Feb 19, 2019

Walmart’s Christmas Turned Out to Be Just Fine

, Bloomberg News

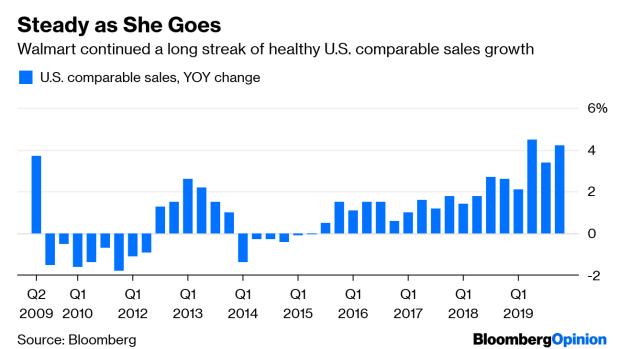

(Bloomberg Opinion) -- Never mind the mixed signals about the state of global consumers, and never mind Amazon.com Inc.’s growing might. Walmart Inc.’s run of booming comparable sales growth continues unabated.

The big-box giant reported Tuesday that its U.S. comparable sales rose 4.2 percent in the fourth quarter from a year earlier, better than analysts had expected. It was its biggest growth on this measure during the crucial holiday quarter in at least 10 years.

The results suggest Walmart was successful in executing its holiday season playbook, which included initiatives such as in-aisle checkout to get customers in and out of stores quickly. It also strategically expanded its assortment of toys to fill the void left by the liquidation of Toys “R” Us and said the category was among its strongest-growing ones in the quarter.

Walmart also reported that its grocery department — crucial both because it makes up such a large share of total sales, but also because it is core to its e-commerce strategy — experienced “mid-single digit” comparable sales growth from a year earlier. Given the aggressive efforts by Amazon and Kroger Co. to sharpen their digital efforts in this segment, it is important that Walmart held its own.

The most important figure in this report, though, was Walmart’s U.S. e-commerce growth, which was up 43 percent from a year earlier. That was a far better performance in the digital realm than Walmart notched in the holiday quarter a year earlier, when growth slowed to 23 percent, in part because of operational challenges. Despite the fact that Walmart overall had a solid fourth quarter a year earlier, shares dropped sharply on the e-commerce results after they were reported, suffering their steepest one-day drop since 1988 as investors questioned whether online chief Marc Lore’s magic had worn off.

This year’s results show Walmart learned from its mistakes and has improved its e-commerce supply chain and selection of merchandise to compete effectively during its busiest time of the year. That bodes well for the year ahead, which its annual guidance says will include e-commerce growth of about 35 percent.

It was a good time for Walmart to demonstrate that its progress is not fragile. Last week’s ghastly Commerce Department retail sales report, which showed a 1.2 percent decline in sales in December from November, offered a grim portrait of the U.S. consumer. (In fact, it was so grim, some analysts questioned the data.) But Walmart’s strength in the quarter that included December suggests that, even if that data don’t turn out to be an aberration, it’s doing a fine job of navigating the consumer environment.

Meanwhile, new e-commerce regulations in India present fresh challenges for Walmart as it aims to make inroads in that market through its $16 billion acquisition of Flipkart, an early e-commerce leader in that market. With uncertainty looming there, investors can take comfort that growth continues to look so strong in its home market.

And all U.S. retailers may soon be grappling with higher tariffs on goods coming in from China, leading to tough choices about when or whether to raise prices. Walmart will bring serious muscle to any negotiations with vendors on prices, but it’s a business reality that can’t be ignored. Fortunately for Walmart, it gets to address those potential troubles from a position of strength.

To contact the author of this story: Sarah Halzack at shalzack@bloomberg.net

To contact the editor responsible for this story: Daniel Niemi at dniemi1@bloomberg.net

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Sarah Halzack is a Bloomberg Opinion columnist covering the consumer and retail industries. She was previously a national retail reporter for the Washington Post.

©2019 Bloomberg L.P.