Mar 23, 2023

Why Japanese Banks Are Well Placed to Withstand Banking Crisis

, Bloomberg News

(Bloomberg) -- Financial turmoil following the collapse of three US lenders and the emergency takeover of Credit Suisse Group AG has fueled questions over whether Japanese banks might be at risk from the fallout.

Shares of the nation’s banks have been among the hardest hit in Asia since the crisis emerged this month. Smaller lenders, which have piled into US Treasuries in recent years, have copped the biggest blows on concern that they may face the sort of losses on bond holdings that helped to bring down Silicon Valley Bank.

Yet regulators and industry heads have been quick to say Japan’s financial system is sound, while analysts have been busy reassuring worried bank investors. Below are four reasons why fears of a banking crisis in Japan are — mostly — overblown.

1. Strong Balance Sheets

It’s true that Japanese banks are sitting on large paper losses on foreign bonds including Treasuries, having loaded up on the securities after years of massive monetary easing depressed yields at home. Regional banks were caught off guard by the Federal Reserve’s aggressive rate hikes that began early last year, which caused the value of Treasuries to sink.

Read about concerns over Japan banks’ Treasuries exposure

Listed regional lenders alone had 1.4 trillion yen ($10.7 billion) in unrealized losses on foreign bonds and other securities as of December, according to SMBC Nikko Securities Inc.

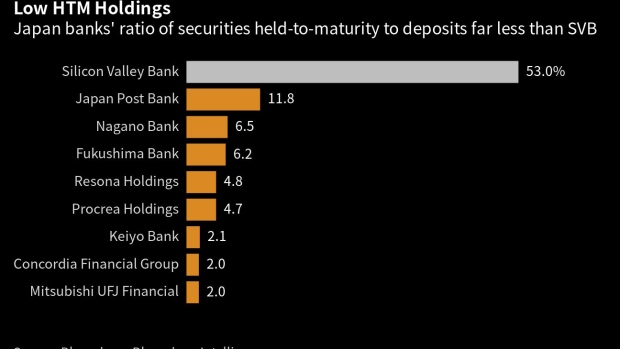

But unlike SVB, Japanese banks tend to carry foreign bonds as available for sale, rather than held to maturity. That means they’re booked at market value, as opposed to face value, and for major banks and some regional lenders with overseas operations, any unrealized losses are reflected in capital ratios rather than the income statement.

Read a BI note on Japan banks’ bond portfolios

Smaller banks don’t need to factor in valuation losses on available-for-sale securities. But SMBC Nikko analyst Masahiko Sato estimates that the impact on their capital ratios is only around 2% at most anyway, even for banks with large unrealized losses on foreign and yen bonds. Sato therefore does “not think potential losses are on a scale with systemic implications,” he wrote in a March 20 note.

What’s more, banks are able to more than offset their paper losses from foreign bonds with larger gains on domestic stocks. Regional lenders had unrealized gains of 0.9 trillion yen on their securities overall in December, Sato estimates.

Reflecting their solid standing, Japan’s domestically active local banks had an average capital ratio of 9.72% as of Sept. 30, according to the Financial Services Agency. Internationally active regional lenders had a common equity Tier 1 capital ratio of 11.96%.

2. Sticky Deposits

SVB’s woes stemmed from the sudden withdrawal of billions of dollars in deposits from its startup customers, which forced it to sell bonds in its portfolio at a loss. But Japanese regional banks have a much different and more diverse deposit base made up of regular households and small businesses, who are unlikely to yank all their savings at once.

“Japan is the last place you’d expect to have a bank run,” said Michael Makdad, an analyst at Morningstar Inc. in Tokyo, adding that even if bank share prices fall and some customers lose confidence, Japanese lenders have ample cash.

3. Bond Financing

The decision by Swiss authorities to write off Credit Suisse’s riskiest bonds has sparked concern that banks will struggle to issue them in the future, or that it will become too expensive to do so, choking off a valuable funding source.

Like their European counterparts, Japan’s largest lenders started issuing so-called Additional Tier 1 bonds after the global financial crisis as part of rules to ensure that creditors, rather than taxpayers, were on the hook if a bank failed. But Japanese banks are unlikely to face pressure on their AT1 funding for several reasons, according to analysts.

First, the main buyers of their notes are domestic institutional investors, who will likely keep purchasing them even if they are low-yielding, Makdad said. Japanese banks have so far only issued AT1 bonds in yen.

Despite the global volatility, prices of yen-denominated AT1 bonds of Japanese banks were indicated at 98.2 yen on average this week, according to data compiled by Bloomberg. By contrast, dollar bonds of Asian lenders outside Japan are trading at around 92 cents on the dollar on average, according to data compiled by Bloomberg.

Also giving breathing room, Japan’s biggest banks don’t have to call any of their AT1 bonds until December, according to Bloomberg Intelligence analysts including Pri De Silva.

At any rate, they have enough capital to avoid refinancing, said Natsumu Tsujino, a senior analyst at Mitsubishi UFJ Morgan Stanley Securities Co. “Japanese banks can meet capital requirements even without refinancing their AT1 bonds after calling them,” she wrote in a note this week.

4. Dollar Access

One perennial concern for Japanese regulators is the vulnerability of the nation’s banks to a tightening of dollar funding conditions. Large banks in particular have been expanding abroad, lending in dollars aggressively, putting them at risk in times when the currency gets more expensive.

How regulators are scrutinizing Japan banks’ dollar funding

Yet there has been little sign that Japanese banks have been caught short on dollar funding during the SVB-induced tumult, even after global central banks stepped up a dollar-swap arrangement last weekend.

As of Thursday, the Bank of Japan hadn’t received any bids for its dollar funding operation since the coordinated action. That compares with the $50 billion tapped by lenders on Oct. 21, 2008, at the height of the global financial crisis, according to BOJ figures. The most recent surge in demand came during the early phase of the pandemic.

Cautionary Tale

The recent banking industry turmoil has served as a reminder to Japanese banks — and their investors — that rising interest rates do have their downside. The nation’s lenders have long bemoaned the Bank of Japan’s policy of keeping rates close to zero, which has crushed lending profitability.

Shares of Japanese banks jumped in December when the central bank eased its cap on bond yields. But if the central bank were to scrap yield curve control altogether, the risk is that Japanese government bond prices would plummet, leading to losses on lenders’ 84 trillion yen in domestic debt holdings.

Read how BOJ easing changed how banks make money

“It’s not about US dollar bonds, it’s actually about JGBs. Every bank holds JGBs,” said Makdad. “Next time if this all blows over, and everyone’s getting bullish again about Japanese interest rates going up and that it’s great for the banks, remember this issue.”

--With assistance from Finbarr Flynn and Paul Jackson.

©2023 Bloomberg L.P.