Aug 18, 2019

Why Ivascyn’s Pimco Income Fund Fell as Long Bonds Rallied

, Bloomberg News

(Bloomberg) -- The rally that lifted long-term U.S. bonds this month eluded the world’s largest actively managed fixed-income fund.

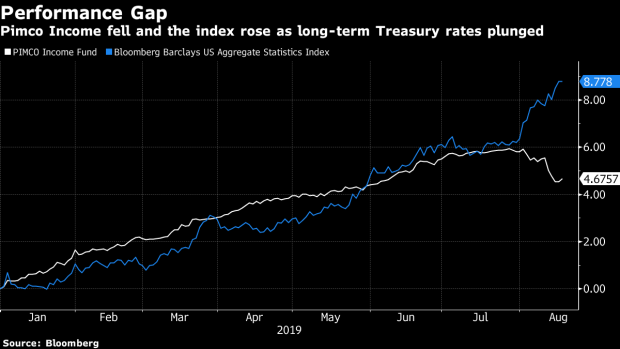

Dan Ivascyn’s $130 billion Pimco Income Fund lost 1.07% since July 31. Its benchmark, the Bloomberg Barclays U.S. bond aggregate index, gained 2.29% -- a gap of 3.36 percentage points.

“We tend to be cautious when we see segments of the market get expensive from a fundamental perspective,” Ivascyn, group chief investment officer at Pacific Investment Management Co., said in an email.

The broad bond rally occurred as investors sought safe havens amid mounting concerns the U.S. and other global economies may be hurtling toward a downturn. Rates plunged on long-term debt, creating a yield-curve inversion, a leading recession indicator.

The institutional class shares of Ivascyn’s fund returned 4.7% for the year through Aug. 16, lagging behind the benchmark, which is up 8.8%. The underperformance is a rarity for the Pimco Income Fund, co-managed with Alfred Murata and Joshua Anderson, which has beaten the benchmark for nine of the past 10 years, averaging annual returns of 9.2% compared with 4% for the index. The fund had almost $14 billion in net inflows this year through July, an endorsement by investors, according to Bloomberg estimates.

Other bond market star managers also have lagged the index both for August and the year so far, including Jeffrey Gundlach’s DoubleLine Total Return Bond Fund and Scott Minerd’s Guggenheim Total Return Bond Fund.

Yields on 30-year U.S. Treasuries reached all-time lows last week and rates on 10-year U.S. bonds approached the record lows set in July 2016, leaving little room for price appreciation and lots of risk if rates turn back up, according to Ivascyn.

“It is dangerous here at these levels,” Ivascyn said in an email. “It can certainly get more expensive but exposed to a snap-back.”

While there may be periods when his fund trails the aggregate index, the managers are more focused on the long term, he said.

The notable difference between the Pimco Income Fund and the index is its duration -- a measure of exposure to interest rate moves. Pimco Income’s effective duration was only 0.35 years as of July 31, according to a fund presentation.

Another factor is mortgage-backed security holdings, the largest share of the portfolio, have trailed corporate debt this year.

“I am fine with that as the housing-related investments will likely be much better performers if the economy deteriorates,” Ivascyn said.

A small additional negative last week was the fund’s holdings in Argentine government debt, which were hit by the peso plunge following the surprise election outcome that raised concerns about the country’s economy.

To contact the reporters on this story: John Gittelsohn in Los Angeles at johngitt@bloomberg.net;Claire Boston in New York at cboston6@bloomberg.net

To contact the editors responsible for this story: Alan Mirabella at amirabella@bloomberg.net, Josh Friedman, Matthew G. Miller

©2019 Bloomberg L.P.