Aug 11, 2021

Voyager Digital is gearing up for rapid growth with new acquisition and all-star crypto partnership

- Cryptocurrency has gained significant traction over the last few years as more investors and institutions pour into Bitcoin, Litecoin, and Ether, among others

- Voyager Digital, a publicly traded cryptocurrency platform, is honing in on its partnerships by teaming up with NBA all-star, Victor Oladipo and NASCAR driver, Landon Cassill; acquiring Coinify; and partnering with Blockdaemon and Market Rebellion

- The company has seen massive growth this year, including a hike from 43,000 to 665,000 funded accounts in just six months

Cryptocurrencies have gone from outlier to mainstream, from attracting the attention of tech’s early adopters to drawing serious interest — and serious money — from major traditional institutional investors.

How do you know cryptocurrencies have entered the big leagues? When crypto businesses literally enter the big leagues, with sponsorships of NBA players and NASCAR drivers, complete with full wraps of race cars.

That’s exactly what Voyager Digital (CSE: VYGR | OTCQX: VYGVF | FRA: UCD2) is doing with the strategic partnerships it has signed so far this year that are aimed at expanding its product offerings and building its brand, even as the company experiences phenomenal growth.

“I cannot be more enthusiastic long-term and that’s because we see this crypto ecosystem developing with substantial amounts of what I would define as the smart money on the institutional [investing] side looking to get involved.” — George Sutton, Partner, Craig-Hallum Capital Group LLC.

Voyager boasts a simple-to-use mobile app for buying, selling, and earning yield on crypto assets, and has been rapidly expanding its business and user base.

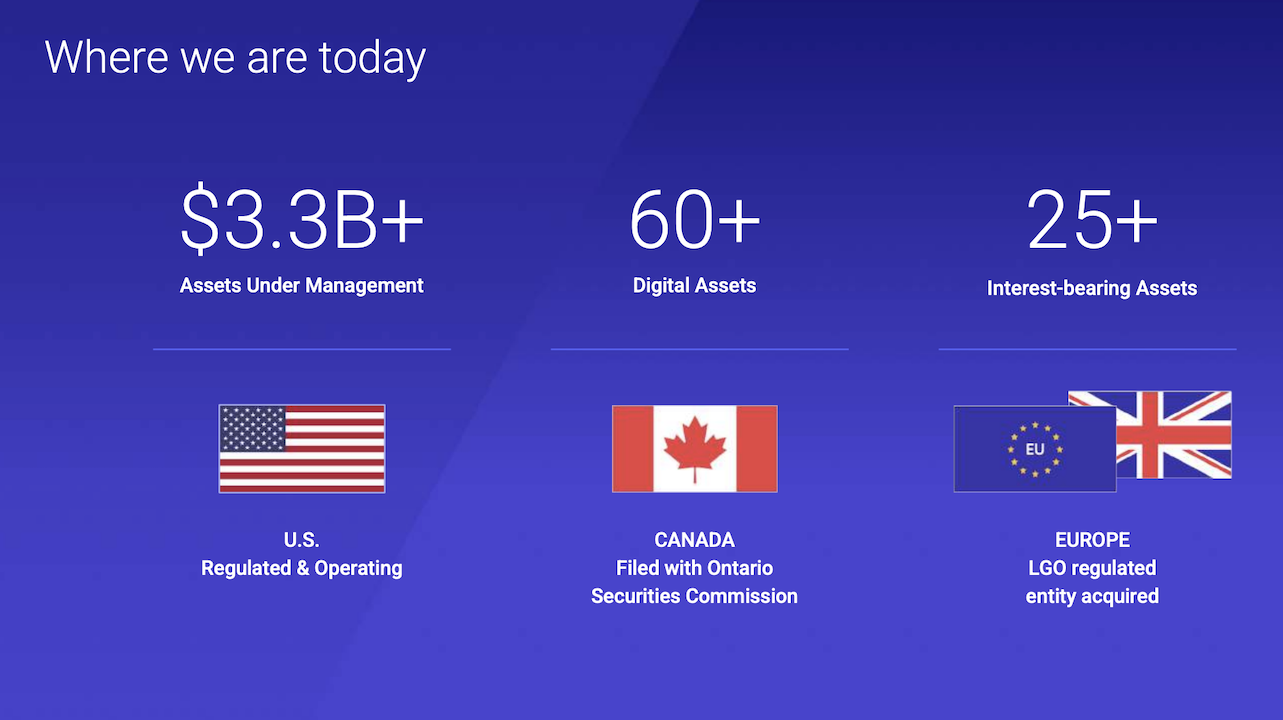

Steve Ehrlich, Voyager's CEO and co-founder, notes that the company had 43,000 funded accounts at the beginning of January and, by the end of June, that figure had ballooned to 665,000. Assets under management have similarly skyrocketed, from US$230 million at the end of last year to over US$3 billion this summer.

