Feb 1, 2021

West Africa’s Oil Exports Slump as Nigeria, Angola Flows Falter

, Bloomberg News

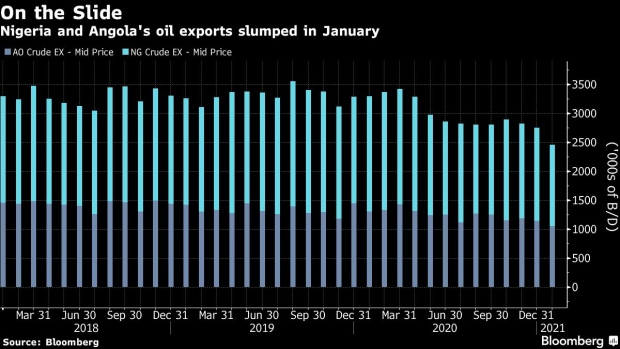

(Bloomberg) -- West Africa’s oil exports slumped to the lowest level in at least three years last month, as infrastructure woes for some of Nigeria’s biggest streams combined with gradually waning output in Angola.

Combined flows from the region fell to 3.41 million barrels a day in January from 3.8 million barrels a day in December, according to tanker-tracking data compiled by Bloomberg. It was the lowest for both countries since January 2018, when Bloomberg started monitoring shipments in detail.

Nigeria -- West Africa’s biggest oil producer - has seen its shipments curtailed in recent months by infrastructure issues affecting several of its biggest crude streams. The nation’s loadings fell to 1.37 million barrels a day in January, the lowest for four years, according to separate data based on loading schedules compiled by Bloomberg.

Exxon Mobil Corp.’s Qua Iboe stream was placed under force majeure until late January following a fire in mid-December at the grade’s oil export terminal. Revised loadings of Qua Iboe slumped to about 61,000 barrels a day over December and January, the lowest rate in more than four years. Liftings averaged 190,000 barrels a day last year, the loading data show.

Nigeria’s Brass crude flows also slumped as shipments were rescheduled following pipeline problems late last year. Eni SpA lifted a force majeure -- a clause in contracts that allows deliveries to be suspended -- on Brass exports in mid-December following repairs to two pipelines that lead to the Brass oil terminal.

Exports of Royal Dutch Shell Plc’s Forcados crude -- the nation’s biggest oil stream -- were also briefly placed under restrictions last month after a pipeline for that facility experienced leaks, although crude flows weren’t fully halted.

Angolan Output

Nigeria’s export problems may be temporary, as infrastructure is repaired and oil flows are restored. But Angola’s dwindling outflows look symptomatic of a longer-term decline in the country’s oil output.

Africa’s second-largest oil producer shipped 1.05 million barrels a day last month, slumping from an average of 1.25 million barrels a day last year, the tanker-tracking data show.

When Angola joined the Organization of Petroleum Exporting Countries in 2007 it was pumping about 1.5 million barrels a day and output was rising as a string of new deepwater discoveries were brought into operation by companies including Total SE, BP Plc, Eni and Chevron Corp.

At the time, Angola said it would accept an OPEC production quota once its output hit 2 million barrels a day -- a level that it struggled to reach on a sustained basis before a steep decline in rates at its offshore fields began to exceed the pace of additional supplies from new discoveries.

Linking smaller satellite fields back to existing floating production units helped the country to keep production close to its 2 million barrel-a-day target for several years, but declines really began to set in from the beginning of 2016, when the stock of new fields available for development began to dwindle.

©2021 Bloomberg L.P.