Aug 24, 2020

Warren Buffett's Berkshire isn't getting the love for its Apple stake

, Bloomberg News

Warren Buffett found a lucrative bet in Apple Inc. His Berkshire Hathaway Inc. just isn’t getting rewarded for it.

Berkshire’s Apple investment has swelled to a value of almost US$122 billion, far surpassing the US$35.3 billion that the company spent in recent years buying Apple shares. At the end of the second quarter, the stake in the iPhone maker accounted for about 44 per cent of Berkshire’s stock portfolio.

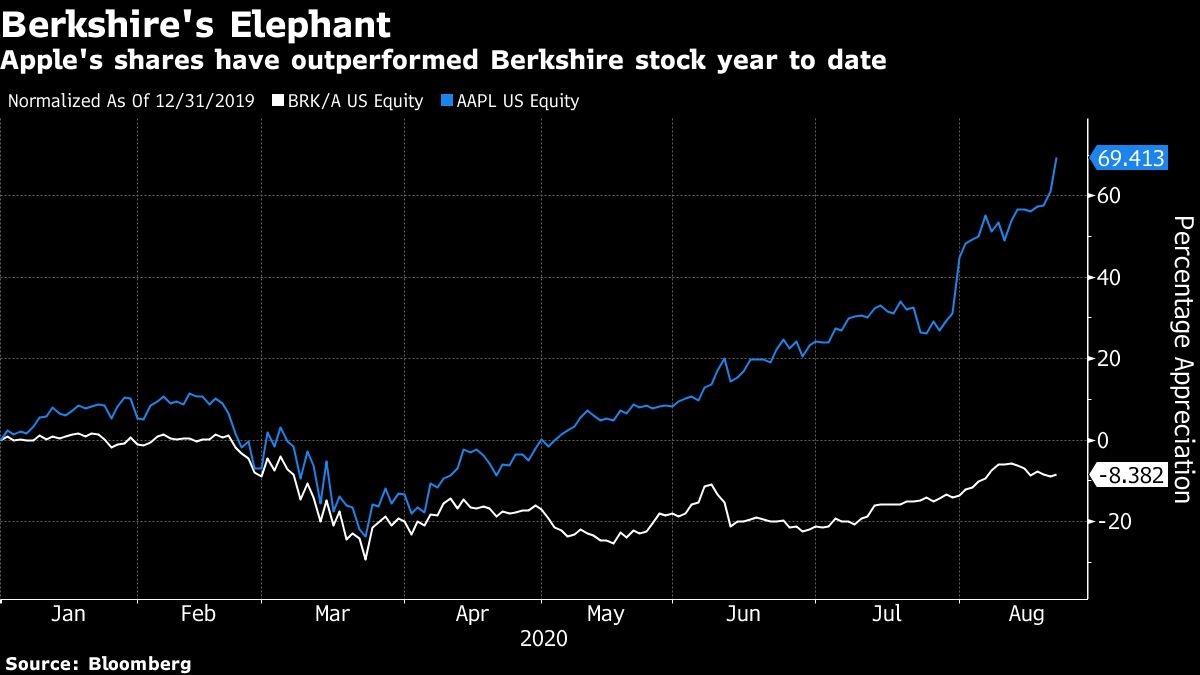

Despite the enormous size of the Apple stake, Berkshire shares slumped 8.4 per cent this year through Friday, compared with the 69 per cent gain in Apple stock. Apple, which counts Berkshire as its third-largest shareholder, recently made history when its market value climbed over US$2 trillion.