Oct 4, 2022

Vodafone-Three Merger Set to Be $16 Billion Test for Watchdogs

, Bloomberg News

(Bloomberg) --

Vodafone Group Plc and CK Hutchison Holdings Ltd’s potential UK merger would create a wireless giant worth about €16.5 billion (£14.3 billion), according to analysts - if it can clear steep regulatory hurdles.

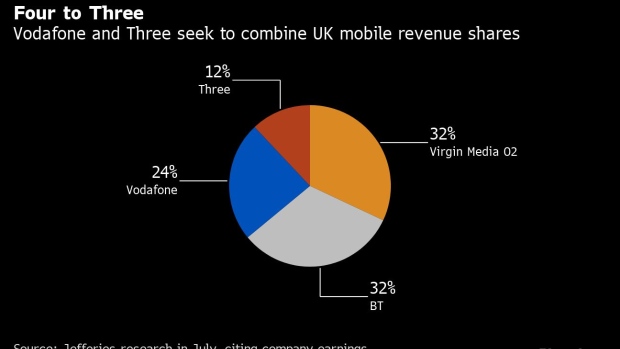

The two mobile operators confirmed they’re in talks about a potential deal on Monday giving Vodafone 51% and CK Hutchison 49% of a combined business, which would bring in more mobile revenue than its main rivals BT Group Plc or Virgin Media O2.

Vodafone UK carries an enterprise value of €9.8 billion and Three UK is worth €4.4 billion, while bringing them together would yield some £2 billion ($2.3 billion) in synergies, according to a note late Monday from New Street Research analysts led by James Ratzer. Meanwhile analysts at Oddo BHF SCA led by Stephane Beyazian put the joint enterprise value at £14.5 billion pounds.

But Oddo set the deal’s chances of success at just 55% given tough regulatory scrutiny. The units could divest tower stakes or spectrum as potential remedies.

New Street said a deal could take more than a year to complete, but it had a “far better” chance of being approved than CK Hutchison’s blocked attempt to buy Telefonica SA’s O2 in 2016, partly because a paper from UK telecom regulator Ofcom assessed both businesses as likely earning below their costs of capital. A 2020 European court ruling also challenged the strength of that 2016 veto.

The main benefit would be from combining the two networks of radio antennas, New Street said, adding a caveat that this could take a while because both operators are tied into long-term contracts with tower companies and other operators.

©2022 Bloomberg L.P.