Sep 14, 2021

What to consider when creating a post-pandemic portfolio

Presented by:

While COVID-19’s fourth wave may be on the horizon, with more people getting vaccinated, many advisors and investors are starting to adjust their portfolios for a post-pandemic future. What will unfold over the next few months – and even years – is still anyone’s guess, but David Arpin, a portfolio manager with Mackenzie Investments, is optimistic about what’s to come.

“When you step back and think about the next decade, we’re going to have all of this innovation and it's going to come from companies that are able to create new things that people want and need,” he says. “And you’ll get paid as a shareholder.”

Creating a post-pandemic portfolio, however, is going to take more work than simply buying a basket of undervalued stocks, which is what many people did after the last recession. Not only are there a variety of newer and higher-growth industries to invest in – such as green energy, healthcare and tech more broadly – but the strong rebound in markets and the economy has made it more difficult to follow past recession investment strategies.

“When you think about the COVID downturn, it was really different from any other downturn that we've seen on record,” says Arpin. “Recessions and recoveries tend to follow a common pattern, but what's happening now is unusual.”

Strong recession rebound

In a typical recession, the economy overheats, consumers and businesses reduce spending, unemployment rises and housing starts to weaken. It can then take years for these areas to reach more normal levels.

While many economic indicators did decline in March 2020, they rebounded far faster than ever before. For instance, Canada’s unemployment rate reached a pandemic high of 13.7% in May 2020, only to start rapidly declining soon after – it now sits at 7.5%. Housing prices also dropped significantly at first, with sales posting record declines in April 2020. By the end of the year, sales of existing homes were the highest they’ve been in 14 years.

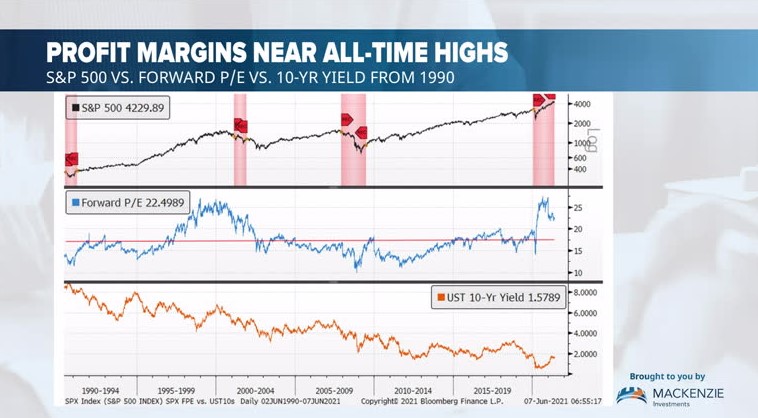

It’s a similar story for stock markets. According to Ned Davis Research, a major stock market drop of between 20% and 40% takes, on average, about 11 months to go from peak to trough and then another 14 months to reach its prior highs. In the last recession, it took six years for the S&P 500 to return to 2007 levels. This time it took a month for the market to fall by about 35% and a mere five months to reach its pre-pandemic peak.

What all of this means, says Arpin, is that investors will have to think more carefully about where they invest their money going forward. Given how strong markets are now – the S&P 500 is up nearly 100% since March 2020 – people can’t just bet on a rising market like they have in the past.

Growth sectors to consider

As more normalcy resumes, it’s a good time for investors to start thinking about ways to add more growth to their portfolios, says Arpin, co-manager of the Mackenzie Global Growth Fund, among other funds. Green technology is one key area that he’s interested in.

While the green tech sector isn’t new – people have been talking about the shift to electric vehicles for years now, for instance – all the attention the pandemic put on gasoline usage and climate change more broadly is getting people more interested in environmental sustainability. It’s now a 20-year trend that’s only picking up speed, he says.

“The green transition is almost inevitable at this point,” he explains, saying that a landmark Intergovernmental Panel on Climate Change report, which warns of more extreme heatwaves, droughts and flooding, is spurring governments and businesses into action. “It’s going to be hard to turn backwards – there’s a lot of push there.” Arpin sees opportunities in everything from decarbonization to electrification to green energy creation.