For some companies, that would be enough to manage. But Ehrlich, who worked seven years at E-Trade, sees much more potential, as well as a maturation of the crypto industry.

This is why Voyager has entered business partnerships with Blockdaemon, a blockchain node infrastructure platform; Market Rebellion, a leading provider of trading education and content; Coinify, a crypto payment platform; Lottery.com; and with NBA all-star, Victor Oladipo and NASCAR driver, Landon Cassill.

Racing towards growth with NASCAR

Voyager is the first primary sponsorship of a NASCAR race car paid fully in a portfolio of cryptocurrency led by Litecoin and the Voyager Token. Landon Cassill raced a car that was customized with a Voyager-branded car wrap that also featured crypto businesses Litecoin and Trade the Chain.

“Landon is the perfect partner for us,” Ehrlich says. “He’s not just a NASCAR driver — and a good one, at that — he is someone who’s been around and believes in crypto. So, when we were looking at where we could extend our reach to find more consumers, to bring them into the ecosystem, NASCAR was one of the areas we looked at. We also made certain that who we were going to partner with was someone who understood crypto.

We $SHIB you not, we did it 🐕

— Voyager (@investvoyager) July 3, 2021

Tune in to see @landoncassill drive the #Voyager #NASCAR race car, now sporting the $SHIB logo 🐾🏎️ 🏁

Watch at 3:00 pm ET on @NASCARonNBC. pic.twitter.com/PjLAYfVXxF

Ehrlich notes, “It’s worked out very well for us. Landon is engaged with our community and other crypto communities, so we’re bringing all those together under the Voyager umbrella.”

Aiming for the net with the NBA

As part of the launch of Voyager for Good, a referral program that awards the charity of an athlete's choice digital assets each time a new account is opened and traded with a unique referral code, Voyager has partnered with the Miami Heat’s Victor Oladipo.

When Victor Oladipo's followers open a new Voyager account using his unique referral code, deposit at least $100, and make their first trade, they will receive $25 in Bitcoin for themselves, and Voyager will also donate $25 in Bitcoin to the Oladipo Foundation. The Foundation aims to empower the next generation of youth, especially young women, to thrive without limits through confidence, creativity, capacity, and community.

Ehrlich says Oladipo is “not only an all-star athlete in the NBA, but he is also a highly-engaged investor who brings passion and positivity to everything he does. He’s also well-positioned in the NBA world to teach others about crypto and really start building that ecosystem.”

“We’re both keen on educating high school and college individuals about crypto,” Ehrlich adds. “I think it’s incumbent upon people who have influence and have a network and have an ability to reach other people, to reach younger Americans. It’s our job to educate and help them grow, and to help people create their wealth over time. It doesn’t happen overnight.”

Voyager Digital Partners with NBA All-Star Victor Oladipo

— Voyager (@investvoyager) May 13, 2021

Join us in welcoming NBA all-star @VicOladipo, as we launch #VoyagerforGood 🚀

Learn more here: https://t.co/m0BYIb5zDv

Increasing payment processing power

Voyager is building out its services beyond crypto trading to offer crypto payment capabilities.

The company recently announced the acquisition of Coinify ApS, a leading cryptocurrency payment platform with a global user base in over 150 countries. The acquisition will allow Voyager customers to make payments directly from their digital asset accounts while fast-tracking the company into the business-to-business payment space.

The acquisition of Coinify's virtual currency payment platform, available in Europe, Asia, North America, as well as South America, allows Voyager to break into the crypto payment space and expand globally, offering services beyond crypto trading.

Voyager plans to provide payment options to its customers, many of whom are small to midsize business owners. As the use of crypto payments grows substantially, Voyager is positioned to capitalize on that growth with an expanding line of products and services.

What’s more, the company has also signed a Memorandum of Understanding with Lottery.com to work toward enabling Lottery.com users to generate payment transactions using the Voyager platform. Calling this deal “a crucial partnership,” Ehrlich says a relationship with Lottery.com shows off Voyager’s payment capabilities to a massive audience.

