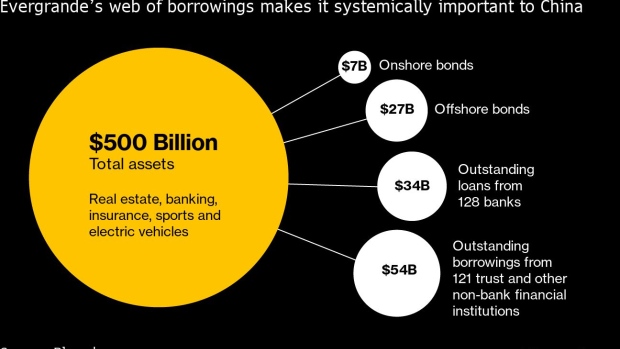

(Bloomberg) -- The danger lurking in China’s debt-laden real estate sector was never so clear as in late September, when word of a possible cash crunch at China Evergrande Group, the world’s most indebted property developer, sent investors running for the exits. With seven more of the 10 most-indebted developers also based in China, policymakers in Beijing have drafted what state-run media are calling “three red lines” -- metrics regarding debt that developers will have to meet if they want to borrow more. The new approach promises to be a game changer for a sector that accounts for about 29% of economic output.

1. How will it work?

The People’s Bank of China and the Ministry of Housing announced in August that they’d drafted new financing rules for real estate companies, but have said little more. But the media reports and people familiar with the upcoming guidelines have said developers wanting to refinance will be assessed against three red lines, or thresholds:

- There will be a 70% ceiling on liabilities to assets, excluding advance proceeds from projects sold on contract;

- a 100% cap on net debt to equity;

- and they must have a cash to short-term borrowing ratio of at least one.

Developers will be categorized based on how many limits they breach and their debt growth will be capped accordingly. If all three are breached, the company won’t be allowed to increase its debt in the following year, according to a report by 21st Century Business Herald. If it passes all three, it can increase its debt a maximum of 15% in the next year. As the regulator hasn’t announced its official calculations, some definitions aren’t clear.

2. Why draw the lines?

A big part is fear of another housing bubble -- and a disastrous bust. Home prices have surged six-fold over the past 15 years, making cities such as Shenzhen less affordable than London. The debt binge by Chinese builders has been an important driver of rising prices, forcing them to charge more to cover a rising interest burden. Potential buyers returned en masse as the pandemic crunch eased, keeping pressure on prices despite the global economic slowdown. The worry is that China could repeat Japan’s mistake in the 1990s of not reining in excessive credit and shutting down insolvent borrowers quickly enough, causing long-term damage to growth in the world’s No. 2 economy. Even before Evergrande’s brief liquidity scare, concern had intensified after Tahoe Group Co. in July became the first large residential developer in the country to default on a bond in five years. Guangzhou R&F Properties Co. and Oceanwide Holdings Co. have also shown signs of stress in recent months.

3. When will it begin?

The government hasn’t given a timetable. But the Economic Information Daily, reported that a dozen developers including Evergrande, China Vanke Co. and Country Garden Holdings Co. were selected for a pilot program that required them to submit a three-year debt-reduction plan by September. Full implementation across the residential sector would begin in 2021, it said. A report published by the official Xinhua News Agency said regulators imposed the red lines and other quantitative limits at an Aug. 20 meeting with developers, in another signal that they are moving ahead. The central bank’s deputy governor Pan Gongsheng said in mid-September there would be a “reasonable transitional period” for the policy’s adoption.

4. What’s the implication for developers?

In the near term, a developer with a weak balance sheet and sizable exposure to second-tier cities may need to cut home prices to boost sales and shore up cash. This is evident in Evergrande’s latest campaign to offer discounts of as much as 30% -- its deepest cuts ever. It may also spur waves of equity sales and spinoffs of non-core businesses such as property management services. Longer term, it may force developers to devote more resources to non-residential property, such as office and retail.

5. Which firms will be most affected?

Among the major players, Evergrande and Guangzhou R&F Properties fall short on all three metrics and face the most pressure to cut debt quickly, according to Bloomberg Intelligence. They may need to cut borrowing by 19 and 21 percentage points respectively under the new rule, based on their 2019 finances. Sunac China Holdings Ltd., which meets only one metric, may need to pare back debt by 35 percentage points. Among China’s 189 listed developers, 14 were in breach of the three red lines as of early October, data compiled by Bloomberg showed. Among the biggest by market capitalization were Zhongtian Financial Group, Oceanwide and LVGEM China Real Estate Investment Co. More than half of the Hong Kong-listed developers passed the all three red line tests, including Country Garden and Vanke.

6. Will it crush the economy?

Probably not. Developers’ debt growth has already been slowing from 53% in 2017 to 16% last year. That’s not far from the caps imposed on firms that pass the red lines test, according to Bloomberg Intelligence. As China’s real estate development investment has grown about 10% in the past two years, there will be room for a mild deleveraging, or debt reduction.

- Bloomberg Intelligence looks at how the three red lines will shake up the industry, and Evergrande’s impact on house prices.

- Bloomberg Opinion’s Nisha Gopalan explains why China can’t afford a property crash.

- A Bloomberg FFM look at Evergrande and other developers testing the limits.

- A profile of Evergrande’s billionaire founder, and why short bets on the company’s shares are tough to win.

©2020 Bloomberg L.P.