Feb 16, 2019

What Can Stop the Baht? Thai GDP Could Give Rally Further Boost

, Bloomberg News

(Bloomberg) -- The baht is looking to repeat its performance as one of Asia’s best currencies last year. Monday’s growth data will shed light on a key pillar of its recent strength and may help it stay in pole position at least through the first quarter.

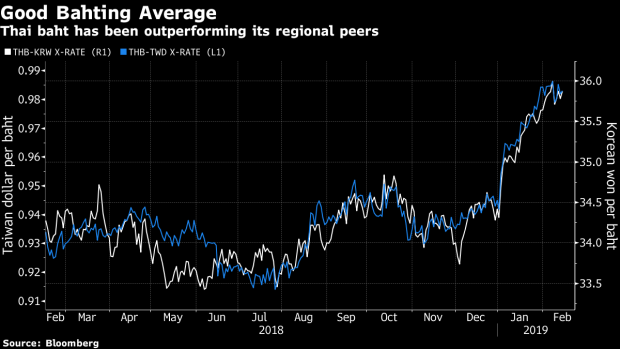

After being beaten by only the yen in 2018, the Thai currency has outshone all its regional peers so far in 2019, rising by 4 percent against the dollar. A robust domestic economy has helped it outperform both the won and Taiwanese dollar, which also have the benefit of a current-account surplus.

“The baht’s outperformance is attributable to the real strength of the nation’s fundamentals, including the current-account surplus,” said Hironori Sannami, an emerging-market currency trader at Mizuho Bank Ltd. in Tokyo. “That also includes the fact that it is less susceptible to the U.S.-China trade war relative to other surplus economies like South Korea and Taiwan.”

Thailand is also less vulnerable to a downturn in the technology sector unlike South Korea and Taiwan, increasing the attractiveness of the baht, Sannami added.

The tourism sector, by one measure worth about a fifth of the economy, is also recovering, noted Frances Cheung, head of Asia macro strategy at Westpac Banking Corp. in Singapore.

GDP Monday

Data due Monday is expected to show the Thai economy grew 3.6 percent on an annual basis in the fourth quarter, its 12th consecutive quarter of above 3 percent growth. The Bank of Thailand said the economy should continue gaining traction even though external demand might slow, in its Feb. 6 policy statement.

In fact, the health of the economy was one reason the central bank has kept a hawkish tone, unlike many of its increasingly dovish global peers. Despite leaving rates unchanged at 1.75 percent at the latest meeting, two policy members voted for a 25 basis point increase, signaling a future rate hike remains a possibility, and further bolstering the relative attractiveness of the baht.

The Bank of Thailand is closely monitoring the baht and is ready to act on any excessive currency movements, Governor Veerathai Santiprabhob told reporters in Bangkok Thursday. December’s rate hike didn’t stoke baht strength, rather dollar weakness, the current account surplus and a recovery in tourist arrivals is behind the move, he said.

Wild Card

Of course, one wild card is the country’s upcoming national election in March, and investors are closely watching to see if political divisions erupt again. Allies of Thailand’s exiled former leader Thaksin Shinawatra are seeking to woo voters with a plan to revive economic growth after a failed bid to run King Maha Vajiralongkorn’s sister as a prime minister candidate in next month’s election.

Still, as United Overseas Bank Ltd. pointed out in a Feb. 12 client note, “both main contending parties practice pro-Keynesian, demand-focus policies, so any political gridlock is largely expected to center around the size of stimulus and infrastructure investment.”

If political divisions can be held in check, the economy should continue to perform well no matter what party wins, and the baht should maintain its regional outperformance.

Below are key Asian economic data and events due this week:

- Monday, Feb. 18: Thailand 4Q GDP, Japan core machine orders, Singapore NODX and budget release

- Tuesday, Feb. 19: RBA minutes, Philippines BoP overall

- Wednesday, Feb. 20: Australia 4Q wage price index, Australia 4Q PPI input /output, Japan trade balance

- Thursday, Feb. 21: Australia employment, Japan Nikkei PMI manufacturing, South Korea 20 days imports/ exports, Bank Indonesia rate decision

- Friday, Feb. 22: RBA’s Lowe parliamentary testimony, New Zealand credit card spending, Japan CPI, South Korea PPI and 4Q household credit, Malaysia CPI, Thailand customs trade balance

--With assistance from Yumi Teso and Tomoko Yamazaki.

To contact the reporter on this story: David Finnerty in Singapore at dfinnerty4@bloomberg.net

To contact the editors responsible for this story: Tan Hwee Ann at hatan@bloomberg.net, Cormac Mullen, Tomoko Yamazaki

©2019 Bloomberg L.P.