Accessing Blockchain data with Blockdaemon

If you’re wondering what blockchain nodes are, you’re not alone. Here’s an explanation from 101 Blockchains: “In [the] context [of] a Blockchain network, nodes are the electronic devices connected to the network and possessing an IP address. Generally, nodes are the communication endpoints which means that any user or application that wants to interact with the Blockchain does so through nodes. Therefore, nodes are also a point of communication redistribution.”

As Ehrlich explains it, proof-of-stake points sit on the nodes, and by validating those, a company reaps rewards. For reference, Investopedia explains that proof of stake is when “a person can mine or validate block transactions according to how many coins they hold. This means that the more coins owned by a miner, the more mining power they have.”

“Instead of us building the nodes and the infrastructure and running those nodes ourselves,” Ehrlich says, “we work with a partner, and that’s why we chose Blockdaemon because they could run the nodes and do the staking on our behalf. Therefore, we could earn these rewards and give the lion’s share of that back to consumers so it’s a better value proposition for consumers.”

The goal of this partnership is to initially integrate validator nodes on Ethereum, Polkadot, and Tezos onto the Voyager platform, with plans to expand the offering to include more of the 30 digital assets that Blockdaemon currently supports including Celo, Terra, and Algorand.

This integration will enable Voyager users to earn interest on a wider scope of coins offered on Voyager’s platform. Integrating Blockdaemon’s secure node infrastructure into Voyager’s platform will also allow Voyager to control its balance sheet more effectively by reducing lending activities and reducing counterparty risk.

Crypto and trading education with Market Rebellion

The partnership with Market Rebellion is focused on creating VYGR Digital Securities LLC, a new U.S.-based, crypto-based licensed brokerage focused on providing online brokerage services for equities, options, and futures. In other words, the companies are providing the ability to buy and sell stocks using cryptocurrency, starting next year.

With Market Rebellion also driving its active trading community to the platform, VYGR Digital Securities is just the beginning of a suite of Voyager products.

“The ability to partner with them to build the infrastructure necessary to bring equity trading and, then option trading and future trading, to our consumers was a very important next step for us,” Ehrlich comments. “Allowing consumers to use crypto to actually buy their stocks is something that isn’t being done by anyone else.”

“If you’re taking care of your customers, your token holders, and your employees, then your investors are going to be taken care of.” — Steve Ehrlich, CEO and co-founder, Voyager Digital, LLC.

Voyager isn’t done creating strategic partnerships with other companies whose cultures match its approach, which is more tech than traditional finance: go fast, break things, bring innovative products to market.

Enthusiastic long-term

“We think there are many other partnerships to come,” says George Sutton, who likes what he sees in Voyager Digital and notes its unprecedented growth in the last year.

A partner at Craig-Hallum Capital Group LLC, a research, trading, and investment banking firm — as well as a Voyager user and an owner of its stock — Sutton notes the company had an incredible spring and has shown “outstanding growth of funded accounts” and has plenty of marketing budget available to expand its reach. He’s also bullish given the growth in popularity of cryptocurrency among investors.

“I honestly cannot be more enthusiastic long-term and that’s because we see this crypto ecosystem developing with substantial amounts of what I would define as the smart money on the institutional investing side looking to get involved,” Sutton explains.

Michael Del Grosso, an equity research analyst and managing director who helps lead fintech and crypto coverage for Compass Point Research and Trading, LLC, a full-service investment bank, is similarly enthusiastic on the prospects for crypto, noting Bitcoin has more than tripled in value in a year.

Voyager has a strong growth profile, Del Grosso says, even with its stock trading option not yet launched. And he’s optimistic that its influencer-based approach to marketing — using the likes of Oladipo and Cassill — will be successful in capturing more users for its platform, which currently has little competition. Compass Point is also forecasting Voyager will hit one million funded accounts by 2022.

Strong numbers ahead

Voyager’s Ehrlich is even more optimistic, saying the adoption of crypto is “very young” and he expects one billion people to have crypto exposure by 2025. He’s also confident that if his company focuses on its four key constituents, it and its investors will do well.

“If you’re taking care of your customers, your token holders, and your employees, then your investors are going to be taken care of,” he says.

And he makes a bold prediction: that Voyager Digital, whose valuation is approximately US$2 billion now, will hit US$10 billion in a year.

With a massive market opportunity, attractive business model and scalable infrastructure, the future looks bright for this cryptocurrency platform.

For more information on Voyager Digital, visit their website here.

Make sure to follow Voyager Digital on social media for the latest company updates: