Feb 8, 2023

Weinberg Capital Starts Fund to Buy French Defense Companies

, Bloomberg News

(Bloomberg) -- Paris-based Weinberg Capital Partners has created a fund to buy small and mid-sized French security and defense companies as it bets on growing interest in an industry that’s in the spotlight due to Russia’s invasion of Ukraine.

The private equity firm has more than €100 million ($107 million) in commitments so far from investors including a large bank and intends to take majority stakes via leveraged buy-outs, it said on Wednesday. It aims to double in size by the end of next year.

“Since the beginning of the war in Ukraine, discussions with investors are playing out on a different level,” Lionel Mestre, a partner at Weinberg Capital, told Bloomberg in a phone interview. “There’s now an understanding that conflicts can be at the core of Europe, it’s a bit slow but things are definitely changing.”

With defense budgets on the rise around the world, investors are showing renewed interest in high-tech companies that can work both for the defense and civil sectors, Mestre added. Bloomberg reported the plan to create the fund on Friday.

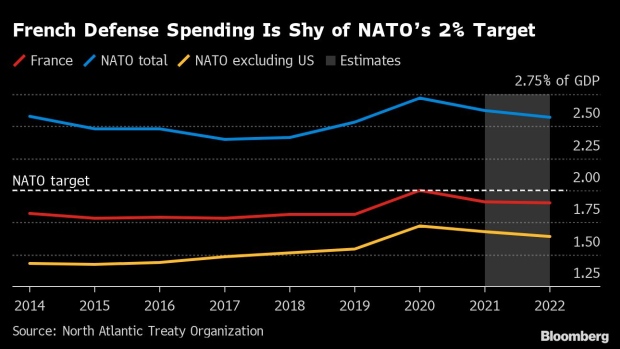

The war in Ukraine has focused attention on financing military capabilities in Europe and prompted governments to boost spending on weapons and equipment. French President Emmanuel Macron has also championed a push for the bloc to become less dependent on the US to defend itself.

The creation of the Eirene fund, whose name personifies peace in ancient Greek mythology, also follows government calls for more private investment in what it sees as key sectors.

Consolidation Opportunities

France counts around 4,000 defense and security companies. Mestre sees opportunities for consolidation as some leaders of family-owned businesses get closer to retirement.

The project was born in 2020, according to Mestre, who said he and Weinberg Capital Partners founder Serge Weinberg, also chairman of French drugmaker Sanofi, agreed that Europe needs to be more independent when it comes to protecting itself.

“The French defense industry is at the cutting edge, it’s exporting, and we don’t want small companies and technologies to leave,” Mestre said.

The businesses targeted cover all areas of activity in the sector from ground, naval and space to aeronautics, electronics and cybersecurity, and typically have both civil and defense operations, Weinberg Capital said.

Mestre will lead the new fund along with David Lebain, a senior director at Weinberg Capital Partners, which has €1.3 billion of assets under management.

--With assistance from Zoe Schneeweiss.

(Updates with comments by Weinberg partner in Bloomberg interview starting in third paragraph)

©2023 Bloomberg L.P.