Feb 25, 2019

Wall Street Banks Trampled All Over Their European Rivals in 2018

, Bloomberg News

(Bloomberg) -- JPMorgan Chase & Co. gained some of the biggest shares in both fixed-income and equities trading last year, solidifying its leadership in one and nearing the top in the other. Deutsche Bank AG lost ground in both markets while trying to restructure its business.

JPMorgan’s share of the $77 billion pool of revenue that banks generated handling investors’ bets on bonds, currencies and commodities rose by more than a percentage point. Its cut of the $53 billion market for trading stocks and related derivatives also increased. The fixed-income pie shared by all banks shrank 6 percent from 2017, but in equities it grew 14 percent.

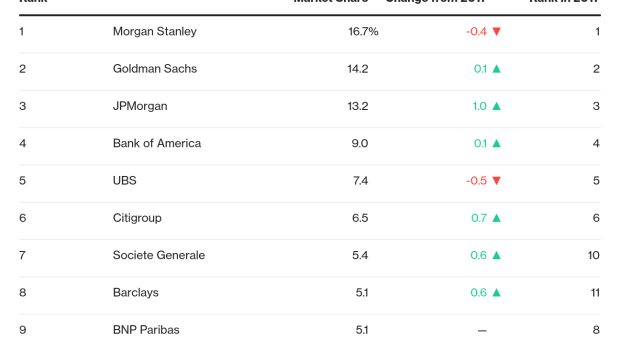

U.S. banks trampled over their European rivals in 2018, gaining ground and holding five of the top six spots in rankings for both markets. Europe’s investment banks had reclaimed some share in 2017 but failed to maintain it, mostly as a harsher trading environment in last year’s second half hurt them more than it did U.S. peers.

Most of Europe’s largest banks are carrying out restructuring programs that have spurred departures of top talent and some clients. Pressure to cut costs is heightened there as interest rates remain negative, squeezing lending margins, and as financial markets remain fragmented

Credit Suisse Group AG lost the most market share in equities trading, dropping to No. 10 from 7 a year earlier. That was followed by Deutsche Bank, which fell to No. 11 from 9. In bond trading, BNP Paribas SA lost the most.

JPMorgan made the biggest gain in equities share while Goldman Sachs Group Inc. led winners in fixed income.

Barclays Plc bucked the trend among European banks, adding market share in both equities and fixed income, albeit much less than at U.S. rivals. Chief Executive Officer Jes Staley promised more buybacks and dividends to shareholders after announcing stronger results than many of its European peers.

Europe’s largest banks handled a majority of capital markets trading before they encountered the dual crises of the U.S. mortgage meltdown and Europe’s sovereign-debt troubles. Since then, the firms have been in constant restructuring mode, trying to slash costs and improve profitability. U.S. banks moved faster to remake their businesses after the 2008 crisis and increased capital levels more aggressively, helping them rebuild customer confidence.

The five largest U.S. investment banks accounted for 58 percent of the trading revenue pool last year, up from 46 percent in 2010. The nine largest European firms saw their share decline to 36 percent from 50 percent.

To contact the reporter on this story: Yalman Onaran in New York at yonaran@bloomberg.net

To contact the editors responsible for this story: Michael J. Moore at mmoore55@bloomberg.net, David Scheer, Dan Reichl

©2019 Bloomberg L.P.