Jun 7, 2023

Wall Street’s New Fear Gauge Is Trading in Curiously Stable Way

, Bloomberg News

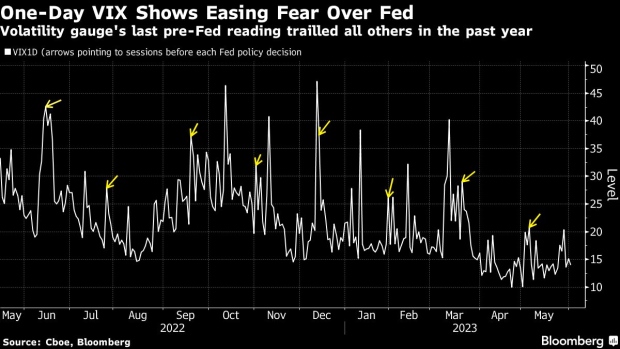

(Bloomberg) -- Designed to capture the mood of investors in a wild corner of the stock market, Wall Street’s new fear gauge is behaving in a decidedly un-volatile way. And that’s confusing traders accustomed to fast-changing moves in the world of options.

Like clockwork every day since its creation in late April, the Cboe One-Day Volatility Index has opened lower, dropping 3.2 points on average from its previous close.

The gauge has been launched to take the temperature of speculators and money managers plunging into so-called zero-day options – a boom said to be so powerful that it risks destabilizing the underlying equity market.

Yet its constant pattern of falling at the open over the past 32 sessions is raising questions over its efficacy as a sentiment indicator. Are investors always turning more sanguine at the start of a trading day?

Rocky Fishman, a 22-year market veteran who just started derivatives analytical firm Asym 500, has a theory on what’s going on. In his view, its propensity to drop at the open is down to the peculiar way of how the VIX1D is calculated — specifically, that the particularly fleeting options underlying it lose significant value due to the time difference between the close and open of trading.

“Don’t watch it all day, just watch where it closes,” said Fishman, who left Goldman Sachs Group Inc. earlier this year as head of index derivatives research. “The closing levels of the VIX1D are a meaningful indicator of the price of one-day SPX options, which have become one of the most heavily traded areas of the derivatives market.”

For now, the one-day VIX can’t be traded, meaning there’s no direct way to profit from this predictable behavior.

The gauge is supposed to reflect the increasingly febrile sentiment of investors over ultra-short time frames, by tracking S&P 500 derivatives with maturities of no more than 24 hours. Think of it as a fast-twitch version of its older sibling, the VIX – the famous benchmark followed by traders the world over since the 1990s.

It was introduced partly in response to the swift migration to fleeting options, activity that is not captured by the VIX, a gauge that’s based on contracts expiring in about 30 days.

Traders have flocked to options with zero days to expiration, or 0DTE, since Cboe Global Markets Inc. expanded contract expirations to every weekday in mid-2022 and as the Federal Reserve’s aggressive monetary tightening spurred market volatility.

All that suggests the new gauge in theory may provide a window into sentiment for equities in the here and now in an era when technical factors like investor positioning play a key role in driving markets, especially as fundamental investors sit on the sidelines.

Still, the likes of Fishman caution against reading too much into its minute-to-minute gyrations, in part because of the way the gauge is designed.

One input in the calculation of options-derived volatility indexes is the time element — how long is left until contracts mature. The closer they’re to expiration, the cheaper they get. It’s a concept know in the derivatives parlance as time decay.

For VIX1D’s old siblings like the VIX, the math on pricing is based on the amount of time left — on the clock, regardless of whether exchanges are open or closed — until expiration.

The methodology for the one-day VIX is different. It only includes business time — 6.5 hours of exchange trading between 9:30 a.m. to 4 p.m. in New York time.

The issue is, when a trading session starts, the calculation doesn’t recognize that no business time has passed since the previous close. Instead, unless something major happens overnight, options contracts expiring that afternoon typically get marked down right away simply because they’re less valuable when maturity is closer. And that feeds into an instant drop in the one-day VIX.

Cboe isn’t unaware of the pattern. According to Rob Hocking, the firm’s global head of product innovation, the gauge incorporates a mix of current-day and next-day options.

Around the market’s open, the calculation is derived from contracts mostly maturing in that session. And as the day goes on, its pricing tilts toward derivatives expiring over the next 24 hours. As a result, the range of strikes in contracts that still have value is smaller at 9:30 a.m. than at 4 p.m. That’s another factor behind the VIX1D’s tendency to fall at the open.

Deliberate Choice

The exchange deliberately chose a different time element for the one-day gauge because it’s intended to capture activity in a period where 0DTE trading is most intense, Hocking said. While Cboe is exploring ways for investors to trade short-term volatility, it doesn’t plan to launch products such as futures that are tied to the one-day VIX.

“We knew going into it that there were nuances to the calculation,” Hocking said. “It’s why pretty much from the start we had mentioned that we weren’t targeting a tradeable product on this.”

For investors trying to figure out sentiment through the lens of volatility, the one-day VIX’s constant drop at the start of a session is largely noise, according to Fishman.

“The VIX1D construction reminds us that the US equity market doesn’t move at a constant velocity around the clock. It’s fastest moving during the US trading hours, and especially around the open and close of the market every day,” he said. “To use that data well, it’s best to use same-time-of-day data, like the closing levels.”

©2023 Bloomberg L.P.