Apr 6, 2020

Wayfair Surges Most Ever Amid Online Furniture Spending Spree

, Bloomberg News

(Bloomberg) -- Wayfair Inc. soared as much as 51% after the online home-goods retailer said first-quarter net revenue growth would at least meet its forecast and that the sharp sales increase at the end of March has continued into April.

The shares posted their biggest intraday jump ever Monday, climbing as high as $76.47.

In a business update, the company said the gross revenue growth rate more than doubled toward the end of last month, and that demand has been seen across most home goods categories in all of its markets. The outlook gave it some breathing room after Wayfair said just last week that the coronavirus was resulting in disruptions to its supply chain.

Meanwhile, the company also announced it’s raising capital through a convertible notes offering, led by Great Hill Partners and Charlesbank Capital Partners. The Spruce House Partnership, one of Wayfair’s largest shareholders, also participated.

Jefferies analyst Jonathan Matuszewski said Wayfair’s update shows that the company’s “pureplay e-comm business model is taking share in an environment where about 80% of the category is closed for business, its largest online competitor is focused elsewhere and consumers are spending on their homes.” The analyst, who rates the stock buy and has a price target of $89, said the convertible offering “provides additional cushioning” if a sustained economic slowdown materializes over in the coming months.

Matuszewski also highlighted the revenue trends from January through early March. “Growth of slightly below 20% sits above the high-end of management’s guidance for 15-17%,” he said, adding that recent efforts to streamline workflows and prioritize high return-on- investment initiatives “may be bearing early fruit.”

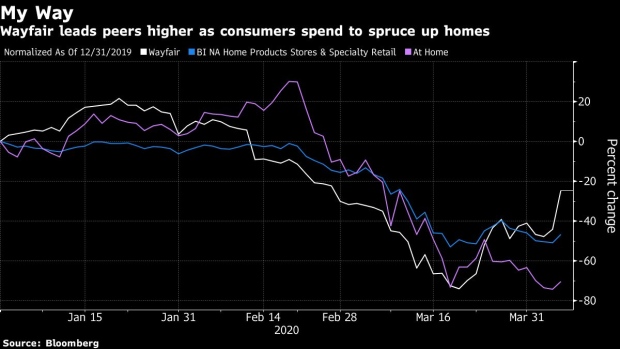

Wayfair led home-good peers higher Monday and is the top performer in the Bloomberg Intelligence North America Home Products Stores & Other Specialty Retail Index. The stock is down about 23% this year, compared with the 46% plunge for the index.

Wayfair will report results for the first quarter ended March 31 in early May. The stock has 14 buy ratings, 13 holds, and 5 sells, with an average 12-month price target on the shares of $74.

©2020 Bloomberg L.P.