Oct 22, 2020

Wheat Harvest in Australia Set For ‘Exciting’ Season After Rains

, Bloomberg News

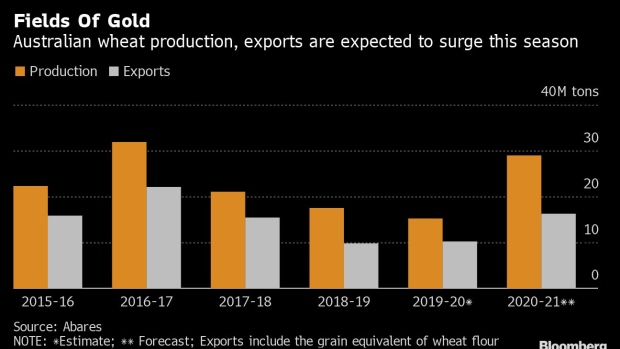

(Bloomberg) -- As harvesting gets underway in Australia, the country’s expecting to have its biggest wheat crop in four years after ample rains on the east coast earlier in the season boosted yields. Exports are poised to surge.

Farmers in New South Wales and Victoria states are particularly well placed for bumper crops thanks to drought-breaking conditions. New South Wales is now set for a record season, according to IKON Commodities, which recently lifted its national forecast to over 30 million tons, more than double last year.

“It’s looking really exciting at the moment on the east coast of Australia,” said Brett Hosking, a grains farmer in Victoria state and chairman of industry group GrainGrowers. “Even if they weren’t coming off a drought, they’d be looking at a really good harvest.”

The Australian Bureau of Agricultural and Resource Economics and Sciences forecasts 28.9 million tons of wheat output this season, while Rabobank expects 28.8 million tons. Barley crops are also set to benefit from the rains, with output poised to rise more than 25% from last year, IKON said.

Hosking is confident the bushels of Australian wheat will find a home in Asian markets, especially as a recent free trade deal with Indonesia paves the way for increased sales to a country that is already one of Australia’s biggest wheat export destinations. Meanwhile, other major global importers are stockpiling the grain in order to shore up their supplies.

The blockbuster season is further bolstered as doubts remain over yields in other key wheat growing areas of the U.S. and the Black Sea region, following dry weather and hurricane activity. Futures in Chicago have surged more than 17% since the start of August, amid concerns about yields in those areas.

“Because the EU has a smaller crop, a lot of the Russian crop is running into North Africa and the typical EU destinations,” said Ole Houe, chief executive at IKON. “So we don’t have a lot of big competition into Asia this year.”

READ: Wheat’s Drought Battle and Surging Demand: Why Prices Are Flying

That’s setting Australia up for a “major return to the global grains market,” according to a Rabobank report released Thursday. The bank forecasts total grain exports to increase by 93% on last year with support from a relatively low Australian dollar.

“The last time Australia had export volumes in these ranges, the Australian dollar was 10 U.S. cents higher and global grain prices were around 35% lower than our current forecasts for the year ahead,” said Rabobank senior grains analyst Cheryl Kalisch Gordon.

Still, risks remain. La Nina is set to bring more summer rain to the southern hemisphere -- rains that, if too heavy, could end up causing crop damage. Some panicked farmers are already working long hours harvesting this week in case forecast rains in the coming days reduce yields.

China Doubts

Simmering tensions between Beijing and Canberra that have seen barley exports hit with bans also add a layer of complexity for markets and could see growers shift from planting barley to wheat next year, Hosking said.

“This is the first harvest that Australian growers will face without China, and coupled with that, it will be quite a big harvest,” he said, referring to barley. If that creates a barley glut, it might flow into wheat and sorghum, he added.

©2020 Bloomberg L.P.