Nov 1, 2022

Wall Street Banks Seize Credit Calm to Sell Risky Corporate Debt

, Bloomberg News

(Bloomberg) -- Big banks are trying to sell risky buyout debt again in the US, taking advantage of growing demand from investors that may prove short-lived.

A group led by Bank of America Corp. and Citigroup Inc. late Monday started selling $2.4 billion of junk bonds and loans to help finance the leveraged buyout of auto-parts maker Tenneco Inc. by Apollo Global Management Inc. They’re selling at steep discounts, and it’s just a portion of the original $5.4 billion package that banks committed for the debt portion of the deal.

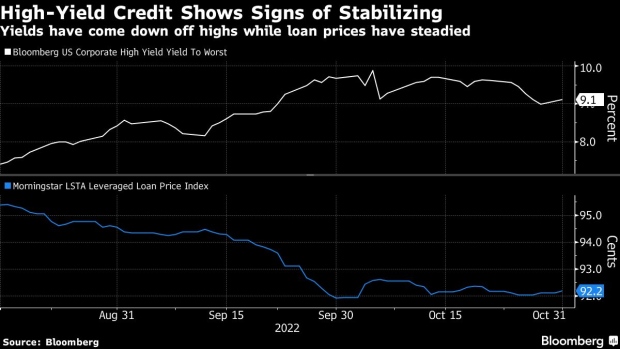

But just a few weeks ago, the lenders had resigned themselves to potentially not being able to sell any of the debt at all in the near term, and possibly having to fund the buyout with their own balance sheets. Demand for US high yield bonds has been growing since then, in part because companies have refrained from selling new debt for the last two weeks. Junk yields fell to 9.1% over the course of October, down more than half a percentage point from the end of September, according to Bloomberg index data.

That drop may pull in more junk issuers. Ford Motor Co.’s credit arm is selling $1.5 billion of five-year notes on Tuesday. The debt, rated in the BB tier, launched at a yield of 7.35%, in line with the 7.36% average for similarly rated bonds as of late Monday.

Investors have grown increasingly hopeful that the Federal Reserve as soon as Wednesday will signal an end to 75-basis-point rate hikes. Junk bonds gained 2.6% in October, only the third month of positive returns this year. Leveraged loan prices have stabilized at around 92 cents on the dollar.

Money has started to flow back into high-yield funds as well, gaining $2.8 billion for the latest weekly reporting period, according to Refinitiv Lipper data. Banks are sitting on buyout transactions that need to get funded, said Steven Oh, global head of leveraged finance at Pinebridge Investments, which managed about $141 billion as of June 30.

“Any reasonable opportunity that banks get to offload exposure from the balance sheet, particularly if they’re able to do so without any type of losses, they’re going to seize it,” Oh said.

But selling risky debt to recession-wary investors will be no easy feat. Banks have struggled for weeks to find demand for high-yield bonds and leveraged loans, and have already used around $40 billion of their own money this year to fund buyout and acquisition debt.

Upcoming Catalysts

Demand for US investment-grade bonds has also been growing stronger in recent sessions. Risk premiums on the bonds were 1.58 percentage point on Monday, tighter than the 1.64 percentage point level in mid-October.

Companies sold more than $34 billion of the bonds last week, more than the $20 billion to $25 billion that dealers had previously forecast. Corporations including American Express Co. and Comcast Corp. sold $7 billion of the debt on Monday as well.

“The windows to issue are open, but they’re harder to navigate given a number of upcoming catalysts for market volatility,” said Maureen O’Connor, managing director of high-grade debt syndicate at Wells Fargo & Co., in an interview. In addition to the Fed meeting this week, there’s a payrolls report on Friday, and consumer price inflation coming next week, plus holidays including US Thanksgiving later this month, she added.

Some strategists are skeptical of how long the high-grade rally will last. Risks in investment-grade credit seem to outweigh the potential gains, JPMorgan Chase & Co. strategists wrote in a note Monday.

Barclays Plc strategists said on Friday that they expect credit spreads, including high-yield, to trade wider.

“The combination of tighter financing conditions, low growth, and elevated inflation has historically been negative for credit spreads. We do not think that this time is different,” Bradley Rogoff and Dominique Toublan wrote.

Elsewhere in the credit markets:

Americas

State Street Corp. is among the companies looking to sell high-grade bonds on Tuesday, having launched a $1 billion offering in two parts.

- A group of Core Scientific convertible bondholders is working with restructuring lawyers at Paul Hastings as the company weighs a potential bankruptcy, according to people with knowledge of the situation

- Moody’s Investors Service lowered its credit rating for Twitter Inc. by two notches to B1 after the closing of its leveraged buyout by Elon Musk

- For deal updates, click here for the New Issue Monitor

- For more, click here for the Credit Daybook Americas

EMEA

Investors’ attention is turning back to investment-grade bonds. High-grade notes are looking more appealing amid rising expectations of a more stable path for government yields, after suffering record losses in 2022.

- BP posted its second-highest quarterly profit on record and announced a further $2.5 billion of share buybacks

- Holland & Barrett’s Russia-linked owner has bought back almost all of the British health-goods firm’s outstanding loans

- The Bank of England is starting to unwind its government bond portfolio in a test of how easily markets can shift away from the era of cheap money

- Europe is set for a mild November, easing pressure on natural-gas storage and bringing some relief to households concerned about the higher cost of heating

Asia

Australia’s central bank raised interest rates by a quarter-point as expected, triggering a rebound for Australian sovereign bonds

- India is taking more steps to boost liquidity in company bond market. The Securities and Exchange Board of India will allow borrowers to have a maximum of 14 bond security identifiers (ISIN) maturing in any financial year

--With assistance from Gowri Gurumurthy and Kevin Simauchi.

©2022 Bloomberg L.P.