Feb 20, 2019

Web Retailers Should Pay Higher Taxes to Save U.K. Shops: Report

, Bloomberg News

(Bloomberg) -- Internet giants such as Amazon.com Inc., Asos Plc and Boohoo Group Plc should pay higher U.K. taxes to help save ailing shopping districts that are losing revenue to e-commerce, according to a government report.

An online sales tax, higher value-added tax and “green taxes’’ on shipping and packaging should all be considered to help soften the blow to physical stores as consumers shift to internet shopping, according to the report Thursday from the Housing, Communities and Local Government Committee.

Some 70,000 jobs were lost in the U.K. retail sector in 2018 as chains like Marks & Spencer Group Plc and Debenhams Plc announced plans to close hundreds of stores. Tesco Plc, the U.K.’s biggest retailer, announced as many as 9,000 job cuts in January. Internet sales are a major factor, with U.K. consumers spending more via the web than any other European country, and one-fifth of December retail sales made online, according to the report.

“Business rates must be made fair,” said Clive Betts, a member of the House of Commons and chairman of the committee, in the report. “They are currently stacking the odds against businesses with a high street presence and this must end.”

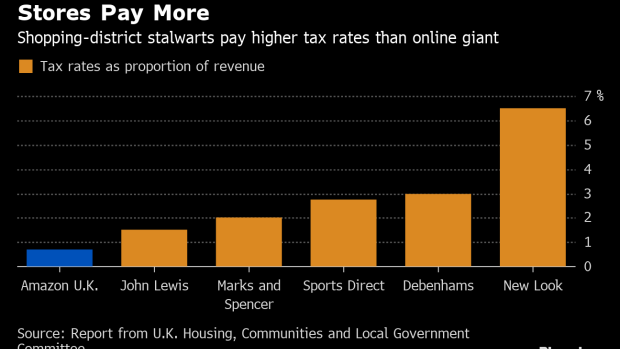

Brick-and-mortar retailers pay more than their fair share of tax, while online retailers are not contributing enough, the report said. Amazon’s rates amount to around 0.7 percent of its U.K. revenue, while most street-based retailers pay double to eight times that. The tech giant already faces the introduction of a U.K. digital tax from April 2020.

The retail sector accounts for about 5 percent of the U.K.’s gross domestic product and pays 25 percent of business rates, according to the report.

The report comes two months after Mike Ashley, the billionaire owner of Sports Direct International Plc, told the committee that e-commerce is the biggest threat to the U.K.’s shops. As a strategy to encourage retailers to keep physical stores open, he proposed a 20 percent tax on retailers that make than a fifth of their sales online.

--With assistance from Jessica Shankleman.

To contact the reporter on this story: Ellen Milligan in London at emilligan11@bloomberg.net

To contact the editors responsible for this story: Eric Pfanner at epfanner1@bloomberg.net, John Lauerman, Jonathan Roeder

©2019 Bloomberg L.P.