Apr 14, 2020

Wells Fargo sets aside the most for loan losses in a decade

, Bloomberg News

Norman Levine discusses Wells Fargo

Wells Fargo & Co.’s credit costs surged in the first quarter, previewing a tough year at the helm for new Chief Executive Officer Charlie Scharf as the coronavirus pandemic brings the U.S. economy to a virtual standstill.

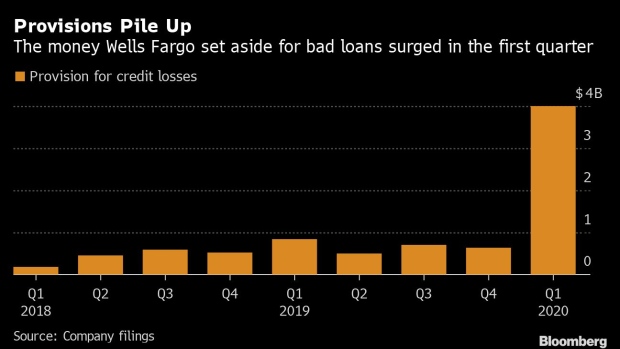

The firm set aside US$4 billion in loan-loss provisions in the first quarter, almost five times what it allocated a year ago and the most in a decade. That contributed to a 89 per cent drop in net income.

Bank earnings are being closely watched as investors assess the extent of the virus’s damage to the U.S. economy in the first month of nationwide lock-down orders. Wells Fargo is a top lender to consumers, small- and medium-size businesses, and commercial-property investors across the country, so its results offer a view into how bad things have gotten, and how much worse they may become.

“Wells Fargo plays an important role in the financial system and the economic strength of our country, and we take our responsibility seriously, particularly in these unprecedented times,” Scharf said in a statement Tuesday.

The lender joins JPMorgan Chase & Co. in having its profit hit by major provisions as the banks expect a spike in consumer and businesses falling behind on debt payments. JPMorgan posted its lowest net income since 2013 as it boosted reserves by more than US$11 billion.

Scharf said that commercial clients used over US$80 billion of their loan commitments in March alone.

Provisions in the wholesale unit jumped 17 times from a year earlier, while the amount Wells Fargo set aside for the community bank more than doubled. The total amount of provisions reflected “the expected impact these unprecedented times could have on our customers,” Chief Financial Officer John Shrewsberry said in the statement.

Shares were were up 2 per cent at 8:27 a.m. in early New York trading. The stock is down 42 per cent this year through Monday.

The San Francisco-based lender is constrained by a Federal Reserve order limiting assets to their end-of-2017 level following a series of scandals at the bank, though it was granted a temporary break last week to expand lending to small businesses. Total assets were just above that level at the end of the first quarter. Scharf said last week that Wells Fargo extended almost US$70 billion in new and increased commitments and outstanding loans in March alone.

Wells Fargo has joined its peers in making a variety of promises to help keep customers afloat. The lender will offer grace periods to mortgage borrowers, pledged millions to charities and relief efforts, offered workers extra pay, and said it paused new job cuts.

The bank’s loan-loss figure factors in an accounting rule that took effect in January requiring banks to recognize potential losses more quickly. The rule requires lenders to predict how a deteriorating economy will spark defaults even before borrowers stop paying.

Wells Fargo’s longer-term strategy has been in flux since former CEO Tim Sloan stepped down more than a year ago. Scharf has been conducting a wide-ranging review of the firm, and has warned that there’s still much to be done. Expenses -- a sticking point for investors in recent years -- fell 6 per cent in the first quarter from a year earlier.

Also in Wells Fargo’s first-quarter results:

Net interest margin, the spread between lending rates and borrowing costs, widened to 2.58 per cent from 2.53 per cent in the last three months of 2019.

Revenue fell to US$17.7 billion, missing analysts’ expectations of US$19.4 billion, the average of 18 estimates.

The bank’s efficiency ratio, a measure of profitability, improved to 73.6 per cent from 78.6 per cent in the fourth quarter. Wells Fargo has been beset by heightened costs stemming from its scandals. It had been targeting 55 per cent to 59 per cent in the long term, excluding litigation costs, though Scharf may set a different goal.