Feb 25, 2022

What to Watch in Commodities: Ukraine Impact Roiling Markets

, Bloomberg News

(Bloomberg) -- Russia’s invasion of Ukraine triggered a wild end to the week for commodity markets, and there’s likely more tumult to come amid supply snarl-ups, sanctions and an altered geopolitical landscape.

Ukraine’s President Volodymyr Zelenskiy said his nation was continuing to resist the assault, which has prompted widespread sanctions from the West. Brent crude pushed higher and was trading near $102 a barrel heading for the weekend, while grains prices surged and gold resumed its advance.

Click here for a rolling update on war in Ukraine

The attack is Europe’s biggest crisis since World War Two, and is a major threat to the continent’s energy security. The resulting jump in commodities prices -- Bloomberg’s gauge just hit a record -- will add to inflationary pressures, so expect more talk of demand destruction and economic damage.

Here are five things to look for next week.

What’s Next for Oil?

The coming days are freighted with event risk for crude: OPEC+ holds a midweek meeting on output; the Biden administration may tap stockpiles; and Iranian nuclear talks look to be nearing a conclusion. On top of that, American crude inventories at the key Cushing hub could sink to the lowest since 2014 if there’s another modest draw.

Goldman Sachs Group Inc. said that despite the rally in prices, it’s unlikely OPEC+ will choose to quicken the pace at which the alliance has been restoring supplies, citing Russia’s “essential role” in the grouping. Both the OPEC+ meeting on Wednesday, and the latest government snapshot of U.S. crude holdings and demand the same day, will be covered by Top Live blogs.

Europe’s Energy Crisis

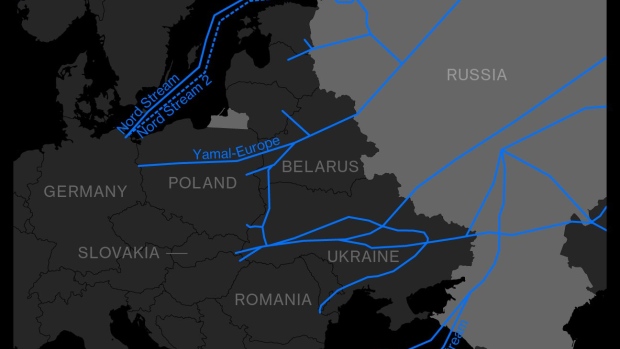

Europe gets more than a third of its gas supply from Russia, and a 62% jump in prices on Thursday testified to jitters around what the immediate future will bring. Conflict in the east comes with the continent already facing spiraling energy costs. Even as Moscow’s forces pushed further into Ukraine, Europe’s top energy companies were hurrying to buy more Russian gas.

The gas market will become “even rockier” in the aftermath of Vladimir Putin’s aggression, according to BloombergNEF. While Russia is unlikely to choke off supplies to Europe for a prolonged period, it’s something that can’t be ruled out -- especially if sanctions are ratcheted up.

Yellow Haven

Thursday was a classic day for a haven asset like gold. Investors rushed to bullion in the flight from geopolitical tumult and economic risks, pushing the precious metal to a 17-month high. What happens next is much trickier.

On the one hand, there’s an argument that adding a European war to soaring commodity prices is a recipe for a wider growth slowdown. If that happens, the recent flow of ETF investment to gold -- even before Thursday’s drama -- might become a rising tide, helping to boost prices. However, there’s also a school of thought that bullion will fall back to earth once the dust settles and investors go back to focusing on rising U.S. interest rates.

Upsetting the Breadbasket

Global inflation could hit an all-time high when the United Nations comes out with its latest monthly snapshot on Thursday. Consumers are already grappling with soaring food costs after drought and labor shortages slashed harvests around the world at a time of rising demand. Now prices of grains and cooking oils have taken another powerful leap upward following the invasion of Ukraine, a country that’s been labeled the breadbasket of Europe.

See also: ‘The Sky’s the Limit’: Food Inflation to Worsen on Ukraine

Wheat jumped to a 13-year high, raising bread costs, while soybean oil and palm oil, used in everything from chocolate to instant noodles, surged to records. Corn and soybeans also rallied. Ukraine’s fertile soils have made it the second-largest global grain shipper and a major sunflower oil exporter. But the invasion is shuttering ports and railways, leaving traders struggling to book vessels. Russia is also a top supplier of wheat and sunflower oil.

Metals Mayhem?

At first glance, it looks like metals markets got a bit of a reprieve. Just as in energy, the U.S. seems unwilling for now to directly disrupt Russian supplies of aluminum, nickel and palladium. That could be a lesson learned from 2018, when curbs on Russia’s top aluminum producer sparked months of market chaos. Consequently, the metal’s surge to a record has lost some momentum.

That doesn’t mean the drama is over, however. Even without direct sanctions on producers, there will still be an impact from the financial restrictions that have been announced. There’s already signs that banking curbs are scaring buyers and trade financiers away from Russian business. That could snarl supply chains and fuel more volatility. And with aluminum tight as it is, don’t rule out new records -- or even a march toward $4,000 a ton.

For The Diary

- Click here for oil markets

- Click here for metals markets

- Click here for agricultural markets

- Click here for China

©2022 Bloomberg L.P.