Dec 11, 2020

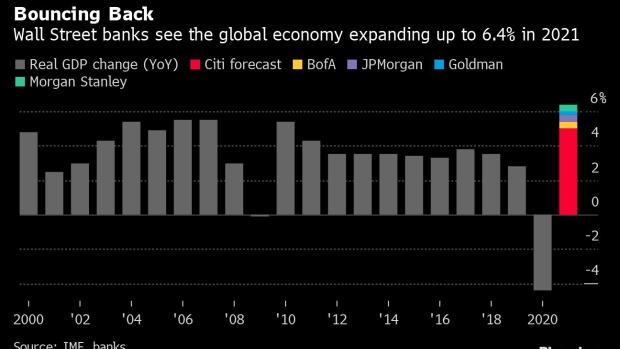

Wall Street Sees World Economy Surging in 2021 From Rocky Start

, Bloomberg News

(Bloomberg) -- Wall Street’s biggest banks are predicting the coronavirus-hit world economy will crawl through the early days of 2021 before bouncing back as vaccines and more fiscal stimulus flow into it.After a year which saw the unanticipated shock of the deepest recession since the Great Depression, economists are bracing for a shaky start to the new year as 2020 ends with a spike in infections and further rounds of restrictions.

The most upbeat are the analysts at Morgan Stanley, who predict an expansion of 6.4% in the coming year and maintain their call for a V-shaped recovery. Less confident are the economists at Citigroup Inc., who predict growth of 5%.Both would be dramatic improvements on the 4.4% contraction the International Monetary Fund has penciled in for 2020.

Read more: Virus to Vaccine, Recession to Recovery: Bloomberg Economics’ 2021 Forecast BookThe consensus is that even with a rebound, employment and inflation will stay under pressure in most parts of the world, requiring central banks to keep their easy money stances through the year.

Below are lightly-edited highlights of the recently-published 2021 outlooks. The forecasts are based on purchasing power parity.

Bank of America Global Research

- Growth forecast: 5.4%

We look for a rocky start to the new year as many countries battle Covid outbreaks. However, a combination of fiscal stimulus and wide vaccine distribution should boost growth by mid-year. Despite the recovery, global inflation likely will remain low and many policy rates likely will remain stuck near zero.

Citigroup Inc.

- Growth forecast: 5%

The asynchronous timetable to return to pre-Covid gross domestic product is a headwind for recovery in 2021. But projects that appear to have stabilized, along with vaccine discovery, potentially provide solid ground for growth ahead. Even so, lost GDP from the pandemic is not expected to be recovered.The vaccine discovery is a shot in the arm, but not until 2022, in part because of expected delays in deployment in the emerging markets that need it.

Goldman Sachs Group Inc.

- Growth forecast: 6%

Just as the global economy rebounded quickly (albeit partially) from the lockdowns in the spring, we expect the current weakness to give way to much stronger growth when the European lockdowns end and a vaccine becomes available.

The developed market central banks are likely to steer a dovish path for the next several years. Even under our forecast of a strong growth rebound, labor market conditions will normalize only gradually and inflation looks set to remain below central bank targets.

JPMorgan Chase & Co.

- Growth forecast: 5.8%

Global growth momentum is expected to slow sharply, with U.S. and European GDP contracting as we turn into the new year. But next year’s outlook has brightened as successful vaccine trials bolster confidence that the link between virus containment and mobility will soon be broken.

Morgan Stanley

- Growth forecast: 6.4%

After a V-shaped recovery to pre-Covid 19 levels, the global economy rises to its pre-Covid path by the second quarter of 2021. Both developed markets and emerging markets will drive this next phase of global reflation.Even as growth reaccelerates toward trend rapidly, policies remain extremely accommodative, laying the groundwork for a rise in inflation.

©2020 Bloomberg L.P.