Apr 24, 2019

Vodacom, MTN Fall After South Africa Finds Data Too Expensive

, Bloomberg News

(Bloomberg) -- Vodacom Group Ltd. and MTN Group Ltd. shares fell after one of South Africa’s competition regulators ruled that the country’s two largest mobile-phone companies overcharge customers for data -- particularly those on lower incomes.

The two carriers bill more in their home market than in other countries in which they operate, the Competition Commission said in a provisional report on an inquiry that began in August 2017. Customers hardest hit are those using smaller prepaid bundles, who tend to be less well off, the regulator said.

“Lower income consumers may be exploited to a far greater degree relative to wealthier consumers,” said Commissioner Tembinkosi Bonakele. The carriers must commit to reduce the price of sub-1GB packages to “within an objectively justifiable and socially defensible range” of current levels, he said.

Vodacom, majority owned by U.K.-based Vodafone Group Plc, and MTN had a combined 75 million customers in South Africa at the end of 2018, or about three-quarters of the current market, which includes those with more than one mobile-phone subscription. Smaller carriers have long appealed to regulators to curb the dominance of the top two carriers, while the high cost of data has been the subject of street and social media protests using the hashtag #DataMustFall.

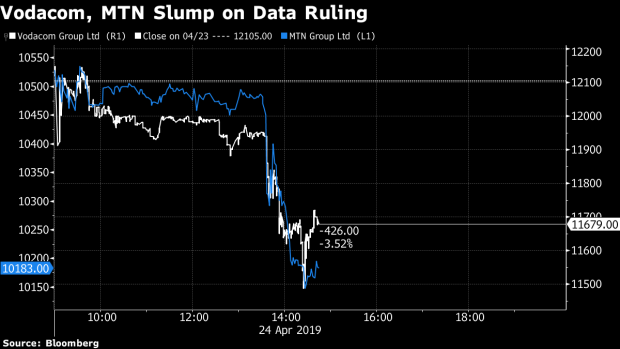

Vodacom dropped as much as 4 percent in Johannesburg, the most in three months, while MTN fell by 2.9 percent.

“‘Vodacom can confirm that, as part of its ongoing pricing transformation strategy to address the cost-to-communicate in South Africa, we have reduced the effective cost of data by 34 percent in the past calendar year alone,” spokesman Byron Kennedy said in an emailed response to questions.

MTN, Africa’s largest carrier by subscriber numbers, couldn’t immediately be reached for comment.

The Competition Commission measured South African data prices against other countries in Africa and around the world and found they compare poorly, the regulator said. One reason is the government’s repeated delays in providing new mobile spectrum, which would increase access and bring down costs, it said. However, any upcoming auction should be based on a requirement for providers to cut fees and lay on services including free WiFi in public spaces.

The wireless carriers’ views on the findings should be submitted by June 14, while a final report will be published later this year.

To contact the reporters on this story: Loni Prinsloo in Johannesburg at lprinsloo3@bloomberg.net;Renee Bonorchis in Johannesburg at rbonorchis@bloomberg.net

To contact the editors responsible for this story: Alastair Reed at areed12@bloomberg.net, ;Rebecca Penty at rpenty@bloomberg.net, John Bowker, Thomas Pfeiffer

©2019 Bloomberg L.P.