Jan 21, 2020

While Virus Whacked Stocks, Some Made Bullish China Options Bets

, Bloomberg News

(Bloomberg) -- Some investors may have been taking advantage of Tuesday’s sell-off in Asian stocks to position for a rebound.

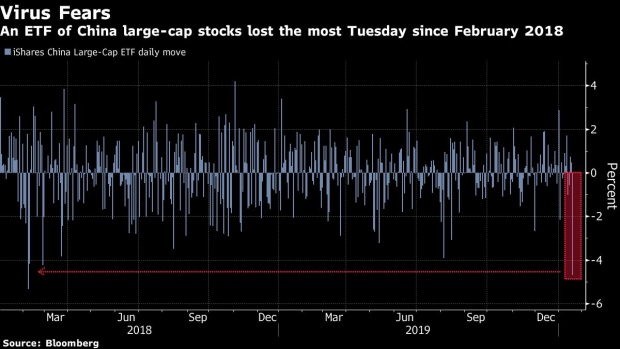

While the iShares China Large-Cap ETF tumbled the most in almost two years on news that the coronavirus out of China has spread, Susquehanna Financial Group LLP spotted buyers of bullish options. Four of the five most-traded contracts on the U.S.-listed exchange-traded fund were calls, data compiled by Bloomberg show.

“Despite the negative news and moves lower in the underlying, we are seeing primarily bullish flow in the options,” Chris Murphy, the co-head of derivatives strategy at Susquehanna, wrote in a note Tuesday. “Some investors have been quick to take advantage of weakness today to get long exposure through the options in China.”

The virus put the brakes on a global risk rally that saw MSCI’s gauge of global stocks rise 2.5% this month through Monday. The Hang Seng Index fell 2.8% on Tuesday, the most in Asia, also likely hurt by Moody’s Investors Service’s downgrade of Hong Kong. The MSCI Asia Pacific Index dropped 1.2%, its biggest slide since August.

Read more about fear of the coronavirus rippling through global markets.

Susquehanna noted buyers of 5,000 March $44/$48 call spreads, 10,000 March $46/$48 call spreads and 10,000 March $45/$47/$48 call trees on Tuesday. Other bullish options activity included a purchase of 12,000 February $47 calls on the iShares MSCI Emerging Markets ETF, and the sale of 2,300 February $52 puts on the KraneShares CSI China Internet ETF, according to Murphy. There was also bullish options trading on some travel-related U.S. stocks.

“Along the same lines, we are seeing sizable call buying in Melco Resorts & Entertainment Ltd., Las Vegas Sands Corp. and Wynn Resorts Ltd. on the China virus-related weakness,” Susquehanna said.

To contact the reporter on this story: Joanna Ossinger in Singapore at jossinger@bloomberg.net

To contact the editors responsible for this story: Christopher Anstey at canstey@bloomberg.net, Cecile Vannucci, Margo Towie

©2020 Bloomberg L.P.