Jul 21, 2022

Warnings of Sovereign Defaults in Asia Frontier Markets Flare Up

, Bloomberg News

(Bloomberg) -- Concerns about potential sovereign defaults among Asia’s frontier markets are growing with the Economist Intelligence Unit joining Malayan Banking Bhd. in warning of risks amid faster inflation and rising borrowing costs.

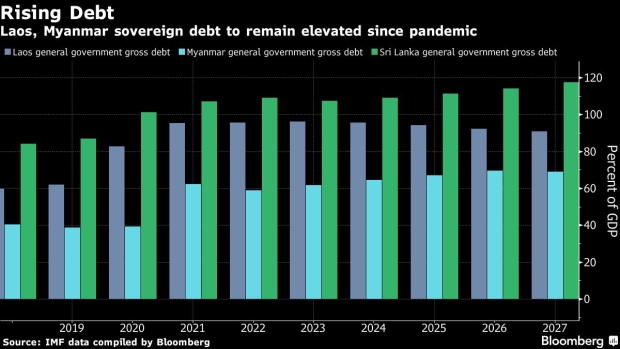

Laos has the highest chance of non-payment in the next four years, followed by Mongolia, the EIU said in a report Thursday, adding that Myanmar is also a potential risk. Global bond investors are becoming more wary of the threat of a historic cascade of defaults after Sri Lanka and Russia halted debt payments this year.

Read: How Sri Lanka Landed in a Crisis and What It Means: QuickTake

The concerns are more acute in frontier economies struggling with surging imports that are cutting into their reserves, compounded by aggressive interest-rate hikes from the Federal Reserve which are driving up borrowing costs globally.

“Our analysis indicates conclusively that Laos and Mongolia are most at risk of following Sri Lanka into default in 2022‑2026, with the former of more immediate concern,” EIU said. Despite forecasts for relative stability in Myanmar, “an escalation of the domestic conflict could come with little warning, jeopardizing the sovereign’s repayment capacity.”

Read: Laos, Myanmar Exposed to Sovereign Default Risk in Asia: Maybank

The outlook for Myanmar’s economic growth remains weak as surging inflation, dollar shortages and lingering domestic conflict pose challenges to its pandemic recovery, according to a World Bank report this week.

Back-Door Default

The key concern for Laos is debt by state-owned companies, mainly due to domestic energy projects, EIU said. Debt restructuring and ownership transfers are a strong possibility, although the government is unlikely to declare these as official public debt default, it said.

Meanwhile, Mongolia is expected to be reliant on new debt inflows this year and next to meet interest payments at a time when its access to financing may be constrained by high inflation and the risk of currency depreciation, EIU said.

©2022 Bloomberg L.P.