Feb 17, 2023

Wall Street Is Baffled by the Stock Market

, Bloomberg News

(Bloomberg) -- The bond market finally got the Federal Reserve’s message on rates, while stock investors continue to ignore it, for the most part.

While the mood music soured in the latter half of the week, equities are still largely defying the one thing that has repeatedly proved kryptonite in past rallies: Surging interest rates.

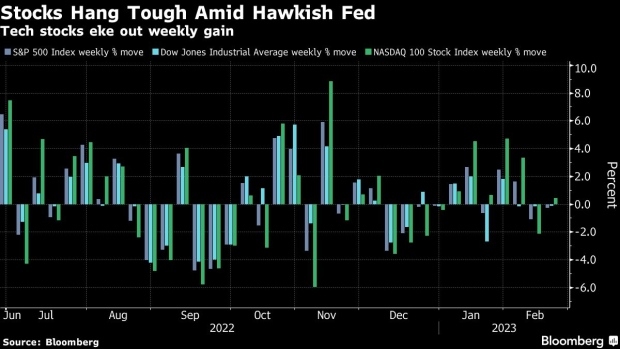

With a slew of Fed officials threatening to ramp up rate hikes after still-hot economic data, Treasury yields broke out anew and traders raised their expectations for how high the benchmark rate will go. Yet the S&P 500 finished the week lower by just 0.3%, and the Nasdaq 100 eked out a 0.4% gain as still-loose financial conditions bely the most-aggressive policy tightening campaign in a generation.

The brutal repricing in the two-year Treasury note would imply a 5% to 10% slump in the Nasdaq 100 and more for volatile tech equities, if past market moves are anything to go by, according to JPMorgan Chase & Co.’s Marko Kolanovic.

However, still-resilient equities have diverged from fresh bond losses, a potentially unsustainable development.

That could mean bad news for hedge-fund managers who have snapped up tech shares over the past two weeks, and bodes ill for balanced-portfolio strategies that are still reeling from last year’s bond-stock crash.

“The key risk is that we are dealing with a bit of a replay from last year,” said Christian Mueller-Glissmann, the head of asset allocation for portfolio strategy at Goldman Sachs Group Inc. “If you have high inflation risk and high macro volatility, then both equities and bonds can go down together. And that is the key concern for us after this bullish sentiment shift — that we could get another 60/40 drawdown.”

So far, that’s been anything but a problem.

Both assets rallied to start the year before surprisingly strong hiring data, housing numbers and retail sales, along with more hawkish Fed commentary sent Treasuries into a tailspin this month. Stocks, meanwhile, are essentially flat in February, holding onto gains from the second-best January in two decades.

“We’re not bullish on the stickiness of this as we don’t see any type of Fed pivot” from rate hikes in the near term, Nicole Webb, senior vice president and financial advisor at Wealth Enhancement Group, said on Bloomberg’s “What Goes Up” podcast.

That’s not to say cracks aren’t showing in the equity rally. The tech-heavy gauge ended the week with a two-day slump of 2.6%. And the riskiest part of the credit market showed minor signs of distress. Both the iShares iBoxx High Yield Corporate Bond ETF (ticker HYG) and the SPDR Bloomberg High Yield Bond ETF (JNK) declined this week, and are each trading below their 50-day moving average lines.

Central bankers are thought to look askance on unbridled equity gains because of their potential to fan consumption and prices. Right now, both stocks and the economy are humming along, normally a welcome pairing. Too much of a good thing could prove a problem should the cycle build on itself, however. Particularly if financial-market resilience comes to be seen as one of the things keeping consumers from reining themselves in.

Stock investors have been betting on a Goldilocks-like scenario, with growth remaining resilient and inflation cooling fast by the second half of the year. Goldman’s Mueller-Glissmann says that’s likely wrong. The bank’s economists say that the Fed can engineer a soft landing, but they also think that to get a handle on inflation, growth has to slow.

“If the Fed has to go further to achieve that, then it will happen. The market is pricing a no-landing — we definitely take the other side on that because it’s a bit too optimistic,” he said.

Goldman recommends a defensive positioning for risky assets, including buying put options and going overweight cash, while also adopting underweight positions in bonds due to expectations of higher rates.

“The market is mispricing both inflation and rates. The challenge from here is that we are vulnerable to disappointment both on growth and inflation,” he said.

--With assistance from Katie Greifeld.

©2023 Bloomberg L.P.