Nov 25, 2022

What to Watch in Commodities as China Adds to Global Demand Fear

, Bloomberg News

(Bloomberg) -- A turbulent year for commodities is heading for a volatile finish, with China’s Covid-19 turmoil adding to global demand fears that look set to buffet markets from oil to copper and crops through December.

Crude opened Monday by slumping to its lowest level this year -- while metals and grains also fell -- after weekend protests over pandemic policies swept major Chinese cities. That compounds uncertainties for Asia’s largest economy as President Xi Jinping’s Covid Zero polices face their toughest test yet.

Gas traders will track Europe’s still-clouded supply situation as temperatures fall. And in this week’s diary, there’s also China’s latest factory activity and third-quarter US GDP, plus another public outing by Federal Reserve Chair Jerome Powell and the latest UN snapshot of food costs. Finally, in new energy, watch for a crucial US trade finding on Chinese solar and the latest on lithium’s slide.

What Next?

November began with some investor optimism for China’s exit from strict virus controls. It ends with fear that a fresh wave of restrictions will once again pummel commodity demand. The protests across China highlight deep frustrations among the population, and investors will be closely monitoring whether the street action is sustained, and how authorities respond. Meanwhile, there are already signs of oil demand dropping as mobility curbs bite.

Read more: China Bulls Look to a Future That No Longer Exists

Traders will watch how key metrics like urban traffic activity, flight numbers and construction activity pan out. Manufacturing PMI figures due Wednesday should also confirm widening economic weakness. “Recent price rallies in a number of commodities in reaction to the prospect of China’s reopening look to have run ahead of themselves,” Citigroup Inc. said.

The Energy Squeeze

Europe’s energy crunch looks like less of a crisis than it did a few months ago but there’s a lot still at stake as winter deepens. First, oil traders are waiting for the final details of a planned price-cap on Russian oil as negotiators wrestle with differences between member states. Negotiations are set to resume on Monday.

Perhaps more importantly, a broader EU energy package including gas price caps also hangs in the balance. A decision on that was just punted into mid-December. Meanwhile, peak cold-weather demand lies ahead and temperatures are set to drop below seasonal norms this week. That should again ramp up demand, sharpen global competition for gas and trigger more volatility.

Counting the Cost

Global food costs likely held steady or eased a little in November, even as they remain elevated historically. Supplies from fresh crops in the Northern Hemisphere, and the renewal of the Black Sea export deal, have capped prices for now. Wheat futures have tumbled this month, and corn is down too. Still, traders will keep a wary eye on the weather. Torrential rains and floods have already hurt Australia’s wheat harvest, threatening to push up prices of bread and noodles.

Global inventories of grains and oilseeds are tight, and any prolonged dry spell in Brazil in coming months could reduce crop yields and cause a shortage. “All it takes is one really bad crop, let’s say in North America or South America, to really send prices higher,” said David MacLennan, CEO of Cargill Inc., America’s largest private company. The UN’s food index is due next Friday.

Trade Tensions

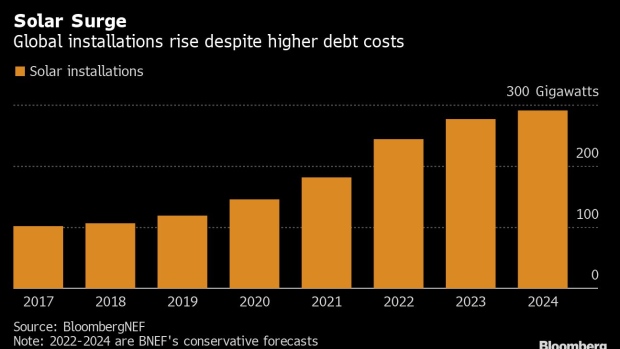

The world’s biggest solar manufacturers will be watching the US closely for developments that could reshape the industry and exacerbate geopolitical tensions. The US Commerce Department is expected to deliver its initial findings within the week on whether Chinese solar panel makers have circumvented 10-year-old tariffs by assembling equipment in Southeast Asia.

Read more: U.S. to Probe Whether China Solar Firms Are Evading Tariffs

If China is deemed to have skirted the rules, it could worsen trade tensions between Washington and Beijing and increase calls from American protectionists to scrap a moratorium on new tariffs. Meanwhile, some of China’s solar manufacturers are due to appear at the BNEF Summit in Shanghai.

For The Diary

- Click here for oil and gas markets

- Click here for agricultural markets

- Click here for China

--With assistance from Andrew Janes.

©2022 Bloomberg L.P.