Another growth area that’s done well during the pandemic is, not surprisingly, healthcare. While biotech has earned the attention of investors for years now, the broader industry should see more gains, too. Why? Because no one takes their healthcare for granted anymore.

“There’s been a huge change in perception in terms of how important healthcare is to people,” says Arpin. “Pulling back health care spending was never popular, but it’s really not popular now.” Biotech will continue to do well, but other areas of the market like medical devices and healthcare services offer opportunities as well.

One reason why Arpin likes these areas is that they benefit from increasing government support. Since the pandemic began, governments have been far more willing to invest in businesses, he explains, and that could last for some time. That’s attractive, because those dollars provide a financial cushion for many of these companies and it gives them money to grow.

“For the last 40 years, we’ve had this idea that the market will solve all problems and that the government needs to stay out of the way,” he says. “With COVID-19 though, we hit a problem that the market could not solve. It couldn’t stop a pandemic. We’ve hit another problem the market can’t solve with the green transition and decarbonization.

“We’re at a point where we need governments to do things and once they start, they like to continue,” he adds. “We’re at a structural change in terms of the amount of government money in the economy and healthcare and green is where a lot of that support will go.”

Get more global

Investors may also want to look farther afield for opportunities. Canadians are still too concentrated in the domestic market, says Arpin, which means they’re missing out on opportunities around the globe. Healthcare, for instance, only accounts for a small fraction of the Toronto Stock Exchange, but it’s one of the largest sectors on the U.S. market.

Returns speak for themselves: over the last five years the S&P 500 has climbed by 107% compared to 40% for Canada’s S&P/TSX Composite Index and that gap could widen. Arpin thinks that as the world moves to a more green economy, Canada’s energy and materials-heavy market could struggle.

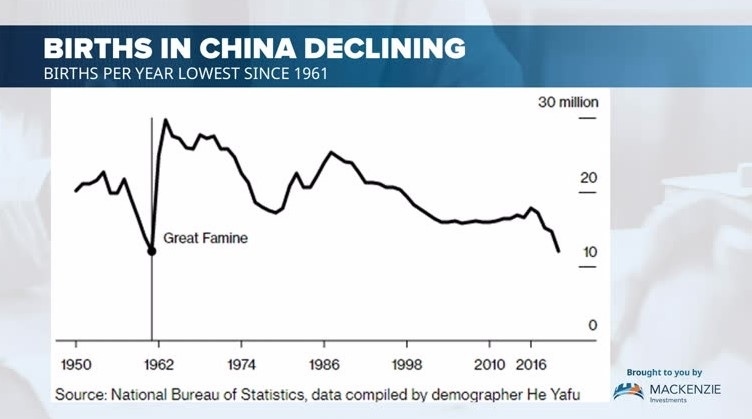

“As we move away from oil and carbon, the opportunity sets outside of Canada are going to be better than in Canada,” he says. “And when you think about global markets, most of the major tech companies are in the U.S., healthcare is heavily concentrated in the U.S. and Europe, you've got a lot of growth that’s happening in Asia – so we’re going to see a lot coming on the global side and not as much from the domestic market.”

Stay diversified

As exciting as these areas may be, investors and advisors don’t need to make any risky bets, says Arpin. These are long-term trends, and there are many established companies in these sectors that already have track records of success.

Still, creating your own global portfolio one stock at a time is difficult for individual investors to do. Instead, consider adding a global growth fund to your portfolio. Arpin’s fund, for instance, has assets in a number of steady growth companies around the world. Its biggest concentration is in the U.S., but it also holds companies in Europe and Asia. Many of the businesses he holds are also multinationals that generate revenue from multiple end markets.

When it comes down to it, you don’t want to make any drastic moves – make sure you’re still diversified and investing within your risk tolerance levels and time horizon – but you can ensure you’re taking advantage of what’s to come when the pandemic finally ends.

“Who knows what the equity markets will bring in the next 12 months, but if you think long term, it’s going to be a good decade,” says Arpin. “There are a lot of strong and dominant companies that grow constantly and generate cash and that’s worth something over time.”

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

The content of this article (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

This article may contain forward-looking information which reflect our or third party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of August 24, 2021. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.