EV Maker to Build Factory in North Carolina

Any transactions may include debt or the private placements of equity, according to the statement, which didn’t go into further detail.

VinFast is on track to start production of electric cars in the US by 2024, Chief Executive Officer Le Thi Thu Thuy said in an interview with Bloomberg TV in June. Construction of the North Carolina plant may start in September.

The upstart EV maker, little known outside Vietnam, has ambitions to deliver as many as 1 million cars globally within five to six years, a goal Thuy reiterated last month was “achievable.”

The target would seem ambitious compared with other, more established automakers.

Chinese EV startup Nio Inc. only celebrated its 100,000th vehicle off the production line in April 2021 after almost three years, while Goldman Sachs Group Inc. earlier this month lowered its 2022 output estimate for Tesla Inc., the world’s biggest maker of electric cars, to 1.4 million units.

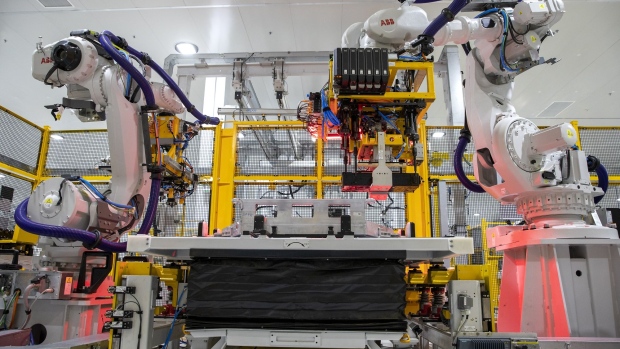

VinFast’s factory complex will be located in the Triangle Innovation Point industrial park in Chatham County, North Carolina, and include manufacturing facilities for EVs, clean buses and batteries, according to the statement. The first phase of the facility is expected to have a production capacity of 150,000 electric vehicles a year, it said.

©2022 Bloomberg L.P.