Aug 7, 2020

Wall Street's Top Ranks Look Nothing Like the Nation They Serve

, Bloomberg News

(Bloomberg Markets) -- Wall Street has been criticized for being an old boys’ club. But a look inside the U.S. finance industry and the offices of fund managers across the country shows it’s even more exclusive than that. Black men and women, who make up more than one-seventh of the U.S. population, are badly underrepresented in Wall Street’s corner offices and across the top levels of investment companies. In the following pages, we shine a light on some of the areas where inequality endures, including executive suites and business schools. What we find is a system in need of greater diversity.

A Broken Corporate Ladder

The top rung of corporate America looks nothing like the country it serves. Although Black people are employed throughout the finance and insurance sector, elite roles are overwhelmingly held by White people. Across all areas of the U.S. economy, Black executives remain rare. Only in businesses involved with public administration, such as federal contractors, do Black people seem to have come close to finding fair representation in the executive suite.

Banks

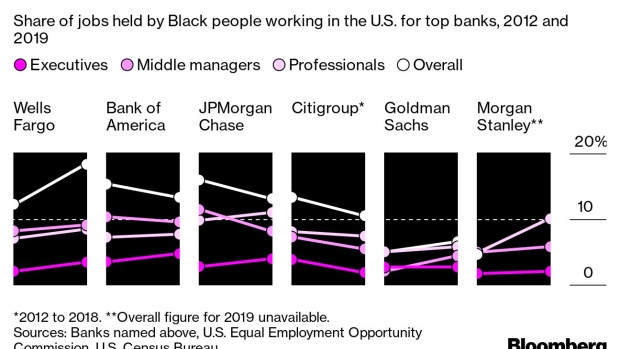

U.S. banks have at least two race problems. First, they’ve often failed to hire or promote Black people to top positions. In some companies, Black executives have even lost ground in recent years. Second, banking has contributed to income and wealth gaps by withholding credit from Black businesses and homeowners and charging them higher rates.

Black people are missing from the very top of Wall Street, where the chief executive officers of the major companies are still White. There was only one Black executive among the more than 80 people included on the elite teams atop the six largest U.S. banks as of mid-June. Despite some recent gains, the problem extends to Wall Street’s middle managers and professionals.

On the consumer side, racial disparities at the big U.S. banks have been a factor in widening the credit gap.

Asset Management

The managers holding the purse strings of America’s fund industry are overwhelmingly White men. A recent study funded by the Knight Foundation found anyone who’s not a White man manages little in the way of mutual funds, hedge funds, private equity, or real estate in the U.S. Only 1.3% of assets in these categories are in funds run by diversely owned companies, according to the study, which used a 25% equity threshold for ownership. Investors in these funds similarly lack diversity.

Who Runs the Funds?

Companies owned by non-White men and women control a sliver of U.S. assets.

Doing More With Less

Hedge funds run by minorities tend to be small on average, so they may struggle to compete with heavyweights on price, however they outperformed in 2018 and 2019.

More Diversity on the Coasts

New York has more hedge fund managers from minority groups than any other city in the U.S., but they make up a relatively small share of the total there.

Little Ventured

The VC community lacks Black investors and isn’t backing Black founders.

A Divide in Investors

Black families in the U.S. are less likely to be invested in a fund.

Business School

Finance’s homogeneity problem starts well before the hiring process. Although a master of business administration degree isn’t a requirement for many jobs in finance, an MBA from a prestigious school can be a ticket to a high-flying career. The top financial companies in the U.S. habitually hire from the most elite schools, so the diversity of their employees reflects the ethnicity of graduates from those programs.

Black students are underrepresented in top MBA programs, but that isn’t the story for all minorities. Asian Americans are a significant share of MBA classes at elite schools.

Barrier to Entry

A relatively small number of business school entrance exam takers are Black.

A Racial Disparity in Financial Support for a Graduate Education

On average, Black students are funding 36% of their business school education with grants, fellowships, or scholarships and only 5% from parental support, according to a 2019 survey. Those numbers are 20% and 14%, respectively, for non-underrepresented people.

©2020 Bloomberg L.P.