Housing starts down seven per cent in March from February: CMHC

Canada Mortgage and Housing Corp. says the annual pace of housing starts in March declined seven per cent compared with February.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Canada Mortgage and Housing Corp. says the annual pace of housing starts in March declined seven per cent compared with February.

A rebound at John Paulson’s family office boosted returns last year but it still wasn’t enough to keep the billionaire investor from having to play catch-up.

New home construction in the US slowed last month as a leveling off in interest rates has given way to a lull in housing demand and caution among builders.

Citadel founder Ken Griffin’s efforts to build a 62-story office tower on Manhattan’s Park Avenue have taken a significant step forward.

As the US economy hums along month after month, minting hundreds of thousands of new jobs and confounding experts who had warned of an imminent downturn, some on Wall Street are starting to entertain a fringe economic theory.

Feb 13, 2018

, BNN Bloomberg

Ontario has changed the mortgage game for first-time buyers by instituting new guidelines. So, what do first-time homebuyers need to consider before wading into the market?

Mortgages of Canada CEO Samantha Brookes joined BNN on Tuesday to give her tips to those seeking to purchase their first property.

Brookes stressed the importance of pre-approval first and foremost, and knowing what money is actually there for a potential purchase.

“It’s so important to know what numbers you’re working with before you actually go in and purchase a home,” Brookes told BNN.

Before you can even know that number, Brookes said, potential homeowners need to have their paperwork in order.

“Make sure you’re organized, your finances are ready when you go meet with your broker or you go meet with your banker and you show them what it is that you have,” Brookes told BNN. “ If we don’t know what you have on paper, then we’re not able to know exactly how much you can afford.”

“We would like to see those documents up-front so we know what we’re dealing with. Things are more concrete when you have everything sitting in front of you. ”

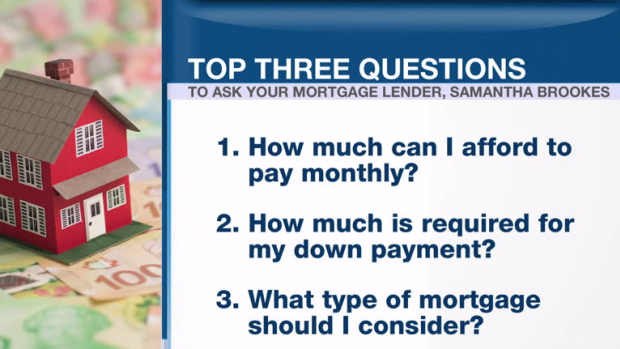

Brookes also provided three questions every potential homeowner should have answered before even beginning their search.

Know your monthly budget

“Let’s not even look at the actual house price. How much can you afford per month?” Brookes said.

“Because, if you have three kids and you think that you can afford an $800,000 house, those payments are coming up around $3800 per month. Can you afford that? Even though on paper it [may] look like you can, with three children that may be in sports or have extra-curricular activities and living expenses on top of that, the affordability may not actually be there.”

Know your down payment

“Right now it’s a buyers’ market, so you have room to negotiate,” Brookes said. “The whole things is, when all these new rule changes came in, that was to help protect consumers and the lenders. At the end of the day we know that people may not be able to afford as much property as before.”

“However, with the price ranges being where they are, those homes are sitting on the market much longer, which means that they have to bring those prices down in order for the buyers to afford those properties.”

Know what type of mortgage to consider

“When it comes to alternative lending, it’s a great solution,” Brookes said. “Especially for individuals who may have maxed out their credit cards and they no longer fit in the ‘A’ space.”

“Your interest may not be as low as if you were with an ‘A’ bank, but you still have a mortgage.”

One final tip from Brookes is for potential homebuyers to be patient and understand that the approval and sale processes can take time.

“Everyone wants things to happen right now,” Brookes said. “When we’re sitting here and asking somebody - a complete stranger, or a bank, or an institution – to lend us half a million dollars, you better believe there has to be some due diligence.”

“It can take a few days, sometimes, to get a pre-approval and people just need to be more realistic.”