Jun 12, 2019

Why Some of China's Debt Could Look a Lot Like Equity

, Bloomberg News

(Bloomberg Opinion) -- In China, debt takes many shapes – on the books, off the books, or buried deep within the financial system. Now, debt can even be considered equity.

In a bid to boost the economy, China this week announced it would allow local governments to borrow more to fund infrastructure investment. As part of this push, it will let municipalities use the proceeds of special-purpose bonds(4) as equity in railroad, highway and other projects.(3) Previously, local governments weren't able to use such debt as seed capital.

Using debt proceeds to fund equity is a dangerous proposition. Typically, equity holders take on extra risk: They’re the first to assume losses and the last to get paid. That comes with higher returns. When an investment is leveraged, the ups and downs are magnified, too. Debtholders, meanwhile, have the first claim on cash flows, though their returns tend to be lower. The question now is whether investors get compensated for the risk when a project goes pear-shaped – especially since bond repayments and project capital will both be dependent on underlying cash flows.

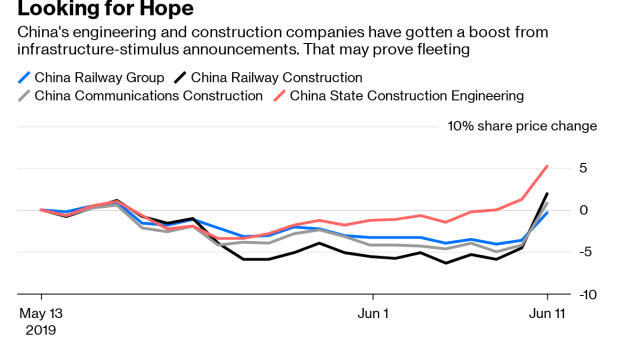

In China, there’s plenty of room for doubt these investments will pan out. Beijing increased the quota for special-purpose bond issuance to 2.15 trillion yuan ($310 billion) from 1.35 trillion yuan in 2018, and around 40% has already been issued in the first five months of this year. Yet these large stimulus measures haven’t amounted to much, even if they’ve occasionally boosted the stocks of construction and engineering companies. Industrial profits fell 3.7% in April and fixed-asset investment in manufacturing dropped 1.5%.

Financing constraints for infrastructure investment, meanwhile, have become a persistent problem. Lending related to capital expenditure fell 26% in April. Reliance on short-term debt has gone up; banks are still hesitant to extend loans to companies with encumbered balance sheets; and construction and engineering firms are already sitting on a mountain of debt. The latest measure could help many of these firms to borrow the minimum amount of equity they would need to meet regulatory capital-ratio requirements of around 20% on most infrastructure projects.

Across the world, infrastructure projects are funded by a combination of debt and equity. The debt typically has long payback periods and equity is limited to 20% to 30% of the outlay. In theory, the assets funded by such investments have the potential for stable cash flows because they tend to be state-mandated, used frequently and aren't cyclical (think, toll roads).

But that hasn’t been the case in China. Projects that were bolstered by stimulus programs still don't make money. Last year, income from highways couldn’t cover principal and interest payments on borrowings. Even if orders start rising, engineering and construction companies have been slow to convert these into revenue streams. Instead, long-term receivables are piling up on their books, according to Goldman Sachs Group Inc., as cash flows deteriorate. This is even before the new round of building has started.

No doubt, China’s bloated financial system and companies need more equity financing. Officials noted such a channel would help fund projects without adding hidden debt. The new policy could amount to an additional $13 billion to $19 billion of project capital from special-purpose bond issuance through the rest of this year, S&P Global Inc. analysts estimate. In theory, adding equity helps secure bank financing, too. Beijing said the usage of special-purpose bonds’ proceeds for project capital would be closely monitored.

Ultimately, however, there’s no getting around the fact that this debt is still the government’s liability – even if it’s being classified as project capital. And that burden is rising as fiscal coffers look weaker. Moody’s Investors Service Inc. expects regional and local governments’ leverage ratio to rise 3 percentage points from 2018 levels, reaching 23% of GDP by 2020. Beijing seems to be backtracking on its deleveraging efforts and going back to its old playbook. The stakes are only getting higher and the risks murkier.

(1) Special-purpose bonds are off-balance-sheet debt issued by municipalities to fund construction projects. The logic is that the cash flows from these projects cover the bonds’ interest and principal payments. Therefore, the credit profile of these bonds is independent of a local government’s fiscal situation, and should be excluded from its budget.

(2) The projects have to meet certain requirements.

To contact the author of this story: Anjani Trivedi at atrivedi39@bloomberg.net

To contact the editor responsible for this story: Rachel Rosenthal at rrosenthal21@bloomberg.net

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Anjani Trivedi is a Bloomberg Opinion columnist covering industrial companies in Asia. She previously worked for the Wall Street Journal.

©2019 Bloomberg L.P.