May 25, 2023

Wall Street Scrutiny Resets $6 Trillion in ESG Debt

, Bloomberg News

(Bloomberg Markets) -- A lot has changed in the five years since Verizon Communications Inc. started selling green bonds. Today investors pore through the fine print, says Scott Krohn, treasurer of the US’s largest mobile carrier. Borrowers must establish their credibility if they want to sell bonds that claim to further environmental, social and governance goals.

“That’s the best recipe to have a successful program,” Krohn says. Transparency can help an issuer “stand out from some of the noise coming from transactions that maybe have lesser quality of reporting.”

Broad skepticism about the validity of ESG investments, along with stricter regulation and more challenging credit conditions, has helped to purge dodgy deals from the $6 trillion market for sustainable debt. It’s an astounding shift from the early days, when bond sellers were able to market ESG with relatively few questions asked. Now, money managers want to know exactly what they’re buying, and they can afford to be picky.

Scrutiny has been intensifying. Borrowers including luxury fashion house Chanel Ltd. and UK grocery chain Tesco Plc have been called out by investors for setting weak ESG goals. Regulators have cracked down on the practice of overstating environmental benefits, know as greenwashing. At the same time, the Federal Reserve and other central banks have been aggressively raising benchmark interest rates to combat inflation.

QuickTake: How to Understand the Correction in the ESG Market

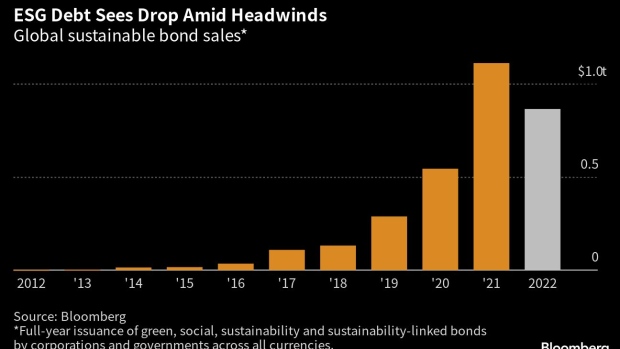

Investors who once agreed to pay a higher price for green bonds than for traditional debt (a “greenium”) started demanding discounts, according to a BloombergNEF analysis in December. Sales of sustainable debt securities by companies and governments worldwide dropped 22% in 2022, the first annual slowdown in 15 years of record-keeping, data compiled by Bloomberg show.

As bond sellers return to the market this year, they’re being more careful about what they label ESG. That’s especially true in the US, where Republican politicians including Florida Governor Ron DeSantis and former Vice President Mike Pence have led a crusade that seeks to ban “woke” ESG investing, arguing that money managers should focus on maximizing returns for investors instead of pursuing their version of social justice.

QuickTake: How ESG Investing Became a Political Battleground

“Before, [borrowers] were just looking to try to find an excuse to slap a label on a bond,” says Andrew Poreda, a senior research analyst at Sage Advisory Services. These days, ESG bond terms are “feeling a lot more concrete and a lot more authentic,” he says.

Empowered Investors

Challenging credit conditions typically empower investors to ask tougher questions when negotiating deal terms for all kinds of bonds—not only ESG, says Andrew Karp, head of the sustainable banking solutions group at Bank of America Corp. But there’s been a clear improvement in the underlying structures of ESG bonds, he says.

Still, the importance of paring back carbon emissions has never been higher—and governments and companies need the cash to help them do it. Global assets in sustainable bond funds have surged 11 times over the past decade, to $516 billion, according to Morningstar Inc. data tallied through the end of 2022.

Greenwashing hasn’t disappeared. Even with recent improvements, there’s no fully unified regulatory framework to guarantee that a sustainable bond’s proceeds are channeled appropriately. Skeptics say that ESG may still prove to be a fad.

Green bonds, which raise money to pay for specific environmental projects, are the largest and most established segment of the ESG debt universe. They’re generally considered less susceptible to greenwashing than the more controversial category of sustainability-linked bonds, which tie the borrower’s interest costs to meeting preset ESG goals.

More Credibility

The European Investment Bank, the lending arm of the European Union, was the first institution to sell a green bond in 2007 and has since raised roughly €84 billion ($91 billion) in total sustainable debt. The bank’s chief sustainable finance adviser, Eila Kreivi, lauds the industry’s growing sophistication.

“I don’t think, in 2007, we had a precise idea of what we wanted green bonds to achieve,” she says. “If the idea was to attract more attention to the climate agenda and environmental lending, that has been done.”

More-credible ESG debt stands to offer better returns for investors, too, says Matt Lawton, a money manager for T. Rowe Price Group Inc.’s global impact credit strategy. “Standards have certainly improved,” says Lawton, who last year condemned the egregious behavior of banks and companies that exploit ESG investors.

Global ESG bond markets are heating up this year. Sustainable bond sales totaled more than $86 billion in April, the most ever for that month. Issuance of green bonds, the largest category of sustainable debt by amount, surpassed $53 billion, also a record for April.

“Globally, investors are becoming more sustainable,” says Stephen Liberatore, head of fixed-income ESG and impact investing strategies at Nuveen and the lead portfolio manager for $17.4 billion of fixed-income ESG and impact investments. “The market is simply responding to this consistent, increasing demand.”

Verizon’s Krohn says he plans to keep tapping the market after raising $1 billion with a green bond in May to help pay for renewable energy plans, its fifth annual ESG sale of that size. Investors placed orders for at least $6 billion in the latest deal, he says.

As of May 22, Verizon’s $1 billion in green bonds that mature in September 2030 were offering a 22 basis-point narrower spread to underlying government debt compared with the company’s $1.1 billion in traditional bonds that mature a month later.

The greenium is back.

Mutua is a reporter at Bloomberg News in New York.

--With assistance from Jiayu Liu.

©2023 Bloomberg L.P.