Apr 17, 2023

Wells Fargo Sells $3.8 Billion in First Post-SVB Big Bank Sale

, Bloomberg News

(Bloomberg) -- Wells Fargo & Co. tapped the high-grade corporate bond market Monday, the first large US lender to sell bonds since the collapse of Silicon Valley Bank.

The $3.75 billion unsecured note offering will mature in 11 years and is callable after 10, according to a person familiar with the matter. The fixed-to-floating-rate security will yield 180 basis points over Treasuries, after early pricing discussions for around 205 to 210 basis points, the person said, asking to remain anonymous as they are not authorized to discuss the sale.

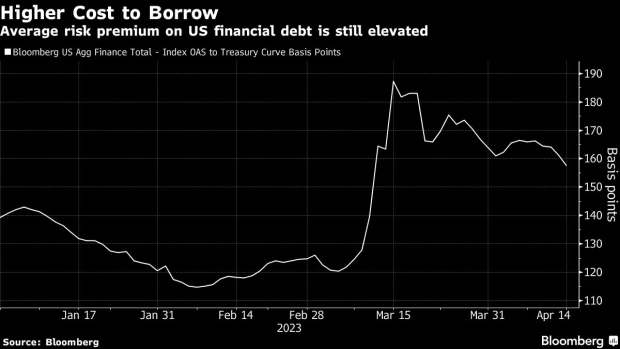

The lender is the first of the six biggest US banks to brave the corporate bond markets since a series of lender failures in March sent risk premiums on financial debt soaring. Tighter lending conditions are expected in the wake of the crisis, analysts say, and as the Federal Reserve meets to likely raise interest rates again in May.

The self-led sale “may help thaw bank primary markets,” CreditSights Inc. analyst Jesse Rosenthal wrote in a note. “We continue to see strong value in the US banks and would be buyers of the Wells Fargo deal.”

With bank earnings underway, some of Wells Fargo’s peers may seek financing as well. JPMorgan Chase & Co and Citigroup Inc. reported last week. Bank of America Corp. and Goldman Sachs Group Inc., meanwhile, are set to announce quarterly results on Tuesday to be followed by Morgan Stanley the next day.

Wells Fargo reported $13.3 billion in net interest income in the first three months of year, up 45% from a year earlier and more than the 42% jump analysts expected, the company said in a statement. Funds from Wells Fargo’s debt sale will be used for general corporate purposes. The company has $17.4 billion due through the end of next year, according to data compiled by Bloomberg.

JPMorgan analysts expect issuance from the six largest Wall Street banks to be around $11 billion to $14 billion this quarter, a relatively muted level. While sales were expected to be light this year, they are lower than anticipated, according to Arnold Kakuda, Bloomberg Intelligence financial credit analyst.

“We expected financial bond issuance to be lower this year, but it has dropped off a cliff,” he said. Most lenders have already met total loss-absorbing capacity requirements after robust issuance over the last three years when rates were lower, he said.

Consumer products company Mars Inc. and Cargill Inc. also sold investment-grade bonds Monday. Representatives from Mars, Cargill and Wells Fargo didn’t respond to requests for comment.

(Updates to show the deal has priced.)

©2023 Bloomberg L.P.