Feb 14, 2023

Wall Street Games Out a ‘No Landing’ in Era of Stock Turbulence

, Bloomberg News

(Bloomberg) -- Renewed pressure on the Federal Reserve to intensify its inflation battle in the grip of a still-resilient economy is forcing Wall Street pros to rethink the stock-trading landscape.

After a worrisome report on consumer prices landed Tuesday, bond investors amped up expectations that interest rates will move past 5% and stay there. The two-year Treasury yield surged anew, with bets on rate cuts later this year all but vanishing — a turnaround from dovish wagers placed just weeks ago.

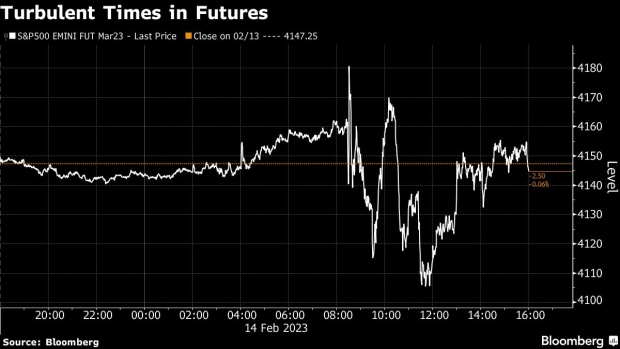

The picture is nowhere near as clear in stocks, where bulls and bears are battling over what matters more: rising rates, or an economy that last month expanded fast enough to create half a million new jobs. Tuesday’s trading reflected each side of the debate with the S&P 500 first surging, then plunging, then bouncing again as traders weighed still-high consumer prices against recent economic and earnings data that give scant sign of a serious slowdown.

Barclays Plc strategists foresee an economic regime where growth will persist at the same time central banks are likely to push restrictive policy for longer, a scenario known as no-landing. The bank has raised both its growth and inflation forecasts for the US.

“Market expectations seems to have moved from hard landing, to soft landing and now to no landing — the regime of resilient growth and higher for longer inflation — which is somewhat supportive of equities,” said Barclays strategist Emmanuel Cau. “Today’s CPI data maintains the status quo in this regard.”

A five-week rally to start the year has faltered this month, though with the S&P 500 down less than 2%, it’s hard to say the market has issued a decisive signal. For now, strategists who warmed to stocks in January are suggesting further gains will be harder to come by at the same time they are less wary of a major selloff.

In anticipation of a more restrictive policy path, Morgan Stanley turned neutral on US Treasuries from overweight and it expects investors to cut their short-dollar positions as they retreat from the idea of an impending policy pivot.

“The market debate likely turns to the economy’s interest rate sensitivity and whether the neutral rate should be higher than previously assumed,” the bank’s strategists said.

While not the rule, periods when relatively high interest rates coexisted with robust earnings growth aren’t unprecedented in the US. Profits in the S&P 500 climbed in the second half of the 1990s, just as the Fed was nudging rates higher. And while the central bank’s efforts to normalize policy at the end of the last decade eventually gutted equities in the last quarter of 2018, corporate income actually soared throughout Donald Trump’s presidential administration.

Fed officials took the latest inflation data as another signal that interest rates will need to move back to such levels to ensure inflation continues to fall. That view has battered dip buyers for almost a year, and prompted fresh warnings across Wall Street that the equity rally cannot persist.

“The Fed has won every single one of these battles over the last 18 months — every time the markets have tried to price out or discount the Fed’s rhetoric or their forecasts, the market’s have basically lost that fight, they’ve lost that game of chicken,” said Brian Nick, chief investment strategist at Nuveen.

Higher for Longer

Still, worries about a recession — though all but guaranteed when the year started — have eased. In the latest fund manager survey from Bank of America, investors are much less pessimistic about the economy than just a few months ago. Only 24% of respondents expect a recession, compared with 77% in November and the number of investors expecting a rate cut in the next 12 months is at the highest since March 2020.

“The biggest tail risk [is] still “higher for longer” inflation,” according to the results of the survey.

This is because the possibility of the US economy avoiding recession also implies that the Fed will have a hard time starting to cut rates.

“China’s re-opening, lower European gas prices and robust US job growth have reduced the chances of recession in the near term. This should also make core inflation more persistent, however, paving the way for additional rate hikes,” the macro team at Barclays wrote in a report this week.

All of this is putting the brakes on a sustained risk rally. Goldman Sachs strategists turned neutral on equities over the next three months due to improving macroeconomic conditions and lower downside risks, but they warned that markets’ risk appetite is “well ahead of the data.”

Christopher Harvey, head of equity strategy at Wells Fargo, sees a peak policy rate of 5% or lower than what Fed swaps are assigning currently but even that may not lead to a sustained recovery. Nevertheless, he says the bear market days are behind us.

“We see inflation moving stubbornly lower, and the economy more resilient than expected, with Fed Funds closing in on 5%,” Harvey said. “This is neither a great nor a terrible environment for equities.”

--With assistance from Vildana Hajric, Lu Wang and Edward Bolingbroke.

©2023 Bloomberg L.P.