Aug 3, 2020

Virus Will Spur a ‘Tsunami of Fraud’ in the U.K., KPMG Warns

, Bloomberg News

(Bloomberg) -- The coronavirus is likely to trigger a tsunami of U.K. fraud cases when courts and law enforcement get back to full strength, accounting firm KPMG warned.

Although there have been fewer fraud cases compared to previous years, that will change as the courts get back on their feet, KPMG said in a report released Tuesday.

“The Covid-19 environment has led to increased financial pressures on individuals and organizations leading to more opportunities to commit fraud,” Roy Waligora, KPMG’s head of investigations in the U.K., said in an emailed statement. “This is likely to lead to further risk of financial misreporting and of misconduct and fraud in traditional hot spots.”

The backlog of criminal cases in England and Wales stood at 37,434 at the end of 2019 and likely has grown considerably during the outbreak, when several courts closed their doors and others scaled back operations.

Several cases may stem from the government’s job-retention program, the accounting firm said.

KPMG says the U.K. tax authority received as many as 1,900 reports of furlough fraud in May. Last month, revenue and customs officials made their first arrest in relation to the program, which paid 80% of wages up to a cap of 2,500 pounds.

“We are likely to see a lot more HMRC activity where government aid schemes have been abused,” Waligora said. “We are likely to see a tsunami of Covid-19 related fraud cases.”

UBS’s $5 Billion Retrial, Theranos Shelved in Virus Backlog

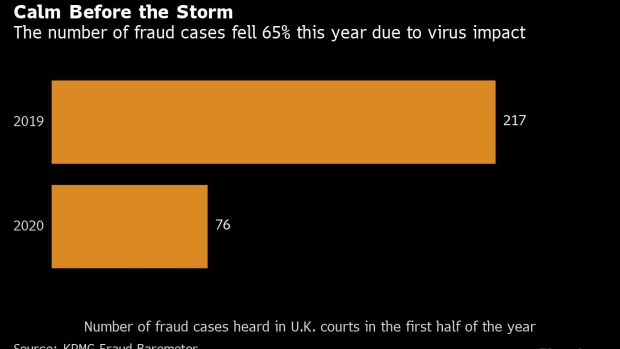

KPMG’s analysis of fraud prosecutions in the country’s courts shows that only 76 cases were heard in the first half of 2020, down from 217 cases during the same period last year. The 65% fall reflects the impact of the virus on law enforcement and indicates a “calm before the storm,” the firm said.

©2020 Bloomberg L.P.