Feb 16, 2018

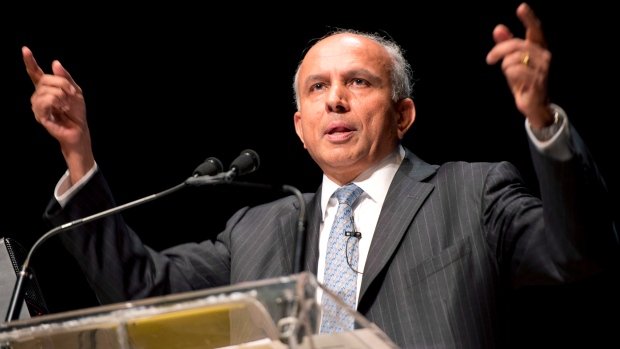

Watsa ‘playing offence’ after Fairfax suffers $449M loss on short bets

One of Canada’s most prominent investors says he’s “playing offence” in the stock market after short bets went sour in the fourth quarter of 2017.

Prem Watsa's Fairfax Financial suffered a US$449.1-million loss on its bets against stocks in the last three months of the year.

After balancing out against paper performance, Fairfax emerged with a US$93.7-million net loss on the shorts.

However, the company's overall equity market strategy fared well, with a US$187.2-million net gain after accounting for long positions.

Markets went on a record-breaking run in the fourth quarter of 2017, as confidence in U.S. President Donald Trump's business-friendly agenda helped push the S&P 500 to a six-per-cent gain during the period.

And now Watsa is positioning Fairfax to capture more upside.

“Our individual short positions have been reduced to minimal levels at year-end and early in 2018,” Watsa said on a conference call Friday morning.

He pointed out there are risks tied to the White House’s trade policies, but believes the country’s economic fundamentals are strong and stand to help lift world output.

“We continue to believe the new administration’s policies may make this a stock picker’s market – and one in which we have thrived over the last 32 years. In the past few years, as you know, we have played defence. We are now playing offence.”

Trump's rise to power has proven to be challenging for Watsa's view of the world. Fairfax suffered a US$1.2-billion net loss on its investments during 2016 because of what Watsa called "fundamental changes in the U.S. in the fourth quarter”.

The stumble in the stock market was only a minor setback for Watsa's sweeping empire in the fourth quarter, with net profit hitting US$869.5-million after a loss of US$701.5 million the same period a year earlier. And for the full year, Fairfax swung to a US$1.7-billion profit.

WEIGH IN