Aug 28, 2020

Volatility Markets Brace for Election Drama Like Never Before

, Bloomberg News

(Bloomberg) -- Traders across major asset classes are sending the same message: Prepare for what could be the most-contentious U.S. presidential elections in decades.

One measure of hedging in the stock market is higher than at any point in the past three presidential elections. In the interest-rates market, implied volatility is well above levels reached in 2016 or 2012. And three-month implied volatility in the dollar-yen pair -- a classic haven trade -- has risen above the two-month tenor by the most in two decades, signaling demand for protection from turbulence near Election Day.

Trades protecting against election-induced volatility have been around all year, with “unprecedented” levels of hedging seen as early as January. Yet the potential for drama has only grown since then as the coronavirus leaves the U.S. mired in a recession and President Donald Trump rages against mail-in voting, raising concerns about a prolonged dispute over vote tallies. That uncertainty is complicating more conventional topics, such as how the results will affect tax policy and the trade war with China.

“You have a global pandemic as your backdrop, which speaks for itself, and then you have a president that’s in a term, volatile, and you have the things going on with the Postal Service,” said Zachary Griffiths, a rates strategist at Wells Fargo. “All these factors that don’t typically play into an election are impacting things now and that’s clearly got people concerned. And vol has bid up tremendously in rates and equities.”

The November election is shaping up to be the most-contested in modern U.S. history, as changes to balloting prompted by the coronavirus fuel legal challenges that could stall the outcome for days or weeks. A recent count by Loyola Marymount University law professor Justin Levitt found 154 cases already filed across 41 states and the District of Columbia. Many more are expected in the months ahead.

Rates Vol

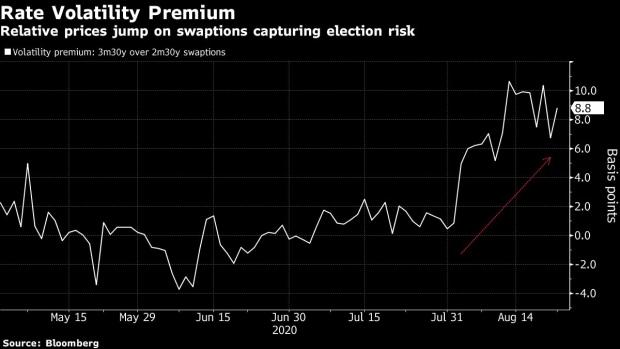

One area that highlights how much traders are bracing for election drama is swaptions, or options on interest rate swaps, which typically mirror the overall direction of Treasury yields. Wells Fargo analysts found that Election Day is priced for four times the volatility of a “typical” trading day in this market, based on the difference between at-the-money volatility on two-month and three-month swaptions on 10-year interest rate swap contracts. That compares to roughly two times at a similar point in the 2016 election cycle and about 1.7 times during the 2012 campaign, they wrote in a note.

The election premium in swaptions is most pronounced in contracts for longer maturity swaps, such as those with 30-years to maturity, according to Goldman Sachs Group Inc.

However, interest-rate markets may not be adequately pricing the possibility of a change in party control, according Goldman strategist William Marshall. Democratic nominee Joe Biden leads President Donald Trump by 7 percentage points in a national average of polls, and holds an advantage in several states seen as key to winning the White House.

Since 1968, a “switching” election has led to higher realized volatility in the months after the vote and the absolute average yield change has been greater, Marshall showed in a report.

“All of the vol premium around the election comes from the event itself and following week, suggesting a market underpricing the potential for a sustained pick-up in vol in the event of a Biden victory,” Marshall said in the note. A Democratic Party sweep of both Houses of Congress likely would cause the largest increase in volatility, he added.

Equities

Though the Cboe Volatility Index -- known as the VIX -- has been grinding lower since March’s dizzying peaks, anxiety is building for contracts tied to it that are meant to protect against stock-market losses. October VIX futures -- which reflect the market’s expectations for volatility from Oct. 21 to Nov. 21 -- are elevated relative to both September and November contracts. That “kink” in the term structure is roughly 3 volatility points higher than the average VIX curve at this time before past presidential elections, according to UBS Group Inc.

The spread between September and October VIX futures is already higher than at any point in the past three presidential elections. Currently, the October contract is trading 3.75 vol points above September’s -- in 2012, the gap was 2.5 percentage points at its widest point, according to Susquehanna Financial Group LLP.

What Bloomberg Intelligence says

“Volatility historically trends up in the months leading into an election. Kinks are now showing up on volatility surfaces around the election date across asset classes. Equity vol may outperform rates vol given yields are anchored and the dovish Fed.”

-- Tanvir Sandhu, chief global derivative strategist

Some traders are bracing for a drawn-out fight rather than just a single burst of turbulence on Election Day.

“As we get closer and more expirations are listed, people will begin to feel a Nov. 4 expiry date is too short,” said Stuart Kaiser, head of derivatives research at UBS. “People are looking at the results may take longer than a month.”

Currencies

The dollar-yen pair also shows signs of larger-than-normal election hedges, with the spread between two- and three-month implied volatility touching its highest level since November 1999 last week.

The uptick in three-month volatility is being driven more by the risk of a delayed result rather than a specific outcome, according to Canadian Imperial Bank of Commerce’s Bipan Rai. He wrote in a note that massive amounts of mail-in ballots raise the risk of a possible “constitutional crisis” should Trump refuse to concede defeat.

Currency volatility is rising across the board as well. A recent jump in the JPMorgan Global FX Volatility Index, based on three-month at-the-money forward options, has knocked the gauge out of alignment with the grind lower in the VIX and the ICE BofA MOVE Index, which measures expected swings in Treasury yields.

The divergence is largely thanks to the dollar’s July plunge, a slide that traders are anticipating may accelerate heading into November’s vote. Bullishness on the euro has lifted options trades known as risk reversals across tenors to between 60 to 80 basis points, a phenomena that’s only happened three times since Bloomberg began compiling the data in 2006. In all cases, the euro rallied by more than 5% within a few months.

“A fall in the USD can be congruent with an uptick in FX vols if we’re talking about a U.S.-specific crisis,” Rai wrote.

©2020 Bloomberg L.P.