Feb 25, 2021

What Investors Are Watching After the Spike in Treasury Yields

, Bloomberg News

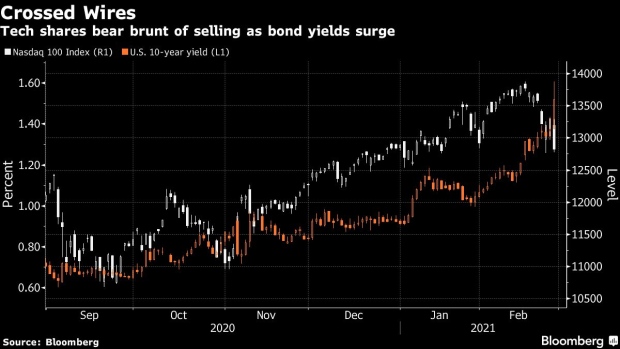

(Bloomberg) -- The surge in global yields and slump in stocks has left bond and equity investors alike nursing losses and asking whether there is more to come or something to stop the rot.

While many see bond yields continuing to push higher as the global economy reopens and growth recovers, others say they are now close to levels that should entice long-term buyers. A disorderly selloff in bonds or equities could also trigger at least verbal intervention from the Federal Reserve to stop a rout, according to investors.

In a Flash, U.S. Yields Hit 1.6%, Wreaking Havoc Across Markets

A bruising session for U.S. shares and Treasuries on Thursday saw benchmark Treasury yields spiked above 1.6% before pulling back, while tech stocks saw the brunt of the losses. A poorly received Treasury auction triggered some of the volatility, and traders yanked forward bets on how soon the Fed will be forced to tighten policy.

Here are some thoughts from market participants on what to watch for next:

Fed Problem

“Today’s market dynamics look to have been fueled by technical factors and the Fed may want to let the dust settle before it judges whether there is anything really problematic here,” said Evercore ISI’s Krishna Guha and Ernie Tedeschi. “But a change of tone at least seems warranted in our view and possibly more. This could well come in the next 24 hours.”

“On the forward rates front, the fed funds futures market is now pricing in more or less a full hike in 2022 as well as two in 2023, and we think the 2022 expectation will be viewed by the Fed as excessive and potentially starting to become problematic.”

Some Yields Too High

“From a fundamental perspective, the five-year rate looks too high. The market is pricing in the first hike in early-2023, which seems too early given the Fed’s higher threshold to hike rates,” said strategists at TD Securities including Priya Misra. “The 10-year is more difficult to call since it depends on the timing of the taper.”

“We expect the Fed to address market concerns of a premature withdrawal of Fed support and highlight the longer-term challenges in a post-COVID world. Chair Powell is set to speak next Thursday, giving him the opportunity to soothe market concerns.”

Buying Opportunities

“While we could see more volatility in the near term, we think this could potentially provide an interesting opportunities to investors to reload on equities,” said Tai Hui, chief Asia market strategist at JPMorgan Asset Management. “The recent rise in U.S. government bond yield has not been fully matched by other developed markets’ counterparts. The widening spread could attract European and Japanese investors back into the Treasury market.”

“This could also enhance the investment case of corporate credit and emerging market fixed income,” Hui said. “Global recovery should help to keep default risks in line with the long term average and justify the current level of credit spread.”

Convexity Focus

“Rising Treasury yields warrant focus on technicals like mortgage-backed securities convexity hedging, foreign buying and bank demand,” Morgan Stanley strategists including Guneet Dhingra and Jay Bacow wrote in a note. “While these technicals could drive yields and curve in the near term, we think the medium-term direction of yields and curve will depend on economic fundamentals and Fed policy.”

Overall convexity needs from MBS holders and servicers pick up with 10-year yields around 1.35%, then peak around 1.60%, the strategists said.

Convexity Hedging Haunts Markets Already Reeling From Bond Rout

Not Healthy

“A move of this magnitude is not healthy for markets and equities are rightfully acting negatively to it,” said Matthew Miskin, the co-chief investment strategist at John Hancock Investment Management. “We will be watching to see if the Fed pushes back more meaningfully on the recent rise in yields. They could do this with greater QE or yield curve control.”

“We would look at U.S. value stocks opportunistically on the dip and would look even to add to bonds in the event that this drawdown reaches the 4%-6% range,” he said.

Expensive Valuations

I’m “watching the 5-year and any changes in Fed buying patterns,” said Brian Barish, chief investment officer at Cambiar. “The Fed has more or less said, via their inflation targeting, that they intend to devalue your fixed income stream. If that’s really true then I should demand a lot more yield on a five-plus year basis as an investor. It will be interesting to see if the Fed actually does anything.”

“Some of the 2020 ‘Pelotonomy’ stocks are valued at rather extravagant levels. So will these continue to falter as momentum rolls over? I suspect so, but let’s see. I am also a little focused on the current prices of commodities, in terms of whether there is a more potent inflationary signal or are these just being speculated on also.”

Pause Near 1.5%

“Our guess is the surge in bond yields will soon take a breather around the 1.5% area before again venturing on another leg higher,” said Jim Paulsen of The Leuthold Group. “If the bond market’s panic about runaway inflation eases somewhat (even if only temporarily), this would help calm the current panic.”

“Yields still have further to rise this year. But, if they do it a bit more slowly and intermittently, rather than all at once, the impact on the economy and the stock market should be far less damaging.”

©2021 Bloomberg L.P.