Nov 28, 2019

Wait for U.S. dollar drop before buying emerging market stocks, Citi says

, Bloomberg News

Emerging Markets a 'Promising Area,' Cresset Capital CIO Says

Investors keen to take on board more risk and buy emerging market equities should wait for changes in two key signals -- a jump in Chinese money supply growth and a break lower in the dollar.

That’s the view of Citigroup Inc. strategists including Jeremy Hale, who are keeping a more cautious stance on developing-nation stocks until signs of fundamental growth improve, as positive sentiment on trade has failed to kick-start a period of outperformance for the asset class.

“When China nominal policy rate easing, that Citi expects in 2020, feeds through to M2 growth, we may see a more pronounced inflection point for improved EM risk taking,” the strategists wrote in a note Thursday. “For us, a turn in the dollar is also one of our signals for increasing EM exposure.”

Renewed expectations of a phase one U.S.-China trade deal and hope the global economic slowdown has ended have seen developed-market stocks hit an all-time high this month, taking the MSCI World Index’s run this year to 22 per cent. That compares with just a 9% year-to-date rise in the MSCI Emerging Market Index, which remains well below its 2007 peak.

China’s easing of monetary policy has so far been more about its currency, and a weaker yuan is not necessarily positive for local risk assets, according to the Citi strategists. A boost to money supply however, would encourage private consumption, lending and investment -- which would be bullish for EM assets, they said.

Meanwhile, a weaker dollar is typically positive for commodities, which may also boost emerging market outperformance given relative terms of trade, they added.

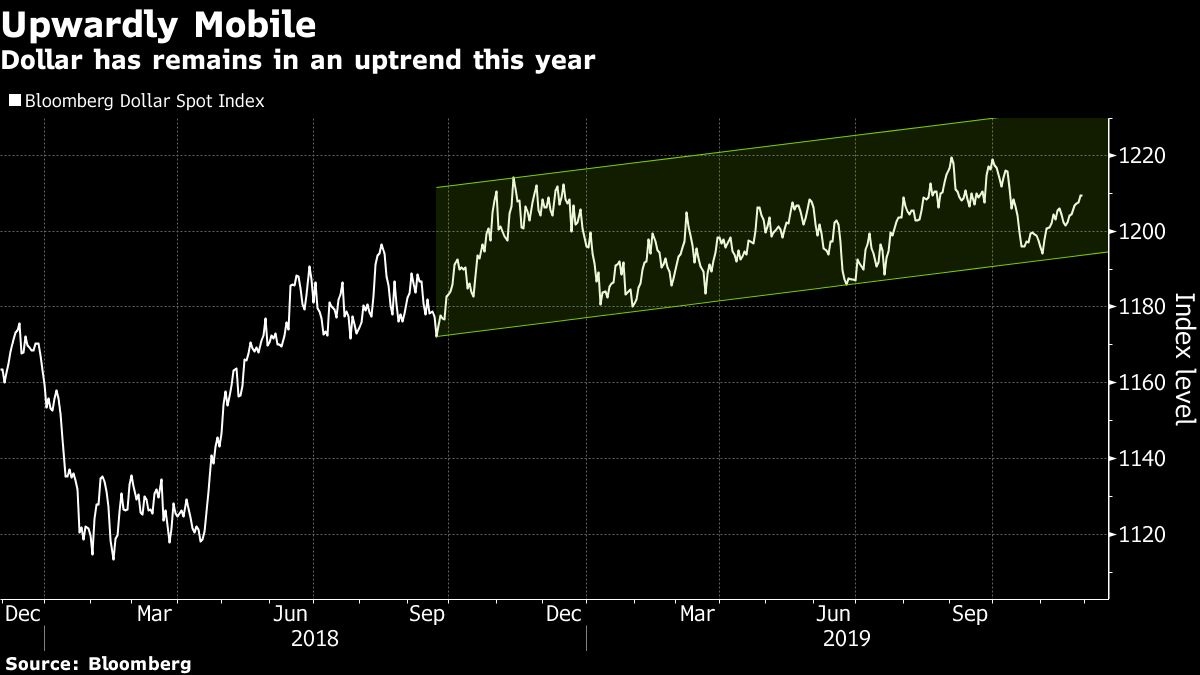

The strategists are watching for a break lower toward 1190 in the Bloomberg Dollar Spot Index, about 1.5 per cent below Friday’s level of 1209.