Jan 31, 2023

Wall Street’s Feel-Good Start to 2023 Sets Up Perilous Fed Day

, Bloomberg News

(Bloomberg) -- Once-hated world stocks, bonds laced with interest-rate risk and even deadbeat crypto coins have just closed out a big new-year rally.

Now Wall Street is wondering how Jerome Powell will react.

Even as the Federal Reserve looks poised to deliver a tough message Wednesday in favor of restrictive monetary policy, money managers are unleashing speculative bets on a soft economic landing — a volte-face from the great 2022 bear market.

Tuesday gave traders fresh ammo to drive up the price of risk assets, on the back of softer wage growth data that adds to the case the central bank may pause tightening or even reverse course.

The S&P 500 closed on a high note, ending January with a 6% gain — the best start to a year since 2019. The once-beaten down Nasdaq 100 jumped more than 10% in a January rebound unseen in more than two decades.

The spirited market revival runs counter to growth angst in Treasuries and falling corporate-earnings estimates — while complicating efforts by central bankers to tighten financial conditions to tame price pressures.

“The market is still swinging wildly from hope to despair — largely based on speculation about what’s going on in Jay Powell’s brain,” said Ben Kumar, senior investment strategist at Seven Investment Management LLP.

Here are some notable moves in the January market rip.

Investing Abroad

A quicker-than-expected reopening of China from Covid-19 lockdowns and a more benign economic trajectory for the euro area have sent investors hunting for cheap equities. An index of global stocks excluding the US is making history with a gain of 8.6% in January — the best start to a year on record.

The likes of HSBC Bank Plc and Barclays Plc have recently upgraded their recommendations for non-US equities, while Goldman Sachs Group Inc. projects strong inflows will continue.

“Global equities have a robust start to the new year,” said Art Hogan, chief market strategist at B. Riley Wealth. “The combination of China reopening in earnest, and the potential for the Eurozone to avoid a recession have acted as a real tailwind.”

Dash for Bonds

Bonds in almost every corner of the $62 trillion global fixed income market have enjoyed stellar gains with global investment-grade debt returning 3.2%.

The advance could quickly deflate again in the face of a Fed still hell-bent on bringing inflation down to its target, according to Matt Maley, chief market strategist at Miller Tabak + Co.

“Investors need to be careful about the high grade and high yield markets near term,” said Maley. “If the Fed sticks to its guns about ‘higher for longer,’ corporate bonds are going to lose some momentum.”

Digital Currency Revival

Even Bitcoin just closed its best January since 2013 in a rebound attributed to growing conviction that the very worst of the monetary-tightening cycle and the industry-wide crypto meltdown is over.

The largest token is up 39% since the turn of the year, with miners and digital-asset funds ranking among the biggest winners. The latter command all positions in the leaderboard of the top-10 equity ETFs in January, according to data compiled by Bloomberg.

“Crypto, alongside high growth potential stocks, have had a fantastic start to 2023,” said James Seyffart, an ETF analyst with Bloomberg Intelligence. “As we have seen a rally in Bitcoin itself, it’s meant an even bigger rally for many miners.”

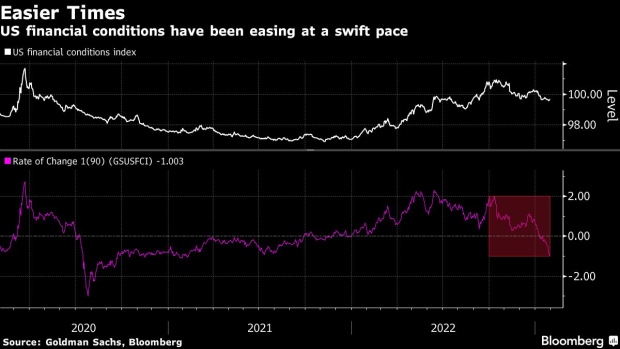

Even-Looser Conditions

In turn, the cross-asset rally has triggered the fastest easing in financial conditions since global policy makers engineered a market turnaround with historic stimulus to combat the 2020 Covid turmoil. All that risks pumping up the investment and consumption cycle, just as the Fed seeks to snuff out demand-side inflation pressures.

--With assistance from Justina Lee and Eva Szalay.

©2023 Bloomberg L.P.