Aug 16, 2022

Walmart jumps most since 2020 after tempering gloom over profit

, Bloomberg News

Walmart cuts profit outlook for Q2 and 2023

Walmart Inc. surged the most in almost two years as a less-dire profit forecast signaled that the retail giant is finding its footing after slashing its outlook three weeks ago.

Results improved more than expected in late July thanks to robust back-to-school sales, lower fuel prices and more buying by wealthier customers seeking bargains, Walmart Chief Executive Officer Doug McMillon said Tuesday. The company has slowed inventory growth and will be well positioned for the holiday season, he said.

Walmart’s upbeat tone suggested it’s making progress in adapting to changing consumer-spending habits after a July 25 cut to its profit forecast that shook investors and spurred fears of a broader economic downturn. Soaring US inflation is forcing shoppers to pay more for essentials, eroding sales of more profitable items and prompting Walmart to mark down prices of apparel and other goods.

“We certainly hope to put the pressures that we’ve had in the first half behind us as quickly as we can,” McMillon told analysts after the company reported quarterly results and said annual profit would fall a little less sharply than expected. “But as you can see in our guidance, we acknowledge reality” as US consumers contend with rising prices.

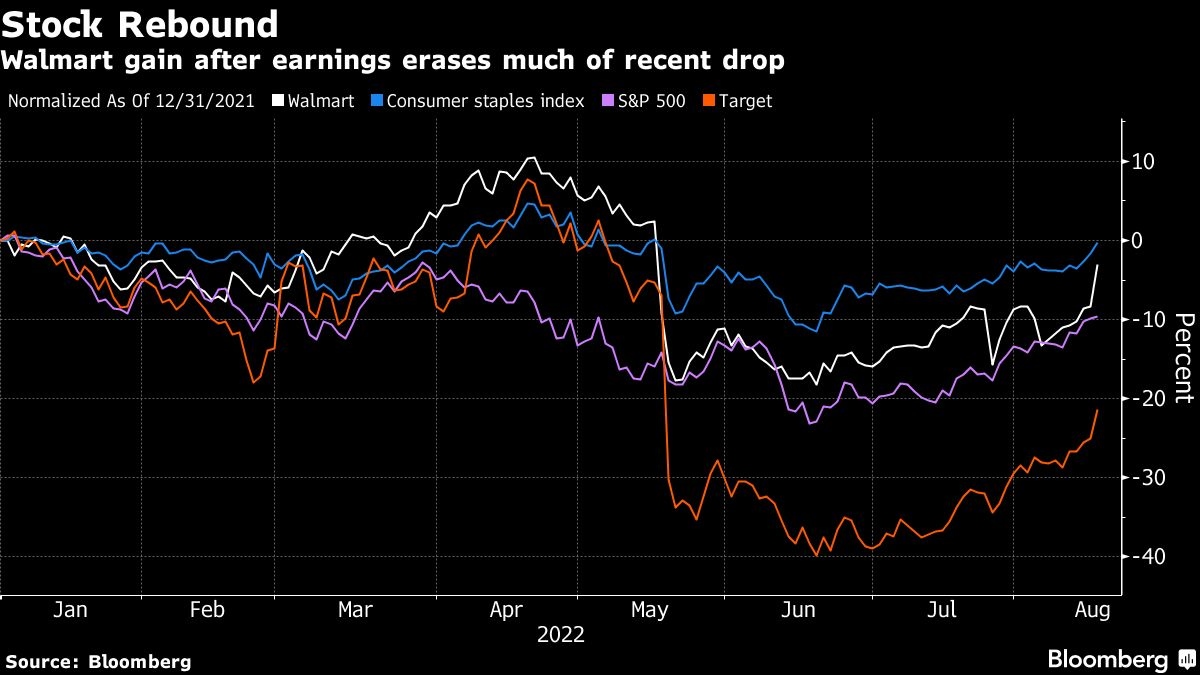

The shares rose 5.6 per cent to US$140.06 at 12:55 p.m. in New York after climbing as much as 6.2 per cent for the biggest intraday gain since Sept. 1, 2020. Walmart fell 8.4 per cent this year through Monday, trailing the 1.6 per cent decline in an S&P index of consumer-staples companies.

Wall Street analysts breathed a sigh of relief after Walmart’s jarring warning last month. The retailer’s earnings report for its fiscal second quarter was a “classic ‘beat the guide-down,’” said Michael Baker, an analyst at D.A. Davidson. Results were “better than feared,” said Rupesh Parikh of Oppenheimer & Co.

HIGHER-INCOME SHOPPERS

Adjusted earnings edged down to US$1.77 a share during the second quarter, Walmart said Tuesday, topping the US$1.63 average of analysts’ estimates compiled by Bloomberg. Sales rose 8.4 per cent to US$152.9 billion in the fiscal second quarter, which ended July 31, Walmart said. Analysts had predicted US$151.1 billion.

Shoppers are looking to scrimp by buying more store-brand goods and spurning higher-end deli meats for hot dogs and canned tuna. In the US, e-commerce sales growth rose 12 per cent in the second quarter, up from a 1 per cent pace in the first quarter, Walmart said.

“Higher-income families are shopping at Walmart because they’re so price-sensitive right now,” McMillon said in an interview with CNBC. “Families making more than US$100,000 in household income have driven a lot of our growth during this last quarter.”

The retailer said it has been adding customers to its Walmart+ membership program. A streaming deal announced Monday between Walmart+ and Paramount Global will provide another boost since customers had been pressing for entertainment options, said John Furner, head of the company’s US operations.

The global advertising business expanded almost 30 per cent, Walmart said. While wage pressures will linger, the company has made progress in reining in supply-chain costs, McMillon said. For example, it has more than halved the number of shipping containers in its system compared with the first quarter and is “now much closer to our historical averages,” he said.

INVENTORY PROGRESS

Inventory rose 25 per cent from a year earlier to US$59.9 billion. That was a slower growth rate than the 32 per cent jump in the first quarter. Walmart has canceled billions of dollars in orders to align its stockpiles with demand, said the company’s new chief financial officer, John David Rainey.

The Bentonville, Arkansas-based retailer will still need to mark down prices of apparel in the current quarter, and home goods and electronics also stand out as problem areas, Rainey said. But only about US$1.5 billion of its US inventory consists of goods that the retailer would get rid of “if we could just wave a magic wand.”

During the year as a whole, earnings per share will fall no more than 11 per cent, compared with last month’s warning of a drop of as much as 13 per cent. Operating income will also slip less than expected, Walmart said. The company reiterated its outlook for a 3 per cent gain in comparable sales at its US stores during the second half, excluding fuel. The metric will rise about 4 per cent for the year as a whole.

Walmart’s profit warning last month was the second cut to the company’s annual forecast. In May, Walmart said earnings per share would dip about 1 per cent. In February, the company had predicted a modest increase.